In the complex ballet of existence and demise, the concepts of trusts and wills wield a potent influence over our inheritances and cherished ones. This article delves into the complex web of trusts and wills, examining how they guide our choices and secure our assets for the future. Join us on this enlightening expedition through the realm of estate planning as we demystify the enigmas of trusts and wills.

Grasping the significance of formulating trusts and wills

When it comes to estate planning, formulating trusts and wills is vital for ensuring your assets are allocated according to your preferences. Trusts enable you to designate specific beneficiaries for your assets, while wills provide directives on how your estate should be managed after your demise. These legal documents offer clarity and tranquility for both you and your cherished ones.

Advantages of formulating trusts:

- Protection of privacy

- Asset protection

- Avoidance of probate

- Control over distribution

Advantages of creating wills:

- Nominating guardians for minor children

- Distribution of assets as per your preferences

- Naming an executor to manage your estate

- Avoidance of intestacy laws

By formulating trusts and wills, you can ensure that your loved ones are cared for and your assets are distributed in a manner that aligns with your wishes. Consulting with an estate planning attorney can help you navigate the complexities of these legal documents and create a plan that reflects your unique situation and objectives.

Fundamental differences between trusts and wills

When considering estate planning, it’s essential to understand the differences between trusts and wills. Both serve different purposes and have distinct advantages and disadvantages. Here are some key points to help you navigate the complexities of trusts and wills:

- Control: A significant difference between trusts and wills is the level of control they offer. A trust allows you to manage and distribute your assets during your lifetime and even after your demise, while a will only takes effect upon your death.

- Privacy: Trusts typically offer more privacy compared to wills. A will becomes a public record once it goes through probate, while a trust allows you to keep your assets and beneficiaries confidential.

- Probate: Another significant difference is probate. Assets held in a trust do not go through probate, which can save time and money for your beneficiaries. On the other hand, assets distributed through a will must go through the probate process.

How to select the appropriate type of trust or will for your estate planning needs

When considering your estate planning needs, it is crucial to choose the right type of trust or will that aligns with your goals and circumstances. Here are some key factors to consider when making this important decision:

- Understand your objectives: Determine what you want to achieve with your estate plan, whether it’s asset protection, minimizing tax liabilities, or ensuring your loved ones are cared for.

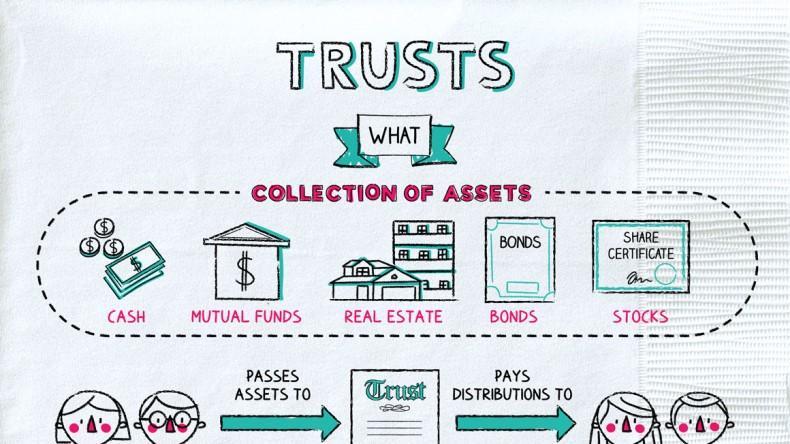

- Assess your assets: Take inventory of your assets, including real estate, investments, and personal property, to determine the best way to distribute them.

- Consider your family situation: Factor in your family dynamics, such as blended families, minor children, or special needs beneficiaries, when deciding on the type of trust or will to create.

| Type of Estate Planning Document | Key Features |

|---|---|

| Revocable Living Trust | Can be modified during your lifetime, avoids probate, and helps maintain privacy. |

| Will | Specifies how your assets will be distributed after your death, goes through probate, and allows for guardianship of minor children. |

By carefully assessing your goals, assets, and family situation, you can make an informed decision on the type of trust or will that best fits your estate planning needs. Consulting with a qualified estate planning attorney can also provide valuable guidance and ensure your wishes are carried out effectively.

