Securing our financial future is a task we all understand to be crucial, yet many of us neglect to consider how to shield our hard-earned 401k from potential long-term care expenses, such as those associated with nursing home care. This article will delve into various strategies and advice on how to protect your retirement savings from being exhausted by unforeseen healthcare costs. So, sit back, relax, and let’s fortify the future of your 401k together.

Proactive Planning for Long-Term Care Expenses

When it comes to preparing for long-term care expenses, it’s crucial to think about how you can shield your 401k from being exhausted by nursing home costs. With the escalating costs of healthcare and long-term care, it’s vital to have a plan in place to protect your retirement savings.

One method to shield your 401k from nursing home expenses is to consider long-term care insurance. This type of insurance can help cover the costs of nursing home care, allowing you to conserve your retirement savings for other needs. Additionally, establishing a trust can also be a useful tool in protecting your assets from being used to pay for nursing home care.

Another strategy to consider is investigating options for Medicaid planning. By understanding the eligibility criteria for Medicaid coverage of long-term care expenses, you can better plan how to use your 401k and other assets to ensure you qualify for assistance when necessary. Consulting with a financial planner or elder care attorney can offer valuable guidance on the best ways to shield your 401k from nursing home costs.

Leveraging Trusts to Protect Retirement Savings

When planning for retirement, one of the biggest worries is how to shield your hard-earned savings from potential threats, such as the cost of long-term care in a nursing home. Leveraging trusts can be a potent tool in protecting your retirement savings, including your 401k, from these potential risks.

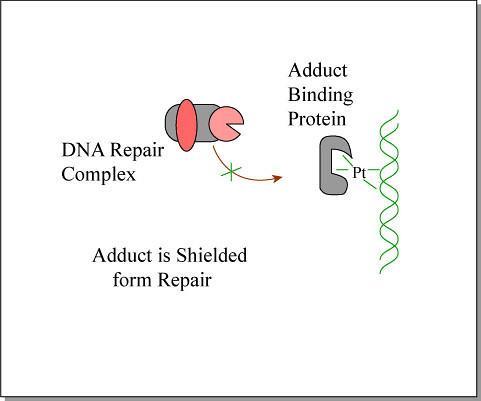

One method to shield your 401k from nursing home expenses is to establish an irrevocable trust. This type of trust can help protect your assets from being counted towards Medicaid eligibility, potentially allowing you to qualify for assistance with long-term care costs without having to spend down your retirement savings.

Another option is to create a revocable living trust, which can provide protection for your assets while allowing you to retain control over them during your lifetime. This type of trust can also help to avoid probate and ensure that your retirement savings are distributed according to your wishes after your passing.

Grasping Medicaid Eligibility and Asset Protection

When it comes to shielding your 401k from nursing home expenses while also qualifying for Medicaid, there are several strategies you can consider. Understanding the eligibility criteria for Medicaid and asset protection is crucial in order to successfully navigate this complex process.

One method to shield your 401k from being counted as an asset for Medicaid eligibility is by converting it into an exempt asset. This can be done by rolling over your 401k into a Medicaid-compliant annuity, which can provide you with a stream of income while also preserving your eligibility for Medicaid benefits.

Additionally, creating a trust can also help protect your 401k from nursing home expenses. By placing your 401k into an irrevocable trust, you can protect it from being counted towards your Medicaid eligibility while still providing for your long-term care needs. It’s crucial to consult with a qualified elder law attorney to determine the best strategy for your individual situation.

Seeking Guidance from Financial Advisors for Customized Solutions

When it comes to shielding your hard-earned 401k from potential nursing home costs, consulting with a financial advisor can provide you with personalized solutions tailored to your specific needs. By working with a professional, you can develop a comprehensive strategy to protect your retirement savings and ensure financial security for the future.

Financial advisors can offer valuable insights and recommendations on various ways to shield your 401k from being drained by nursing home expenses. Some strategies may include:

- Long-term care insurance: Consider investing in a long-term care insurance policy to cover potential nursing home costs.

- Asset protection trusts: Explore the option of establishing an asset protection trust to protect your 401k from being accessed for nursing home expenses.

- Medicaid planning: Work with a financial advisor to develop a Medicaid plan that can help you qualify for government assistance with nursing home costs without depleting your retirement savings.

| Option | Description |

|---|---|

| Long-term care insurance | Insurance policy to cover nursing home costs. |

| Asset protection trusts | Trust to protect retirement savings from expenses. |

| Medicaid planning | Plan to qualify for government assistance. |

The Path Ahead

While planning for retirement is a vital step, protecting your 401k from unexpected expenses such as nursing home care is equally important. By considering all your options and making informed decisions, you can ensure that your hard-earned savings are protected for the future. Remember, preparation is key when it comes to securing your financial well-being, so take the necessary steps now to shield your 401k from potential nursing home costs. Your future self will thank you.

How to Shield Your 401k from Nursing Home Costs

As you plan for retirement, one of the key financial concerns is how to protect your hard-earned savings from the potentially astronomical costs of nursing home care. With the average cost of a private room in a nursing home exceeding $100,000 per year, it’s crucial to have a plan in place to safeguard your 401k and other retirement funds.

Benefits of Protecting Your 401k

- Ensure financial security in your golden years

- Preserve your retirement savings for your heirs

- Avoid spending down your assets on long-term care

- Have peace of mind knowing your future needs are covered

Practical Tips for Shielding Your 401k

Here are some effective strategies to protect your 401k from nursing home costs:

1. Long-Term Care Insurance

Consider purchasing long-term care insurance to help cover the costs of nursing home care. This type of insurance can provide financial assistance for services such as skilled nursing care, assisted living, and home health care.

2. Medicaid Planning

Work with a financial advisor to develop a Medicaid planning strategy that allows you to qualify for Medicaid benefits while protecting your assets, including your 401k. Medicaid planning typically involves transferring assets to a trust or family member to meet eligibility requirements.

3. Irrevocable Trust

Create an irrevocable trust to shield your assets, including your retirement savings, from nursing home costs. By placing your assets in an irrevocable trust, you can protect them from creditors and Medicaid while ensuring they are still available for your care.

Case Study: Protecting Your 401k with Long-Term Care Insurance

| Client Profile | Strategy | Outcome |

|---|---|---|

| John, 65-year-old retiree | Purchased long-term care insurance | Managed to cover nursing home costs without depleting retirement savings |

Firsthand Experience: Safeguarding Your Retirement Savings

After watching my grandmother deplete her retirement savings on nursing home care, I knew I needed a plan to protect my own 401k. By investing in long-term care insurance and working with a financial advisor on Medicaid planning, I feel confident that my retirement savings are secure no matter what the future holds.

Remember, the key to shielding your 401k from nursing home costs is to plan ahead and explore all available options. By taking proactive steps now, you can protect your financial well-being and enjoy a worry-free retirement.