Consider the predicament: after toiling tirelessly for years to create a lasting legacy for your loved ones, what would happen if you were to pass away without a will? This is where intestate estate comes into play. This piece will delve into the definition of intestate estate and its implications for both you and your assets in the absence of a will.

Deciphering Intestate Estate Distribution

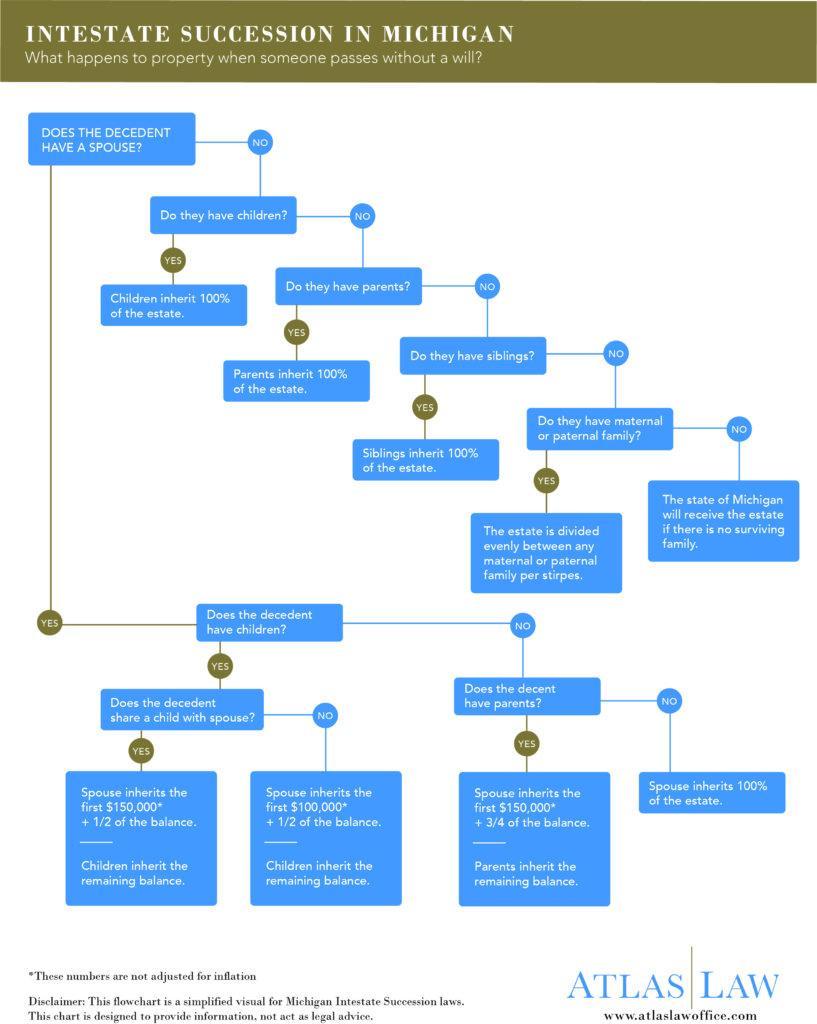

Intestate estate distribution involves the legal process of dividing a deceased individual’s assets when they have not left behind a will. In such cases, state laws will determine how the estate is distributed among the deceased person’s heirs. Understanding intestate estate distribution is crucial to ensure that the deceased person’s assets are handled in accordance with the law.

In intestate estate distribution, the assets of the deceased person are typically divided among their closest relatives, such as their spouse, children, parents, or siblings. However, the distribution of assets may vary based on state laws. Consulting with a legal professional is essential to comprehend how the estate will be distributed and to ensure the process is carried out correctly.

Navigating Complex Legal Processes for Intestate Succession

Navigating intestate succession laws can be challenging when someone passes away without a will. This complex legal process involves the distribution of assets left behind by a deceased individual. It is vital to understand the intricacies of intestate succession to ensure that the deceased’s wishes are upheld and their estate is distributed fairly.

In the absence of a will, state laws determine the order in which heirs will inherit from the intestate estate. Seeking legal counsel from an experienced attorney can help individuals navigate the complexities of intestate succession and ensure that the estate is administered correctly.

