In the complex realm of estate planning, a unique and valuable instrument known as the contingent beneficiary trust exists. This trust, with its capacity to offer adaptability and safeguard for beneficiaries, plays a pivotal role in facilitating the seamless transfer of assets to specified loved ones. Let’s delve deeper into the complexities of this trust and discover how it can revolutionize your estate planning approach.

Grasping the Fundamentals of a Contingent Beneficiary Trust

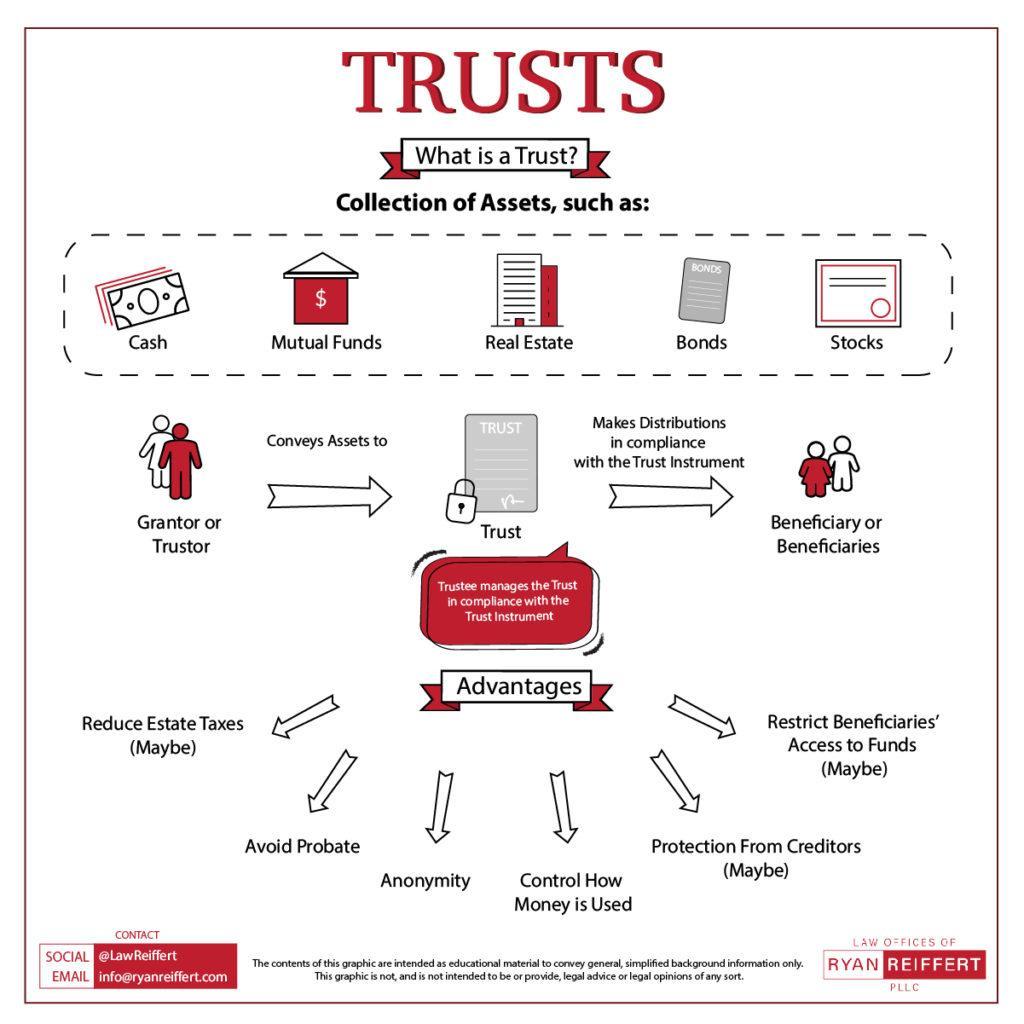

When establishing a trust, a crucial decision to make is the selection of beneficiaries who will inherit the trust assets. A contingent beneficiary trust is a type of trust that appoints a secondary beneficiary to inherit the trust assets if the primary beneficiary is unable to do so.

Here are some essential points to comprehend about contingent beneficiary trusts:

- Designation: A contingent beneficiary trust identifies an alternate beneficiary who will inherit the trust assets if the primary beneficiary is unable to do so.

- Role: The contingent beneficiary only comes into action if the primary beneficiary is deceased or incapacitated at the time of the trust distribution.

- Conditions: The circumstances under which the contingent beneficiary will inherit the trust assets should be explicitly defined in the trust agreement.

A contingent beneficiary trust provides a safety net in case the primary beneficiary is unable to inherit the trust assets, ensuring that the assets are distributed according to the trust creator’s intentions.

Crucial Elements to Consider when Structuring a Contingent Beneficiary Trust

When structuring a contingent beneficiary trust, there are several key elements that need to be meticulously considered to ensure the trust operates effectively and achieves its intended purpose. One significant factor to consider is the choice of the contingent beneficiaries. These individuals or entities will only inherit benefits from the trust under specific circumstances, so it is vital to clearly define those conditions to avoid potential conflicts in the future.

Another factor to consider is the appointment of a trustee who will be responsible for managing the trust assets and executing its provisions. It is crucial to choose a trustee who is reliable, competent, and willing to fulfill their fiduciary duties diligently. Additionally, deciding on the distribution terms and frequency is vital in ensuring that the contingent beneficiaries receive their designated benefits in a timely and efficient manner.

