In the complex realm of property ownership, the mortgage acts as the central document that solidifies the transfer of ownership. It’s more than a mere document; it signifies the shift of a home from one person to another. Let’s explore the importance of this vital document and how it redefines the dynamics of property ownership.

Grasping the Importance of a Mortgage Contract

When entering into a mortgage contract, it’s crucial to comprehend the profound influence this document has on ownership rights. A mortgage is not merely a document; it signifies a legal transaction that transfers property rights to the lender until the loan is fully repaid. This implies that the lender has an interest in the property until the borrower meets their financial obligation.

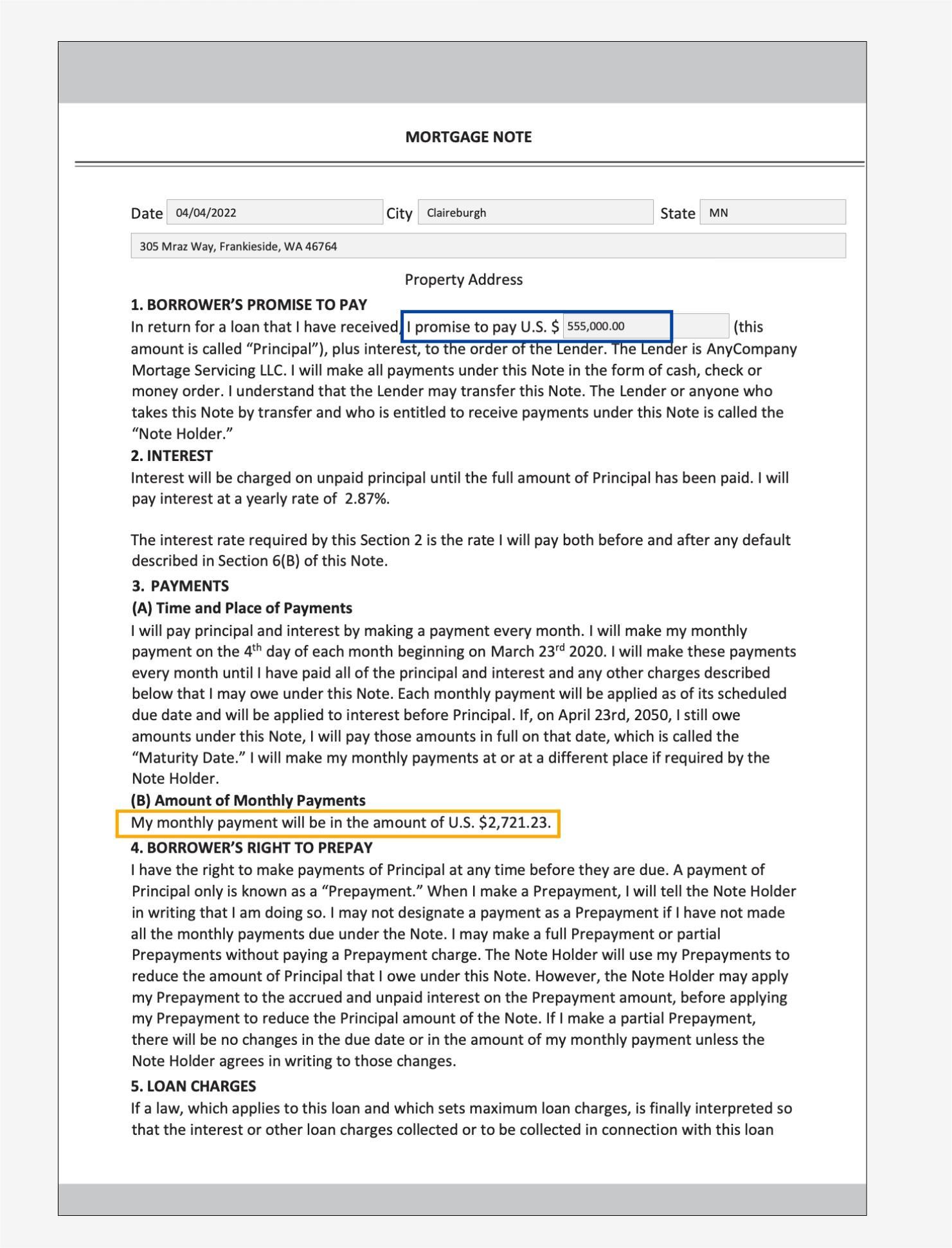

A crucial element of a mortgage contract is the repayment terms detailed in the document. This includes specifics such as the interest rate, loan amount, and repayment schedule. Non-compliance with these terms could lead to foreclosure, where the lender seizes the property due to non-payment. Comprehending these terms is vital for both parties involved to prevent any misunderstandings or legal complications in the future.

Another significant feature of a mortgage contract is the lien placed on the property. This grants the lender the right to sell the property to recover the outstanding loan amount if the borrower defaults on their payments. It’s crucial for borrowers to be cognizant of this potential outcome and to make timely payments to safeguard their ownership rights.

