Dealing with the aftermath of a loved one’s death can be a challenging and emotional journey. One of the most critical tasks is managing the deceased’s estate, which includes distributing assets, settling debts, and ensuring all legal obligations are met. This article aims to shed light on the various stages involved in managing an estate after death, offering guidance to help you navigate this complex process.

Grasping the Probate Process and Executor Duties

Managing Estate After Death

When a loved one dies, their estate must undergo the probate process to resolve their affairs. This process involves appointing an executor, who is tasked with executing the deceased’s wishes as stated in their will. The probate process can be intricate and time-consuming, making it crucial for the executor to fully comprehend their duties.

Executor Duties:

- Find and manage the deceased’s assets

- Settle any debts and taxes owed by the estate

- Distribute the remaining assets to beneficiaries as per the will

- Submit necessary paperwork to the probate court

The executor must act in the best interest of the estate and its beneficiaries, and should consult legal counsel if necessary. By understanding the probate process and their duties, the executor can ensure that the deceased’s estate is settled correctly and efficiently.

Addressing Debts and Taxes Related to the Estate

Handling debts and taxes related to an estate can be a complicated and challenging task. It is crucial to address these matters meticulously to ensure the deceased’s affairs are settled correctly. Here are some key points to consider:

- Identify and Compile Debts: The first step is to identify and compile all outstanding debts of the deceased, including mortgages, loans, credit card balances, and other liabilities.

- Inform Creditors: After identifying the debts, it is crucial to inform creditors of the individual’s death and initiate the process of settling those debts.

- Settle Taxes: Taxes related to the estate, including income tax, property tax, and other relevant taxes, must also be addressed and paid promptly.

- Asset Distribution: Once debts and taxes have been settled, the remaining assets of the estate can be distributed to beneficiaries as per the deceased’s will or state laws.

| Debts & Taxes | Settlement Status |

|---|---|

| Mortgage | Settled |

| Credit Card Balances | In Progress |

| Income Tax | Paid |

Allocating Assets to Beneficiaries

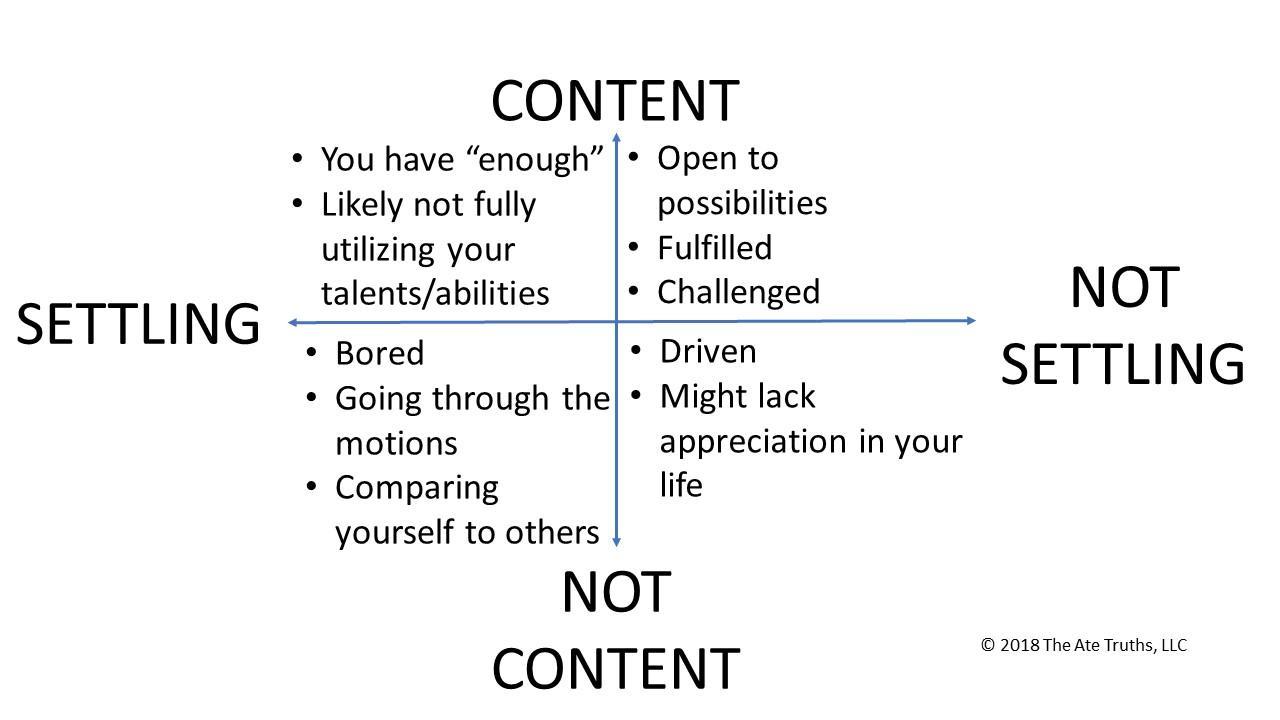

One of the most critical steps in managing an estate after death is asset distribution. This process can be complex and emotional, but with careful planning and communication, it can be handled smoothly.