Ensuring Fair Distribution of Assets in the Absence of a Will

In the absence of a will, the deceased’s assets will be distributed according to the laws of the state in which they resided. Consulting with a probate lawyer specializing in intestate estates can help guide individuals through the legal process and navigate any complexities that may arise. It is also crucial to gather all relevant documents and information related to the deceased’s assets and communicate openly with beneficiaries and heirs to avoid potential conflicts.

Key Considerations for Managing an Intestate Estate

When managing an intestate estate, it is essential to consider state laws that govern intestacy, identify and locate all assets belonging to the deceased individual, appoint an administrator for the estate, and work with a probate attorney to ensure all legal requirements are met.

In Conclusion

Understanding the complexities of intestate estate is crucial for effective estate planning. Whether formulating your own plan or dealing with the passing of a loved one without a will, knowing the laws and implications of intestacy can provide clarity and guidance during a difficult time. Embracing the complexities of intestate estate may not be easy, but it is a necessary step in safeguarding your assets and honoring your wishes.

Unlocking the Mystery of Intestate Estates: Understanding the Definition

Unlocking the Mystery of Intestate Estates: Understanding the Definition

When it comes to estate planning, many people focus on creating a will to ensure their assets are distributed according to their wishes after they pass away. However, not everyone takes the time to create a will, leading to what is known as an intestate estate. In this article, we’ll delve into the definition of intestate estates, what happens when someone dies intestate, and how you can avoid this situation.

What is an Intestate Estate?

An intestate estate refers to the situation where a person passes away without a valid will in place to outline how their assets should be distributed. When someone dies intestate, the laws of the state where they reside will dictate how their assets are distributed among their heirs.

In cases of intestacy, the estate will go through the probate process, which is the legal process of administering the estate of a deceased person. During probate, the court will appoint an executor to manage the estate and oversee the distribution of assets according to the state’s intestacy laws.

What Happens When Someone Dies Intestate?

When someone dies intestate, their assets will be distributed according to the state’s intestacy laws, which vary from state to state. In general, intestacy laws prioritize close family members such as spouses, children, parents, and siblings as beneficiaries of the estate.

Here is a brief overview of how assets are typically distributed in intestate estates:

– Spouse Inherits: The deceased person’s spouse will usually inherit a significant portion of the estate, with the exact share depending on whether there are children, parents, or siblings.

– Children Inherit: If the deceased person has children but no spouse, the children will typically inherit the estate in equal shares.

– Parents Inherit: In the absence of a spouse or children, the deceased person’s parents may inherit the estate.

– Siblings Inherit: If there are no surviving spouse, children, or parents, the deceased person’s siblings may inherit the estate.

It’s important to note that intestacy laws can be complex, and the distribution of assets can vary based on the specific circumstances of each case. Consulting with an estate planning attorney is recommended to navigate the probate process and ensure the estate is distributed correctly.

How to Avoid an Intestate Estate?

To avoid the complications of intestacy and ensure your assets are distributed according to your wishes, it’s essential to create a comprehensive estate plan that includes a valid will. Here are some practical tips to help you avoid an intestate estate:

1. Create a Will: Draft a will that specifies how you want your assets to be distributed upon your death. Be sure to update your will regularly to reflect any changes in your circumstances or preferences.

2. Designate Beneficiaries: Consider designating beneficiaries on your financial accounts, retirement plans, and life insurance policies to ensure these assets bypass probate and go directly to the intended recipients.

3. Establish a Trust: Setting up a trust can provide additional flexibility and control over the distribution of your assets while avoiding the probate process.

4. Seek Legal Advice: Consult with an experienced estate planning attorney to help you create a comprehensive estate plan that addresses your specific needs and goals.

By taking proactive steps to create an estate plan, you can avoid the uncertainties of intestacy and ensure your loved ones are taken care of according to your wishes.

In conclusion, understanding the definition of intestate estates is essential for anyone concerned about the distribution of their assets after they pass away. By creating a will, designating beneficiaries, establishing trusts, and seeking legal advice, you can avoid the complications of intestacy and ensure your estate is handled according to your wishes. Don’t leave your estate up to chance – take the necessary steps today to protect your legacy and provide for your loved ones.