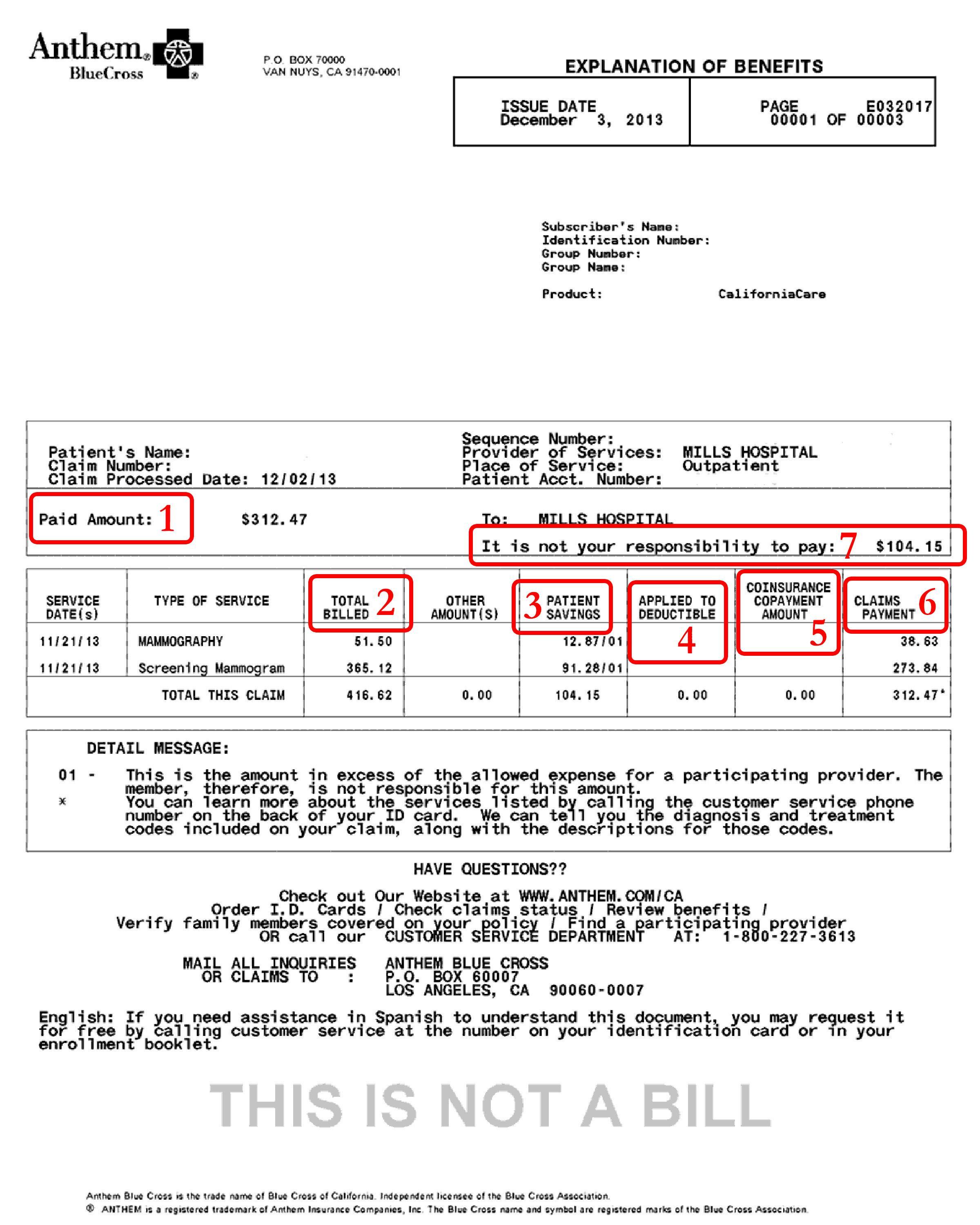

Dealing with the practical aspects of a loved one’s passing can be a daunting task. One frequently asked question is how long to retain their Explanation of Benefits (EOBs). These documents are vital in comprehending their medical costs and insurance coverage. Let’s explore the significance of EOBs after death and the duration for which you should keep them for your peace of mind.

Grasping the Significance of EOBs Post-Death

Following the death of a loved one, their family members are often tasked with managing their affairs. An essential aspect to consider during this period is the importance of retaining EOBs (Explanation of Benefits) post-death. EOBs are documents issued by insurance firms that detail the healthcare services rendered, their cost, and the portion covered by the insurance company.

It might seem convenient to discard these documents after a loved one’s death, but it’s vital to keep them for a certain duration. Here’s why:

- Expense Verification: EOBs can assist in confirming the costs incurred during the deceased’s healthcare treatment, which might be required for tax or insurance claims.

- Resolution of Unpaid Bills: Retaining EOBs can also aid in settling any pending medical bills that might surface after the person’s death.

| Reasons to Retain EOBs Post-Death |

|---|

| Expense Verification |

| Resolution of Unpaid Bills |

Recommendations for Keeping EOBs After Death

Sorting through all the paperwork after a loved one’s death can be overwhelming. One crucial aspect to consider is what to do with Explanation of Benefits (EOBs) from healthcare providers. Here are some recommendations to guide you through this process:

- Keep EOBs for at least one year: It’s advisable to retain EOBs for at least one year after the date of death. This will enable you to refer to them in case of any disputes or queries that might arise.

