Deciphering the legal intricacies of probate fees in Pennsylvania can be a challenging endeavor for many individuals. Grasping the complexities of estate administration and the associated costs can seem daunting. In this article, we will delve into the details of probate fees in Pennsylvania, illuminating this frequently misunderstood facet of estate planning. Whether you are a beneficiary, executor, or simply interested in the process, continue reading to unravel the mystery of probate fees in the Keystone State.

Decoding Probate Fees in Pennsylvania

Probate fees in Pennsylvania can be a perplexing element of estate planning, but comprehending how they operate is crucial for anyone navigating the probate process. In Pennsylvania, probate fees are determined based on the total worth of the assets included in the estate. These fees can fluctuate depending on the magnitude of the estate and other factors.

One crucial point to remember is that probate fees in Pennsylvania are remitted to the Register of Wills in the county where the deceased lived. These fees are typically utilized to cover the expenses of administering the estate, including court costs and other expenditures. It’s important to be cognizant of these fees when planning your estate to prevent any unexpected costs for your loved ones.

It’s also noteworthy that certain assets may be exempt from probate fees in Pennsylvania, such as assets held in a living trust or assets that pass directly to a beneficiary outside of probate. Collaborating with an experienced estate planning attorney can assist you in navigating the probate process and lessen the impact of probate fees on your estate.

Elements Affecting Probate Costs in Pennsylvania

can fluctuate based on various components that come into play during the probate process. Understanding these elements can aid individuals in anticipating and planning for potential expenses associated with probate proceedings. Some key elements that can influence probate costs in Pennsylvania include:

- Value of the estate: The total worth of the assets included in the estate can directly affect probate costs, as fees are often determined based on a percentage of the estate’s value.

- Complexity of the estate: The intricacy of the estate, including the number of assets and liabilities, whether there are disputes among beneficiaries, and the presence of business interests, can all contribute to higher probate costs.

- Attorney fees: Engaging an attorney to guide you through the probate process is common in Pennsylvania, and attorney fees can vary based on the attorney’s expertise, the size of the estate, and the amount of work required.

- Court costs: Court fees and other administrative expenses associated with probate proceedings can also impact overall probate costs.

In addition to these elements, there may be other expenses to consider, such as appraisal fees, accounting fees, and executor fees. By understanding the elements that can influence probate costs in Pennsylvania, individuals can better prepare for the financial aspects of the probate process and make informed decisions throughout the proceedings.

Strategies for Reducing Probate Fees in Pennsylvania

When it comes to managing estates in Pennsylvania, reducing probate fees is often a top priority. Here are some strategies to help you navigate the process and keep costs low:

- Plan Ahead: The most effective way to reduce probate fees is to plan ahead by creating a comprehensive estate plan. This can include setting up trust funds, naming beneficiaries on retirement accounts, and establishing joint ownership of property.

- Avoid Probate: One of the most efficient ways to reduce probate fees is to avoid probate altogether. This can be achieved by designating beneficiaries on life insurance policies, retirement accounts, and bank accounts. Assets held in trusts also bypass probate.

- Consider Small Estate Procedures: In Pennsylvania, estates valued at $50,000 or less can qualify for avoid probate in Florida?”>simplified probate procedures, which can help reduce fees and expedite the process. Be sure to check if your loved one’s estate meets the criteria.

| Tip | Benefit |

| Plan Ahead | Helps minimize probate fees by having a clear estate plan in place. |

| Avoid Probate | Assets bypass probate, saving time and money for beneficiaries. |

| Consider Small Estate Procedures | Can qualify for simplified probate procedures to reduce fees. |

Unraveling the Complexities of Probate Fees in Pennsylvania

Unraveling the complexities of probate fees in Pennsylvania can be a challenging endeavor for many individuals. Understanding the various fees and costs associated with the probate process is vital in order to properly plan and manage your estate.

One of the key elements to consider is the executor’s fee, which is typically a percentage of the estate’s total worth. This fee can fluctuate depending on the size of the estate and the intricacy of the probate process. Additionally, there may be court fees, attorney fees, appraisal fees, and other miscellaneous expenses that can accumulate quickly.

It’s crucial to meticulously review and understand the fee structure in Pennsylvania probate cases to avoid any unexpected costs or misunderstandings. Seeking advice from a proficient estate planning attorney can assist you navigate through these complexities and ensure that your estate is managed in a cost-effective and efficient manner. Remember, proper planning and understanding of probate fees can help alleviate stress and confusion for both you and your loved ones in the future.

Final Thoughts

In conclusion, deciphering probate fees in Pennsylvania can be a complex and challenging process. Understanding the details of probate laws and regulations is crucial in order to ensure a smooth and efficient distribution of assets. By seeking advice from experienced professionals and staying informed, you can confidently navigate probate fees in Pennsylvania and secure a favorable outcome for all parties involved. So, take control of your estate planning and legal matters to protect your legacy and provide peace of mind for your loved ones.

rnrn

The Basics of Probate Fees in Pennsylvania

Probate is the legal process of administering the estate of a deceased person, which includes distributing their assets to beneficiaries and settling any outstanding debts or taxes. In Pennsylvania, probate fees are the costs associated with this process, which can vary depending on the size and complexity of the estate. It’s important to understand how these fees work and what factors can impact the final cost.