Creating a comprehensive inventory of all assets left by the deceased is a crucial consideration. This can include real estate, investments, personal belongings, and more. By having a clear understanding of what needs to be distributed, you can ensure a fair and equitable division among beneficiaries.

Communication is vital during this process. Clearly stating the deceased’s wishes in a will or trust can help prevent confusion and conflicts among beneficiaries. Additionally, keeping beneficiaries informed and involved in the distribution process can promote transparency and fairness. By handling the distribution of assets with care and consideration, you can facilitate a smooth and respectful settlement of the estate.

Formulating a Comprehensive Estate Plan for Future Readiness

In the unfortunate event of a loved one’s passing, it is crucial to have a comprehensive estate plan in place to ensure a smooth settlement of their assets and debts. The first step in this process is identifying all the assets owned by the deceased, such as property, investments, and personal belongings.

Next, it is essential to designate beneficiaries for each asset to clearly outline who will inherit what. This can be done through a will, trust, or other legal documents. Having a clear designation of beneficiaries can help prevent any disputes or confusion among family members after the individual’s passing.

Additionally, creating a durable power of attorney and healthcare directive can ensure that a trusted individual is appointed to make financial and medical decisions on behalf of the deceased if they are unable to do so themselves. This can provide peace of mind knowing that their wishes will be carried out in the event of incapacitation.

In conclusion, formulating a comprehensive estate plan is crucial for future readiness and can help alleviate stress and uncertainty for loved ones during a difficult time. By planning ahead, individuals can ensure that their assets are distributed according to their wishes and that their loved ones are taken care of after they are gone.

Moving Forward

In conclusion, managing an estate after death is a complex and often emotional process that requires meticulous attention to detail and thorough organization. By following the necessary steps and seeking guidance from legal professionals, you can ensure that your loved one’s final wishes are executed smoothly and efficiently. Remember, while it may be a challenging task, it is ultimately a way to honor and preserve the legacy of those who have passed on. Thank you for reading, and may you find peace and closure in the journey of managing an estate.

Navigating the Process of Settling an Estate After a Loved One’s Death

Introduction

Losing a loved one is a challenging and emotional time. In addition to dealing with grief, there are also practical matters to attend to, such as settling the deceased’s estate. This process can be overwhelming and complex, but with the right information and guidance, it can be managed effectively. In this article, we will explore the steps involved in settling an estate after a loved one’s death and provide valuable insights to help you navigate this difficult time.

Understanding the Estate Settlement Process

Settling an estate involves various legal and financial tasks that need to be completed in order to distribute the deceased’s assets and resolve any outstanding debts. The following steps are typically involved in the estate settlement process:

- Obtain the death certificate

- Identify and secure assets

- Notify creditors and pay debts

- File the will with the probate court

- Distribute assets to beneficiaries

- Close the estate

Benefits and Practical Tips

Settling an estate can be a time-consuming and complex process, but there are several benefits to doing so properly:

- Ensures the deceased’s wishes are carried out

- Protects the assets and interests of beneficiaries

- Prevents disputes among family members

Here are some practical tips to help you navigate the estate settlement process:

- Consult with an estate attorney

- Keep detailed records of all transactions

- Communicate openly with beneficiaries

Case Studies

Here are two case studies that illustrate the challenges and outcomes of settling an estate after a loved one’s death:

| Case Study 1 | Case Study 2 |

|---|---|

| Family members were in disagreement over the distribution of assets, leading to a lengthy legal battle. | By following the deceased’s detailed estate plan, the settlement process was completed smoothly and efficiently. |

Firsthand Experience

Dealing with the estate settlement process can be overwhelming, but with the right support and guidance, it is manageable. Here are some firsthand experiences from individuals who have gone through the process:

- “I found it helpful to work closely with an estate attorney who guided me through each step of the process.” – Sarah, 52

- “Communication with family members was key to ensuring a smooth settlement process and avoiding conflicts.” – John, 48

Conclusion

Settling an estate after a loved one’s death is a challenging but necessary task. By understanding the steps involved, seeking professional guidance, and communicating openly with family members, you can navigate the process effectively and ensure that the deceased’s wishes are carried out.