- Store EOBs in a specific folder: Establish a separate folder specifically for EOBs and other healthcare-related documents to keep them all in one place for easy access.

- Consider digitizing EOBs: If you prefer a paperless method, consider scanning EOBs and storing them digitally. This can help save physical space and make it easier to find specific documents.

Remember, each situation is unique, so it’s crucial to evaluate your individual needs when deciding how long to keep EOBs after a loved one’s death. By adhering to these recommendations, you can ensure that you have the necessary documents at hand while also effectively decluttering and organizing paperwork.

Considerations When Deciding Duration to Retain EOBs

When deciding how long to keep Explanation of Benefits (EOBs) after a loved one’s death, there are several key factors to consider. Here are some important considerations to bear in mind:

- Legal Obligations: Check with local laws to determine the specific requirements for retaining medical records and documents after someone’s death.

- Estate Resolution: If the deceased had unpaid medical bills or insurance claims, it might be necessary to keep EOBs for a certain duration to facilitate the resolution of their estate.

- Insurance Coverage: Keeping EOBs can be useful for reference in case of any disputes or queries regarding insurance coverage or payments.

| Factor | Significance |

|---|---|

| Legal Obligations | High |

| Estate Resolution | Medium |

| Insurance Coverage | High |

Ultimately, the decision of how long to keep EOBs after a death will depend on individual circumstances and preferences. It’s advisable to consult with legal and financial experts for advice on managing post-death paperwork effectively.

Effective Methods for Organizing and Storing EOBs Post-Death

Following the death of a loved one, organizing and storing their Explanation of Benefits (EOBs) is a crucial yet challenging task. EOBs contain vital information about medical costs and insurance claims, so it’s essential to keep them safe and accessible for potential future reference. Here are some effective methods to consider:

- Establish a specific folder or filing system: Store all EOBs in one central location, such as a physical file folder or a digital folder on your computer. This will make it easier to locate specific documents when needed.

- Clearly label EOBs: For physical copies, label each EOB with the date of service, provider, and type of medical procedure. For digital copies, use descriptive file names or folders to easily identify each document.

- Consider digitizing EOBs: To minimize clutter and ensure backup copies, consider scanning physical EOBs and storing them in a secure cloud storage service. This will help protect the documents from loss or damage.

Conclusion

In conclusion, understanding how long to keep Explanation of Benefits (EOBs) after the death of a loved one can provide a sense of organization and closure during a challenging time. While there are no strict rules, it’s important to consider the specific needs of the estate and any potential legal obligations. By staying informed and organized, you can ensure that the necessary documentation is retained while also honoring the memory of your loved one. Ultimately, finding the right balance between practicality and sentimentality is key in managing EOBs after death.

How Long Should You Retain EOBs After a Loved One’s Passing?

Losing a loved one is a difficult and emotional time, and the last thing you may want to think about is paperwork and documents. However, it’s important to understand how long you should retain Explanation of Benefits (EOBs) after a loved one’s passing. EOBs are documents that detail the services provided by healthcare providers, the amount billed, the amount covered by insurance, and the amount owed by the patient or their family.

Why Should You Keep EOBs?

Retaining EOBs after a loved one’s passing can be beneficial for a number of reasons:

- Documentation: EOBs serve as a record of the medical services provided and the associated costs. This documentation may be needed for tax purposes, insurance claims, or legal matters.

- Verification: EOBs can help you verify that you were billed correctly for the services received. Errors on medical bills are not uncommon, and keeping EOBs can help you catch these mistakes.

- Insurance Claims: If there are outstanding insurance claims or disputes, EOBs can be useful in providing evidence to support your case.

How Long Should You Keep EOBs?

While there is no strict rule on how long you should retain EOBs after a loved one’s passing, it is generally recommended to keep them for at least a few years. Here are some guidelines to consider:

- Three Years: Keeping EOBs for at least three years is a good rule of thumb. This timeframe allows you to have documentation on hand for tax purposes and any potential insurance claims or disputes.

- Probate Period: If you are involved in settling your loved one’s estate, you may need to retain EOBs for the duration of the probate period. This can vary depending on state laws.

- Extended Period: In some cases, it may be wise to keep EOBs for an extended period of time, especially if there are ongoing legal or financial matters related to your loved one’s passing.

Practical Tips for Organizing EOBs

When it comes to organizing and storing EOBs after a loved one’s passing, consider the following tips:

- Create a dedicated folder or binder specifically for EOBs to keep them organized and easily accessible.

- Label each EOB with the date of service, healthcare provider, and any other relevant details to make it easier to find specific documents when needed.

- Make digital copies of EOBs and store them securely in a cloud-based storage platform or on a secure external hard drive.

Case Study: Sarah’s Experience with Retaining EOBs

Sarah lost her mother to a prolonged illness and found herself overwhelmed with paperwork following her passing. Despite the emotional toll, Sarah made a point to retain all of her mother’s EOBs for three years. This decision proved to be invaluable when she discovered a billing error on one of the medical bills that had been overlooked.

Conclusion

While retaining EOBs after a loved one’s passing may not be a top priority during a difficult time, it is important to consider the benefits of keeping these documents for a period of time. By organizing and storing EOBs properly, you can have peace of mind knowing that you have documentation to support any future tax, insurance, or legal matters.