Factors That Influence Probate Fees

- Size of the Estate: The value of the assets in the estate will directly impact the probate fees. Larger estates typically incur higher fees.

- Complexity of the Estate: Estates with multiple beneficiaries, disputes, or unusual assets may require more time and resources to administer, resulting in higher fees.

- Legal Representation: Hiring an attorney to guide you through the probate process will incur additional fees, but can also help ensure the process runs smoothly.

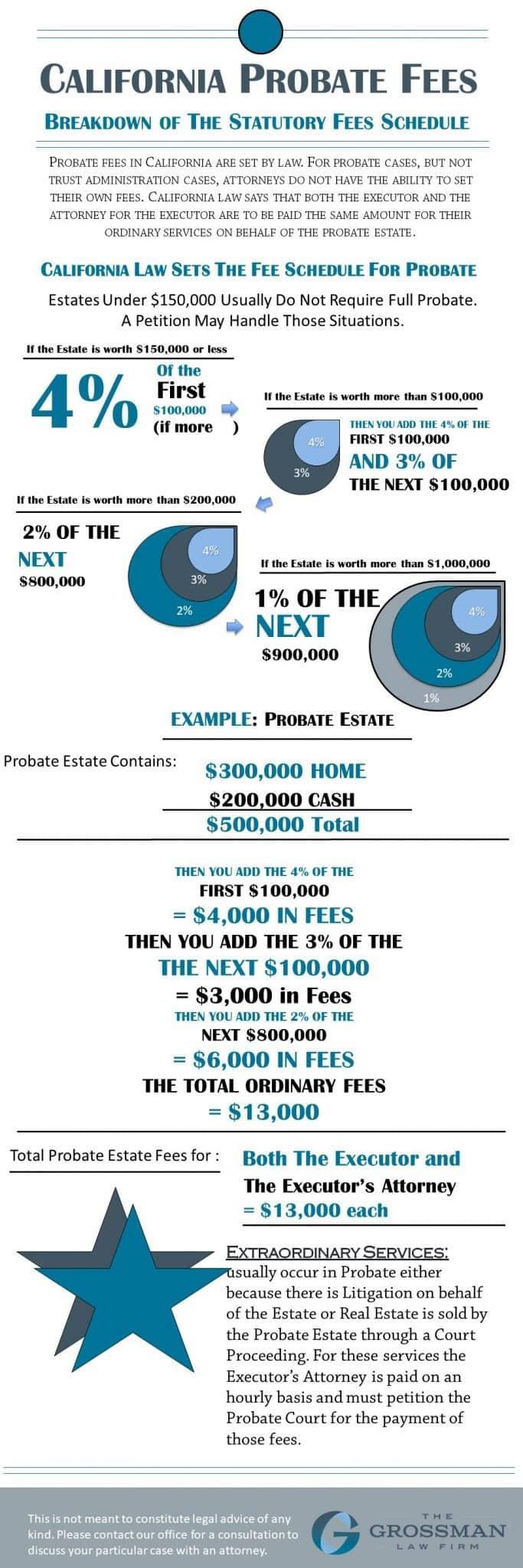

Understanding the Fee Structure

In Pennsylvania, probate fees are typically calculated based on the “probate assets” of the estate. This includes assets that are solely owned by the deceased and do not pass directly to beneficiaries outside of probate. The fee structure is as follows:

| Probate Assets Value | Probate Fee |

|---|---|

| Up to $50,000 | $150 |

| Over $50,000 | $150 + 4% of the excess over $50,000 |

Tips for Managing Probate Fees

- Plan Ahead: By creating a comprehensive estate plan, you can minimize probate fees and ensure your assets are distributed according to your wishes.

- Communicate with Beneficiaries: Keeping beneficiaries informed about the probate process can help prevent disputes that could lead to increased fees.

- Consider Alternative Options: In some cases, assets can be transferred outside of probate through methods like living trusts, which may help reduce overall costs.

Benefits of Understanding Probate Fees

By educating yourself about probate fees in Pennsylvania, you can make informed decisions about your estate planning and potentially save money in the long run. Knowing how fees are calculated and what factors impact the cost can help you navigate the process more effectively and avoid any unnecessary expenses.

Practical Tips for Probate in Pennsylvania

When dealing with probate in Pennsylvania, it’s important to stay organized, communicate clearly with all parties involved, and seek professional guidance when needed. By following these practical tips, you can streamline the probate process and minimize the associated fees.

Case Study: Managing Probate Fees

John recently lost his father and was tasked with administering his estate through the probate process. By carefully tracking all expenses, communicating openly with his siblings, and seeking guidance from an experienced estate attorney, John was able to navigate the process efficiently and keep probate fees to a minimum. His proactive approach ultimately saved his family time and money during a challenging time.

Firsthand Experience with Probate Fees

As a probate attorney in Pennsylvania, I have seen firsthand the impact that probate fees can have on families. By guiding my clients through the process and helping them understand the costs involved, I strive to make the experience as smooth and affordable as possible. With the right knowledge and support, navigating probate fees in Pennsylvania doesn’t have to be a daunting task.