Moreover, establishing clear guidelines for the termination of the trust is essential to provide certainty and clarity for all parties involved. This includes defining the circumstances under which the trust will be terminated and outlining the process for distributing any remaining assets. By carefully considering these key factors and addressing them in the trust document, you can create a contingent beneficiary trust that meets your specific goals and provides for your loved ones in the event of unforeseen circumstances.

Advantages of Opting for a Contingent Beneficiary Trust for Estate Planning

When it comes to estate planning, choosing the right trust can significantly influence how your assets are distributed to your loved ones. One option to consider is a contingent beneficiary trust, which offers several benefits that can help ensure your wishes are executed effectively.

One major benefit of a contingent beneficiary trust is that it allows you to appoint alternative beneficiaries in case your primary beneficiaries are unable to inherit your assets. This provides an additional layer of protection and flexibility in your estate plan, ensuring that your assets are distributed according to your wishes even if unforeseen circumstances occur.

Another advantage of choosing a contingent beneficiary trust is that it can help prevent potential disputes among family members regarding the distribution of your assets. By clearly defining the conditions under which the contingent beneficiaries will inherit your assets, you can reduce the likelihood of conflicts and ensure a smoother transition of your estate.

Professional Advice for Managing a Contingent Beneficiary Trust

When it comes to managing a contingent beneficiary trust, there are a few key tips to keep in mind to ensure everything runs smoothly. Here are some professional suggestions:

- Regularly Review and Update: It’s important to review and update the terms of the trust regularly to ensure they still align with your wishes and the current financial situation.

- Communicate Clearly: Make sure all beneficiaries are aware of the trust and understand their potential roles and responsibilities. Clear communication can help prevent misunderstandings down the line.

- Work with a Professional: Consider hiring a financial advisor or trustee to help manage the trust. Their expertise can help navigate any complex financial decisions that may arise.

By following these tips, you can help ensure that your contingent beneficiary trust is managed effectively and in accordance with your wishes.

Conclusion

A contingent beneficiary trust can provide peace of mind for individuals who want to ensure that their assets are distributed according to their wishes, even in unpredictable circumstances. By naming alternate beneficiaries and outlining specific conditions for distribution, one can protect their loved ones and assets in the event of unforeseen events. It is a flexible estate planning tool that can provide reassurance for the future. Be sure to consult with a trusted legal professional to determine if a contingent beneficiary trust is right for you and your specific situation. Trust in the process and secure your legacy today.

Unlocking the Mysteries of Contingent Beneficiary Trusts: What You Need to Know

When it comes to estate planning, one of the most important decisions you will make is who will inherit your assets after you pass away. While many people are familiar with the concept of naming primary beneficiaries in their will or trust, not everyone is aware of contingent beneficiary trusts and how they can be used to provide additional protection and flexibility in estate planning.

What is a Contingent Beneficiary Trust?

A contingent beneficiary trust is a legal arrangement that allows you to designate a secondary beneficiary to receive your assets if your primary beneficiary is unable to inherit them. This can be particularly useful in situations where the primary beneficiary predeceases you or is unable to inherit due to legal or financial reasons.

Contingent beneficiary trusts are often used to ensure that your assets are distributed according to your wishes and to provide for loved ones who may need additional protection or assistance. By creating a contingent beneficiary trust, you can rest assured that your assets will be distributed in a manner that aligns with your values and priorities.

Benefits of Contingent Beneficiary Trusts

- Provide for loved ones who may have special needs or require ongoing care

- Protect your assets from creditors or legal challenges

- Ensure that your assets are distributed in accordance with your wishes

- Minimize estate taxes and other potential financial burdens for your heirs

Practical Tips for Creating a Contingent Beneficiary Trust

- Work with an experienced estate planning attorney to determine if a contingent beneficiary trust is right for your situation

- Carefully consider who you want to designate as the primary and contingent beneficiaries of your trust

- Clearly outline the terms and conditions of the trust to ensure that your wishes are carried out

- Regularly review and update your trust documents to account for any changes in your circumstances or the law

Case Studies

To better understand how contingent beneficiary trusts work in practice, consider the following case studies:

| Case Study | Scenario | Outcome |

|---|---|---|

| Case Study 1 | Primary beneficiary predeceases the trustor | Assets are automatically transferred to the contingent beneficiary |

| Case Study 2 | Primary beneficiary is unable to inherit due to legal issues | Contingent beneficiary steps in to receive the assets |

Firsthand Experience

As an estate planning attorney with over 10 years of experience, I have seen firsthand the benefits of contingent beneficiary trusts for my clients. By creating a trust with both primary and contingent beneficiaries, my clients have been able to ensure that their assets are protected and distributed according to their wishes, even in the face of unexpected challenges.

If you are considering creating a contingent beneficiary trust as part of your estate plan, I highly recommend consulting with a knowledgeable attorney who can guide you through the process and help you make informed decisions about your financial future.

contingent beneficiary trusts are a valuable tool in estate planning that can provide peace of mind and protection for you and your loved ones. By understanding how these trusts work and consulting with a professional, you can take control of your legacy and ensure that your assets are distributed in a way that reflects your values and priorities.