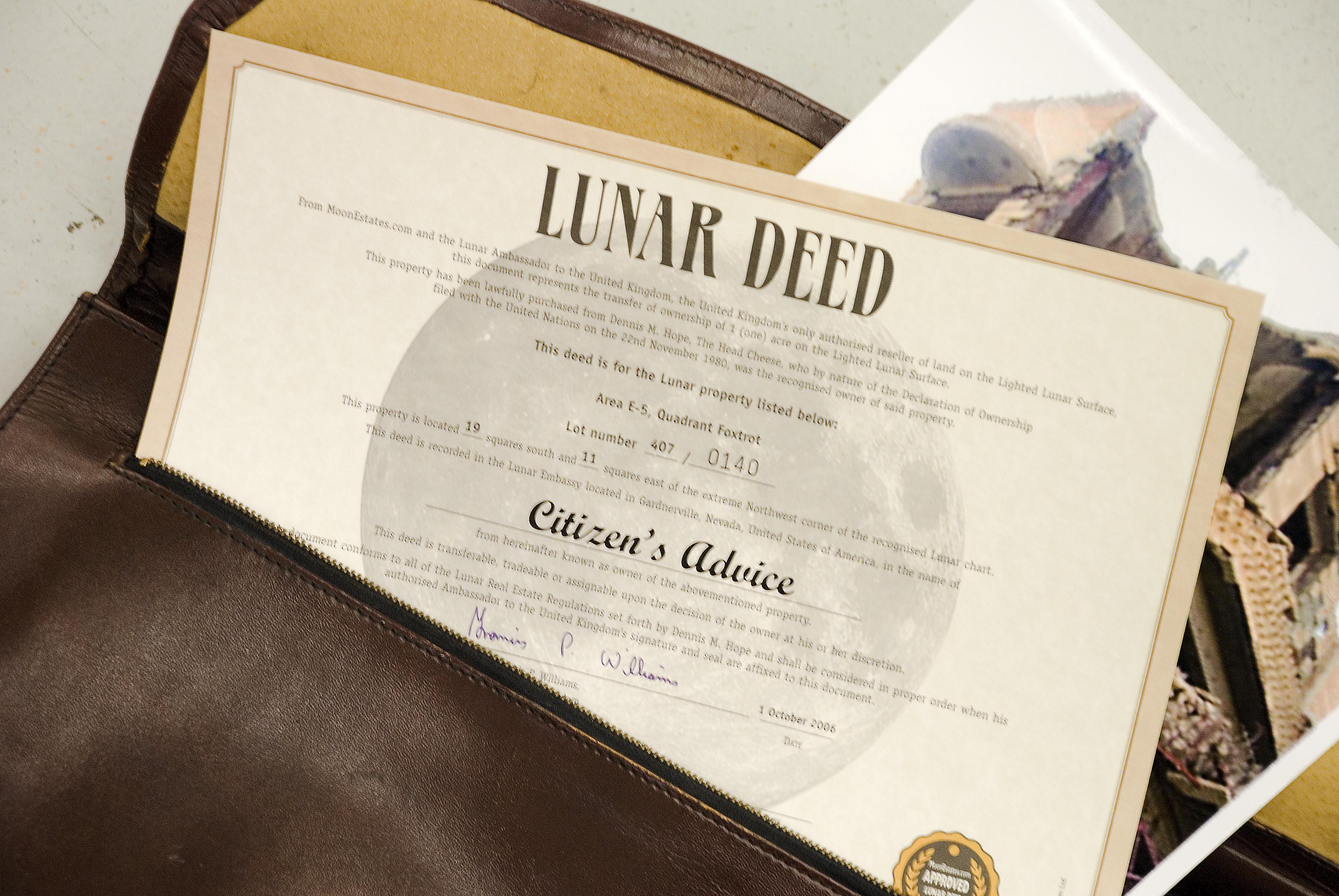

In the realm of real estate, the deed to a home is a pivotal document that signifies ownership and legal rights. It is far more than a mere piece of paper; it embodies the connection between a property and its legitimate owner. Let’s delve into the significance and ramifications of this seemingly simple document in the context of homeownership.

Grasping the Significance of a Home Deed

One of the most critical documents you will receive when purchasing a home is the deed. This legal instrument serves as proof of ownership and is indispensable for asserting your rights to the property. It is a fundamental necessity for any homeowner.

Possessing a deed to your home offers security and peace of mind. It confirms your legal claim to the property and shields you from others attempting to assert ownership. Additionally, the deed details essential aspects of the property, such as its boundaries, restrictions, and any existing easements.

Moreover, the deed is crucial for selling or transferring the property in the future. Without a deed, you would be unable to prove ownership or legally transfer the property to another party. This document is vital for any real estate transaction and is mandated by law.

It is essential for safeguarding your investment and ensuring your rights as a homeowner are protected. Keep this document in a secure location and consult with a real estate professional if you have any questions or concerns about your deed.

Essential Elements of a Deed and Their Importance

Understanding the key components of a deed is crucial for homeowners and prospective buyers. Here are some significant elements of a deed and their importance:

- Grantor: The grantor is the person or entity transferring ownership of the property. This is vital as it identifies who has the legal authority to transfer ownership rights.

- Grantee: The grantee is the person or entity receiving ownership of the property. This is essential for establishing who will hold legal ownership of the property.

