Private Trust: A Vital Aspect of Wealth Management

Private trust is a crucial tool for safeguarding assets, providing for loved ones, and ensuring a lasting legacy. This article delves into the complexities and benefits of private trust to shed light on its role in wealth management.

Establishing a Private Trust for Asset Protection and Wealth Preservation

When it comes to protecting assets and preserving wealth for future generations, a private trust is a powerful tool. It offers a way to safeguard assets from creditors, lawsuits, and other risks while also allowing for long-term financial well-being. Private trust provides a high level of control, allowing the grantor to set specific terms and conditions for the management and distribution of assets. This customization enables individuals to tailor the trust to meet their unique goals and objectives, whether that involves providing for children’s education, supporting charitable causes, or ensuring the financial security of future generations.

Additionally, a private trust can help minimize estate taxes and avoid probate, providing an efficient and cost-effective way to transfer wealth to heirs. Trusts also offer a greater level of privacy as they are not part of the public record like a will.

Key Considerations when Choosing Trustees for a Private Trust

Selecting trustees for a private trust requires careful consideration to ensure effective management in line with the trustor’s wishes. Factors such as expertise, reliability, trustworthiness, and availability of the trustee are crucial to ensure that the trust is managed effectively and in the best interests of the beneficiaries.

Maximizing Tax Benefits with a Private Trust

A private trust can be a powerful tool for minimizing tax liability and maximizing overall wealth. It offers the ability to reduce estate taxes and protect assets from creditors and legal claims, providing an added layer of protection for high-net-worth individuals looking to safeguard their assets for future generations.

Navigating Legal Pitfalls in Setting Up a Private Trust

While creating a private trust can be beneficial, there are several legal pitfalls to navigate. Proper documentation, compliance with relevant laws and regulations, asset protection, and the selection of trustworthy and competent trustees are essential considerations. Seeking legal advice from a professional with expertise in trust law can help navigate these pitfalls and ensure that the trust is structured to meet specific needs and goals.

In Retrospect

In conclusion, private trusts offer a unique and flexible way to manage assets and protect beneficiaries’ interests. Whether safeguarding assets from creditors, providing for loved ones, or minimizing estate taxes, a private trust can offer a range of benefits and peace of mind. Considering speaking with a financial advisor or estate planning attorney to explore the possibilities of incorporating a private trust into your overall wealth management strategy. Trust in the power of private trusts to secure your financial future.

Unveiling the Secrets of Private Trusts: What You Need to Know

Private trusts are a powerful tool that can be used for estate planning, asset protection, and wealth management. However, many people are unfamiliar with how trusts work and the benefits they can provide. In this article, we will delve into the world of private trusts and unveil the secrets behind them. Whether you are a seasoned investor or someone who is just starting to build their wealth, understanding private trusts is essential for securing your financial future.

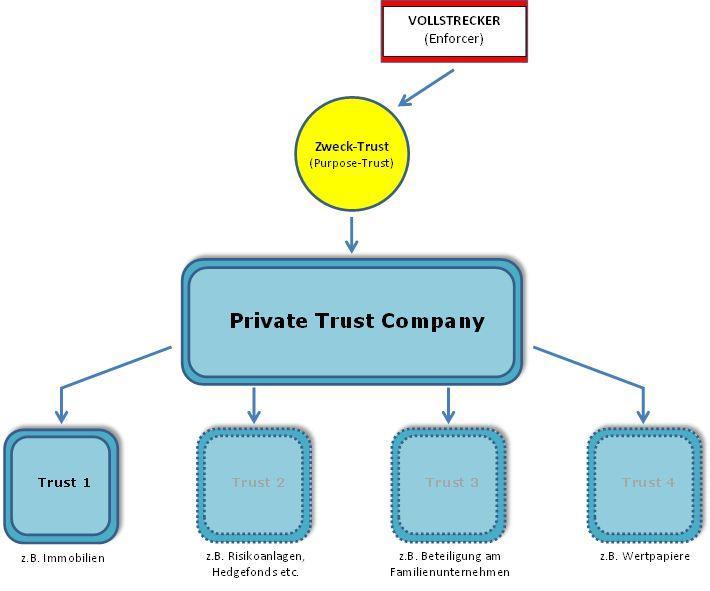

What is a Private Trust?

A private trust is a legal arrangement where a trustee holds assets on behalf of beneficiaries. The trustee is responsible for managing the assets in the trust according to the terms set out in the trust deed. Private trusts are commonly used for estate planning to ensure that assets are distributed according to the wishes of the settlor (the person who creates the trust).

Types of Private Trusts

- Revocable Trusts: The settlor retains the ability to modify or revoke the trust during their lifetime.

- Irrevocable Trusts: The terms of the trust cannot be changed once it is established.

- Discretionary Trusts: The trustee has discretion over how and when to distribute the assets to the beneficiaries.

- Asset Protection Trusts: Designed to protect assets from creditors and other claims.

Benefits of Private Trusts

There are several benefits to using private trusts as part of your financial planning strategy:

- Asset Protection: Assets held in a trust are generally protected from creditors and legal claims.

- Probate Avoidance: Trust assets can pass directly to beneficiaries without going through the probate process, saving time and money.

- Privacy: Trusts are private arrangements, unlike wills which are a matter of public record.

- Tax Efficiency: Trusts can be structured to minimize tax liabilities for both the settlor and beneficiaries.

Practical Tips for Setting Up a Private Trust

When setting up a private trust, it is important to consider the following practical tips:

- Choose the Right Trustee: Selecting a trustworthy and competent trustee is crucial for the success of the trust.

- Define Clear Objectives: Clearly outline the purpose and objectives of the trust in the trust deed.

- Review Regularly: Keep the trust provisions up to date and review them periodically to ensure they still meet your needs.

- Seek Professional Advice: Consult with a financial advisor or legal expert who specializes in trusts to ensure that the trust is structured correctly.

Case Study: The Benefits of a Family Trust

Let’s consider a hypothetical example of a family trust set up by a wealthy individual to manage their assets and provide for their children.

| Benefit | Description |

|---|---|

| Asset Protection | The trust shields the assets from potential creditors or legal claims. |

| Probate Avoidance | Assets can be distributed to heirs without going through probate court. |

| Tax Efficiency | The trust structure allows for tax planning to minimize tax liabilities. |

This case study illustrates how a family trust can provide financial security and peace of mind for the settlor and their beneficiaries.

Conclusion

Private trusts are a versatile tool that can offer a range of benefits for individuals looking to protect and manage their assets. By understanding how trusts work and the advantages they provide, you can make informed decisions about incorporating them into your financial planning strategy. Whether you are looking to protect your wealth for future generations or minimize tax liabilities, a private trust may be the right solution for you. Remember to seek professional advice and carefully consider your objectives when setting up a trust to ensure that it aligns with your long-term financial goals.