Intriguing Financial Concepts: Understanding and Establishing Trust Funds

The term “trust fund” often evokes images of wealth, privilege, and mystery. So, what exactly is a trust fund, and how does it function? Let’s delves into the world of trust funds to unravel the secrets behind this common yet enigmatic financial concept and its impact on individuals and families.

Concept of Trust Fund

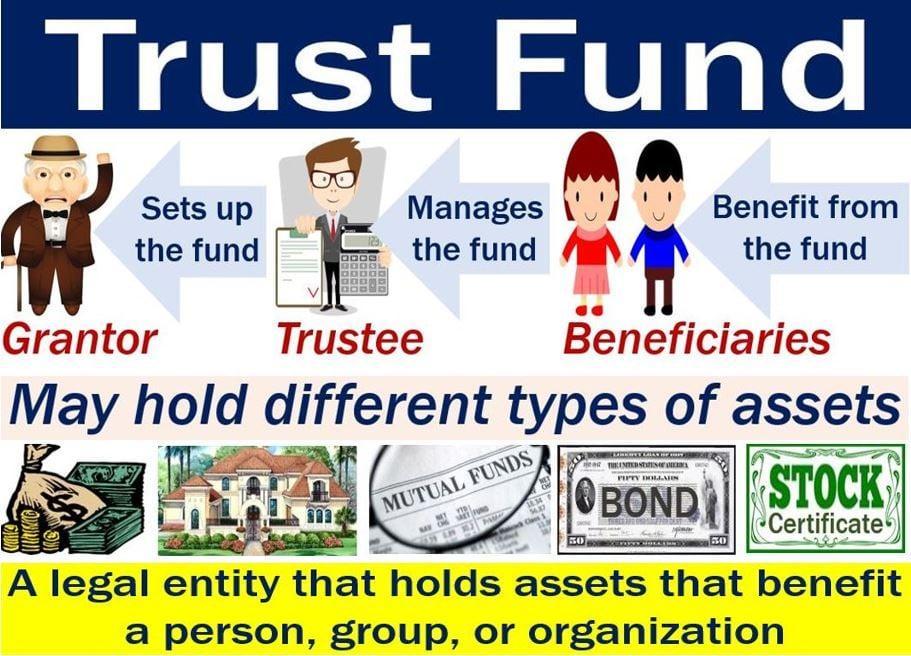

A trust fund is a financial arrangement where one party holds assets on behalf of another party or beneficiary. These assets can include cash, stocks, bonds, real estate, and other valuable items. Trust funds are typically set up to provide financial security and support for the beneficiary, whether it be a child, family member, loved one, or charity. The trustee, responsible for managing the trust fund, has a fiduciary duty to act in the best interests of the beneficiary.

One key aspect of a trust fund is that it allows for the assets to be managed and distributed according to specific instructions outlined in the trust document. This provides a level of control and protection over the assets that may not be available through other financial arrangements.

Benefits and Purpose of Establishing a Trust Fund

Trust funds offer various benefits, including asset protection, control over distribution, and tax advantages. Furthermore, trust funds can serve various purposes, such as providing for family and supporting charitable causes, allowing assets to make a positive impact on society.

Types of Trust Funds and How to Set Them Up

Trust funds are a versatile financial tool that can help individuals safeguard and manage assets for themselves or their beneficiaries. Some common types of trust funds include revocable trusts, irrevocable trusts, charitable trusts, and spendthrift trusts. When setting up a trust fund, careful planning and attention to detail are essential to ensure that the assets are managed according to the wishes of the grantor.

Key Considerations When Choosing a Trustee

Choosing a trustee for a trust fund requires considering factors such as the trustee’s level of experience and expertise in financial matters, trustworthiness and integrity, and availability and willingness to fulfill their responsibilities. By carefully assessing these key factors, a trustee who can effectively manage the trust fund and safeguard the interests of the beneficiaries can be selected.