- Legal Description: The legal description of the property outlines its boundaries and specifics. This helps verify the exact location and dimensions of the property.

| Component | Significance |

|---|---|

| Consideration | Indicates the price or value exchanged for the property. |

| Date | Specifies when the deed was executed and finalized. |

| Signatures | Validates the agreement between the grantor and grantee. |

Frequent Challenges in Deed Transfers

Transferring a deed to a home can present several common issues that need careful consideration and resolution. These challenges can have significant legal and financial consequences, so it is crucial to be vigilant and proactive during the deed transfer process.

One frequent issue is errors in the deed itself. This can include misspelled names, incorrect property descriptions, or missing signatures. Any of these mistakes can invalidate the deed transfer, leading to delays and potential legal disputes.

Another issue to be aware of is outstanding liens or encumbrances on the property. These can affect the new owner’s ability to obtain clear title to the property and may require legal action to resolve. Conducting a thorough title search can help identify any existing debts or claims on the property.

Additionally, it is important to consider local zoning regulations and restrictions that may impact the deed transfer. Failure to comply with these regulations can result in fines or even forced property changes. Consulting with a real estate attorney or agent can help you navigate these potential pitfalls and ensure a smooth deed transfer process.

Strategies for Protecting and Managing Your Home Deed

Backup your deed: Ensure that you have both a physical and digital copy of your home deed stored in a safe and secure location. This will help protect your ownership in case the original deed is lost or damaged.

Keep your deed safe: Store your original deed in a fireproof and waterproof safe or safety deposit box. Ensure it is easily accessible to you but secure from theft or natural disasters.

Update your contact information: Make sure your contact information on the deed is current. If you move or change your phone number, update your deed to reflect these changes to ensure you receive important notifications regarding your property.

Review your deed regularly: Periodically review your deed to confirm that all information is accurate and up to date. If there are any discrepancies, address them promptly to avoid any potential issues in the future.

Looking Ahead

The deed to a home is not merely a piece of paper but a symbol of ownership and security. It represents the bond between a homeowner and their property, granting them the authority to make decisions and create a place to call their own. Whether you are buying, selling, or inheriting a home, understanding the importance of the deed is crucial in protecting your investment and ensuring your future. So, cherish that document and all the possibilities it holds for you and your family. Remember, a home is more than just a building – it’s where memories are made and dreams are built.

Understanding Property Deeds

Securing a property deed is a significant milestone in the journey towards homeownership. A property deed is a legal document that transfers ownership of real property from one person to another. Understanding its importance is crucial for aspiring homeowners.

The Types of Property Deeds

There are several types of property deeds, each serving a unique purpose:

- Warranty Deed: Offers the highest level of protection for the buyer, guaranteeing that the property is free of any claims, debts, or liens.

- Quitclaim Deed: Provides the least protection, transferring whatever ownership interest the grantor may have without any warranties.

- Special Warranty Deed: Ensures that the property has been free of encumbrances during the period in which the seller owned it, but doesn’t cover previous owners.

Navigating the Property Deed Process

The process of securing a property deed can be intricate. Here’s a step-by-step guide to help you navigate through it:

Step 1: Obtain Title Insurance

Title insurance protects against any potential disputes over property ownership. It’s an essential safeguard when purchasing real estate.

Step 2: Conduct a Title Search

A title search is conducted to ensure the property is free of any liens or legal disputes. This step is crucial in confirming clear ownership.

Step 3: Prepare the Deed

Have a qualified attorney draft the property deed to avoid any legal issues. The deed should detail the property’s legal description and the name of the new owner.

Step 4: Execute the Deed

The deed must be signed and notarized by the seller in the presence of a notary public to be legally binding.

Step 5: Record the Deed

Submit the signed and notarized deed to the local county recorder’s office to be officially recorded. This step makes the transfer of ownership a matter of public record.

Benefits of Having a Property Deed

Holding a property deed provides several key benefits:

- Legal Ownership: A property deed legally confirms your ownership of the property.

- Security: It secures your investment by ensuring your rights are legally protected.

- Transferability: Property deeds can be used to transfer ownership, making them crucial for selling or bequeathing property.

Practical Tips for Securing Your Property Deed

Consider these practical tips:

- Hire a Real Estate Attorney: An attorney can help navigate legal complexities and ensure the deed is correctly prepared.

- Verify all Documents: Ensure all information, including property descriptions and ownership details, are accurate throughout the process.

- Keep Records: Maintain copies of all documents and communications related to the purchase and deed process.

Real-life Case Studies and Experiences

Case Study: Avoiding a Property Dispute

Jane’s story highlights the importance of title insurance. Jane purchased a home only to discover a year later that there was a dispute over the boundary lines. Thankfully, her title insurance helped her resolve the issue without a financial burden.

Case Study: The Value of a Real Estate Attorney

Mark and Sarah’s experience demonstrates the value of hiring a real estate attorney. When complications arose regarding an easement on their new property, their attorney ensured that all necessary adjustments were made in the deed before closing, saving them from potential future legal problems.

Relevant Tables

Types of Property Deeds: A Quick Comparison

| Deed Type | Description | Protection Level |

|---|---|---|

| Warranty Deed | Guarantees clear title at the time of the property’s transfer. Covers all previous owners’ actions. | High |

| Quitclaim Deed | Transfers whatever interest the grantor has in the property without any warranties or guarantees. | Low |

| Special Warranty Deed | Guarantees that the property has been free of encumbrances during the grantor’s ownership only. | Medium |

Steps for Securing a Property Deed

| Step | Action |

|---|---|

| 1 | Obtain Title Insurance |

| 2 | Conduct a Title Search |

| 3 | Prepare the Deed |

| 4 | Execute the Deed |

| 5 | Record the Deed |