Prevalent misunderstandings about trusts and wills and how to address them

One prevalent misunderstanding about trusts is that they are only for the affluent. In reality, trusts can be beneficial for individuals of various income levels. They can help avoid probate, provide for minor children or disabled family members, and ensure privacy in the distribution of assets. By setting up a trust, you can have more control over how your assets are managed and distributed after your passing.

Another misunderstanding is that creating a will is a one-time task that never needs to be revisited. However, life changes such as marriage, divorce, birth of children, or acquisition of new assets can all impact the effectiveness of your will. It is important to regularly review and update your will to reflect any changes in your circumstances or wishes. Failure to do so could result in unintended consequences and disputes among your beneficiaries.

To address these misunderstandings, it is important to seek advice from a qualified estate planning attorney who can provide guidance on the best options for your specific situation. They can help you understand the benefits of trusts, navigate the complexities of estate planning laws, and ensure that your wishes are carried out effectively. By staying informed and proactive in your estate planning efforts, you can protect your assets and provide for your loved ones in the most efficient way possible.

In Conclusion

As we navigate the complexities of estate planning and ensuring our loved ones are cared for after we’re gone, trusts and wills stand as pillars of security and tranquility. By establishing clear directives and frameworks for the distribution of our assets, we can provide our families with a sense of stability and protection for the future. Let us embrace the importance of trusts and wills as tools for safeguarding our legacies and fulfilling our promises to those we hold dear. Remember, when it comes to securing your assets and providing for your loved ones, trust in trusts and wills as your steadfast allies in planning for the future.

The Importance of Trusts and Wills

Trusts and wills are essential legal tools for ensuring your assets are distributed according to your wishes after you pass away. By creating a trust or will, you can protect your loved ones and provide for their future needs.

Understanding Trusts

A trust is a legal agreement that allows you to transfer assets to a trustee, who holds them on behalf of your beneficiaries. There are many types of trusts, including revocable trusts, irrevocable trusts, and living trusts. Each type serves a different purpose and offers unique advantages.

Understanding Wills

A will is a legal document that outlines how your assets should be distributed upon your death. It also allows you to appoint a guardian for any minor children and specify other wishes, such as funeral arrangements.

Benefits of Trusts and Wills

- Ensuring your assets are distributed according to your wishes

- Minimizing estate taxes

- Protecting assets from creditors

- Providing for minor children or disabled family members

- Avoiding probate

Practical Tips for Creating Trusts and Wills

- Consult with a qualified estate planning attorney

- Review and update your trust or will regularly

- Discuss your wishes with your loved ones

- Consider setting up a living trust for added flexibility

Case Study: The Importance of Estate Planning

John and Mary were a married couple with two young children. They decided to create a trust and will to protect their assets and provide for their children in the event of their untimely death.

| Name | Age | Relationship |

|---|---|---|

| John | 35 | Husband |

| Mary | 32 | Wife |

| Emily | 6 | Daughter |

| Jack | 4 | Son |

By working with an estate planning attorney, John and Mary were able to create a comprehensive plan that ensured their children would be cared for and their assets would be distributed according to their wishes. Their trust and will provided peace of mind knowing their family’s future was secure.

Firsthand Experience: Why Trusts and Wills Matter

As a financial advisor, I have seen firsthand the importance of trusts and wills in protecting families and assets. Without a proper estate plan in place, loved ones can face unnecessary challenges and disputes over inheritance. By taking the time to create a trust and will, you can ensure your legacy is preserved and your family is taken care of.

In Conclusion

Trusts and wills are vital tools for protecting your assets and providing for your loved ones. By understanding how trusts and wills work, their benefits, and practical tips for creating them, you can secure your family’s future and leave a lasting legacy.