Closing Remarks

In conclusion, understanding the intricacies of trust funds can empower individuals to make informed decisions about their finances and legacy planning. Whether you are the beneficiary of a trust fund or considering establishing one yourself, knowing what a trust fund means can help you navigate the complex world of wealth management with confidence. Trust in the process, and trust in the future that lies ahead.

Unlocking the Power of Trust Funds: Everything You Need to Know

Unlocking the Power of Trust Funds: Everything You Need to Know

Trust funds are a powerful wealth management tool that can provide both financial security and peace of mind for individuals and their families. In this comprehensive guide, we will explore everything you need to know about trust funds, including their benefits, how they work, and practical tips for setting up and managing a trust fund.

What is a Trust Fund?

A trust fund is a legal arrangement in which a trustee holds and manages assets on behalf of a beneficiary or beneficiaries. The trustee is responsible for managing the trust according to the terms set out in the trust document, which typically include instructions for how the assets should be distributed to the beneficiaries.

Trust funds are commonly used to provide for the financial needs of minor children, elderly parents, or individuals with disabilities. They can also be used to protect assets from creditors, avoid probate, and minimize taxes.

Benefits of Trust Funds

There are several key benefits to setting up a trust fund, including:

1. Asset Protection: Trust funds can protect assets from creditors, lawsuits, and divorce settlements, ensuring that the assets are preserved for the benefit of the beneficiaries.

2. Avoiding Probate: Assets held in a trust fund are not subject to probate, which can save time and money and ensure that the assets are distributed according to the wishes of the grantor.

3. Tax Efficiency: Trust funds can be structured in a way that minimizes taxes, allowing the assets to grow and be distributed to beneficiaries tax-free.

4. Control: Trust funds allow the grantor to control how and when the assets are distributed to the beneficiaries, providing flexibility and peace of mind.

Practical Tips for Setting Up and Managing a Trust Fund

If you are considering setting up a trust fund, here are some practical tips to keep in mind:

1. Determine Your Goals: Before setting up a trust fund, clearly define your goals and objectives for the trust, including who the beneficiaries will be, how the assets will be distributed, and who will serve as the trustee.

2. Choose the Right Trustee: Selecting the right trustee is critical to the success of a trust fund. Consider choosing a professional trustee, such as a bank or trust company, to ensure that the trust is managed effectively and impartially.

3. Fund the Trust Appropriately: To fund a trust fund, transfer assets into the trust and ensure that the assets are titled in the name of the trust. Be sure to follow all legal requirements for transferring assets into the trust.

4. Review and Update Regularly: It’s important to review and update the trust document regularly to ensure that it aligns with your current goals and objectives. Consider reviewing the trust with your attorney or financial advisor on a regular basis.

Case Studies

Let’s take a look at a couple of real-world examples of how trust funds can be used to achieve financial goals:

Case Study 1: Mary’s Education Fund

Mary sets up a trust fund to provide for her daughter’s education expenses. The trust is structured to pay for tuition, books, and other educational expenses until her daughter completes her degree. By setting up the trust fund, Mary ensures that her daughter’s education is financially secure, regardless of any unforeseen circumstances.

Case Study 2: John’s Retirement Fund

John establishes a trust fund to provide for his retirement. The trust is invested in a diversified portfolio of stocks, bonds, and real estate, with the goal of generating income for John to live on during retirement. By setting up the trust fund, John can retire with peace of mind, knowing that he has a secure source of income for the future.

First-Hand Experience

“I set up a trust fund for my children to ensure that their financial needs are taken care of in the future. By working with a professional trustee and regularly reviewing the trust document, I can rest easy knowing that my children’s financial future is secure.”

In conclusion, trust funds are a powerful wealth management tool that can provide financial security and peace of mind for individuals and their families. By understanding how trust funds work, the benefits they offer, and practical tips for setting up and managing a trust fund, you can unlock the power of trust funds to achieve your financial goals and protect your assets for future generations. Trust funds offer a level of control and protection that can provide immense peace of mind for those looking to secure their financial future.