Crucial Components of a Mortgage Document

| A mortgage is more than just a document – it’s a legal contract that signifies a substantial financial commitment. Grasping the details is vital for any homeowner, as it outlines the terms and conditions of the loan. |

An essential element of a mortgage document is the loan amount. This is the total amount of money borrowed from the lender, which must be repaid with interest over a specified period. Knowing the exact loan amount is crucial for budgeting and planning your finances.

Another key component is the interest rate. This is the percentage of the loan amount that must be paid to the lender as interest. The interest rate can significantly affect the total amount you end up paying for your home, so it’s important to understand and negotiate for a favorable rate.

- Payment schedule: This outlines when and how your mortgage payments are due, including the amount and frequency.

- Collateral: The property being purchased serves as collateral for the loan, meaning the lender can repossess it if the borrower fails to meet their repayment obligations.

Consequences of Transferring Ownership Through a Mortgage

Transferring ownership through a mortgage is a complex process that can have significant consequences for both the buyer and seller. While many people view a mortgage simply as a loan to buy a home, it’s also a legal document that changes ownership of the property.

One of the main consequences is that the lender now has a lien on the property. This means that if the borrower fails to make their mortgage payments, the lender has the right to foreclose on the property and take ownership. This can have serious repercussions for the borrower, including losing their home.

Another consequence of transferring ownership through a mortgage is that the buyer must undergo a thorough approval process with the lender. This can include a credit check, income verification, and an appraisal of the property. It’s important for both the buyer and seller to understand the terms of the mortgage and the potential consequences of defaulting on the loan.

Strategies for Protecting Your Property Rights Through a Mortgage Contract

When entering into a mortgage contract, it’s crucial to understand the implications it has on your property rights. By signing this document, you’re essentially transferring ownership of your property to the lender until the loan is fully repaid. To protect your property rights throughout this process, consider the following strategies:

- Review the terms: Thoroughly read the mortgage contract to ensure you fully understand the terms and conditions set by the lender.

- Preserve your equity: Ensure to make timely payments on your mortgage to avoid defaulting on the loan and risking losing your equity in the property.

- Consider insurance: Consider getting mortgage insurance to protect your property in case of unforeseen circumstances such as loss of income or disability.

| Strategy | Description |

|---|---|

| Review the terms | Understand the terms and conditions of the mortgage contract. |

| Preserve your equity | Make timely payments to avoid losing equity in the property. |

| Consider insurance | Obtain mortgage insurance for added protection. |

Conclusion

The mortgage is a potent legal document that signifies the transfer of ownership from one party to another. It serves as a pathway to achieving the dream of homeownership, but also comes with a significant amount of responsibility and commitment. Understanding the importance of the mortgage is crucial for anyone venturing into the real estate world. So, the next time you sign on the dotted line, remember that the mortgage is not just a document, but a transformative instrument that paves the way for a new chapter in your life.

Discover How a Mortgage Document Can Shift Property Ownership!

When it comes to buying a home, one of the most critical documents you’ll encounter is the mortgage document. This piece of paperwork outlines the terms and conditions of the loan you’re taking out to purchase the property. But did you know that a mortgage document can also play a significant role in shifting property ownership? Let’s explore how this happens and what you need to know about it.

Understanding Mortgage Documents

Before we dive into how a mortgage document can impact property ownership, let’s first understand what exactly this document is. A mortgage document is a legal agreement between a borrower and a lender that lays out the terms of a loan used to purchase a property. This document typically includes details such as the loan amount, interest rate, repayment schedule, and any other conditions that both parties must adhere to.

How a Mortgage Document Can Shift Property Ownership

When you take out a mortgage to buy a home, you essentially become a joint owner of the property with the lender. The lender holds a security interest in the property until the loan is fully paid off. This means that if you default on the loan, the lender has the right to foreclose on the property and take ownership of it.

But even before foreclosure, a mortgage document can impact property ownership in other ways. For example, if you decide to sell the property before the loan is fully paid off, the lender will need to be repaid first from the proceeds of the sale. Only after the lender is fully compensated can you transfer ownership of the property to the new buyer.

Benefits and Practical Tips

- Make sure to read and understand your mortgage document thoroughly before signing it. This will help you avoid any surprises down the road.

- Keep up with your mortgage payments to maintain ownership of your property and avoid foreclosure.

- If you’re struggling to make your mortgage payments, consider reaching out to your lender to discuss potential options such as loan modification or refinancing.

Case Studies

Let’s take a look at a couple of hypothetical scenarios to illustrate how a mortgage document can impact property ownership:

| Scenario | Outcome |

|---|---|

| Scenario 1: Default on mortgage payments | Lender forecloses on the property and takes ownership. |

| Scenario 2: Sell the property | Lender must be repaid first before ownership can be transferred to the new buyer. |

Firsthand Experience

As a real estate agent, I’ve seen firsthand how important it is for buyers to understand the implications of their mortgage documents on property ownership. By taking the time to review and fully grasp the terms of their loan, buyers can protect themselves and their investment in the long run.

a mortgage document is a powerful tool that can shape property ownership in significant ways. By being informed and proactive, you can navigate the complexities of this document and ensure a smooth homebuying process.