Introduction:

In the realm of financial planning and legacy management, state estate taxes play a pivotal role, affecting not just individual families but also the wider societal framework. As we explore the intricacies of wealth transfer and inheritance, the presence of state estate taxes demands attention and analysis. These taxes, characterized by a diverse array of laws and rates across different jurisdictions, can profoundly impact how families plan for their futures, with effects that may extend across generations.

But what do state estate taxes signify for the average person, policymakers, and the economy as a whole? Are they essential for funding public services and addressing wealth inequality, or do they impede personal wealth growth and deter investment? This article delves into the multifaceted impact of state estate taxes, exploring their effects on fiscal policy, individual behavior, and the socio-economic landscape, aiming to clarify a topic often surrounded by confusion and debate.

The Evolution of State Estate Taxes: A Historical Perspective

State estate taxes in the United States have undergone significant changes over time, rooted in the need for revenue and evolving societal values regarding wealth distribution and inheritance. The origins of estate taxes date back to the 18th century, primarily aimed at funding government operations following the Revolutionary War. These taxes emerged as states faced limited resources and sought to establish a tax structure to support growing public services.

As time progressed, cultural attitudes towards wealth and inheritance shifted. The Progressive Era, spanning the late 19th and early 20th centuries, brought about reforms aimed at reducing wealth inequality, leading to renewed interest in state estate taxes. During this period, many states began to reconsider how the growing fortunes of the wealthy could contribute to the public good, solidifying estate taxes as a tool for wealth redistribution.

By the mid-20th century, estate taxes had further evolved, reflecting broader economic changes and critiques. The establishment of the federal estate tax in 1916 prompted states to rethink their tax strategies. Consequently, many states aligned their estate taxes with federal regulations, creating a complex web of tax liabilities for families dealing with multi-state inheritances. Key milestones in the evolution of state estate taxes include:

- **1942**: The implementation of the modern federal estate tax structure.

- **1976**: The introduction of the Unified Estate and Gift Tax system, providing clearer guidelines for estates.

- **2001**: The Economic Growth and Tax Relief Reconciliation Act, which gradually increased exemption limits.

The interplay between political priorities and economic realities continues to shape state estate taxes today. As states evaluate their fiscal needs against the backdrop of wealth inequality and demographic shifts, adjustments to estate tax policies will likely remain a relevant topic of debate.

Economic Impacts on Families and Local Communities

The imposition of state estate taxes introduces a complex dynamic for families planning their financial futures. These taxes, levied upon the transfer of wealth at death, often lead to challenging decisions for heirs as they navigate the implications on their inherited assets. Families may face several economic considerations:

- Financial Planning: The prospect of estate taxes prompts families to engage in strategic financial planning, which may involve trusts or other estate planning tools to mitigate tax burdens.

- Asset Liquidation: Heirs may need to liquidate assets quickly to cover tax liabilities. This urgency can lead to distressed sales, adversely affecting the value received.

- Long-Term Wealth Transfer: The presence of estate taxes can influence the long-term trajectory of family wealth, potentially limiting the resources available for future generations.

Additionally, local economies face their own set of challenges and opportunities stemming from estate tax policies. Large estates often represent significant real estate and business interests, and the decisions made by heirs can ripple through the community:

- Property Market Dynamics: If numerous families choose to sell inherited properties to cover estate taxes, this could lead to market saturation, affecting local property values and real estate dynamics.

- Local Business Sustainability: Heirs who inherit local businesses might struggle to maintain operations amidst tax pressures, impacting employment rates and community stability.

- Revenue for Local Governments: On a positive note, estate taxes can generate substantial revenue for state and local governments, which could be redirected into public services and community initiatives.

Understanding these economic implications is crucial for both families planning their legacies and policymakers shaping estate tax regulations. Striking a balance between fair taxation and the preservation of family wealth requires continuous dialogue among stakeholders, ensuring that the challenges posed by estate taxes align effectively with the broader objectives of fostering both familial and communal prosperity.

State-by-State Comparisons: Approaches to Estate Taxation

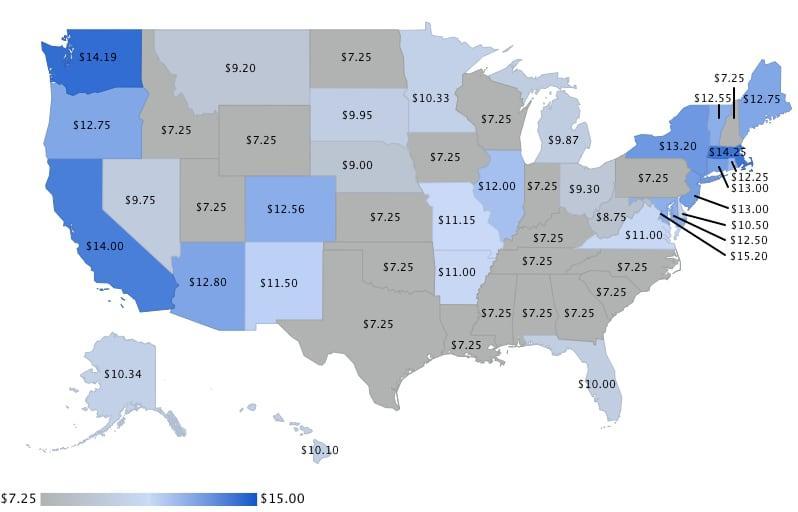

Examining how state estate taxes function reveals significant disparities in approach and implications for residents. Different states adopt various methodologies regarding tax rates, exemptions, and structures that ultimately influence estate planning strategies. For example, some states impose a flat rate on estate transfers, while others have progressive rates based on the value of the estate. Understanding these differences is essential for effective financial planning and ensuring compliance with state-specific regulations.

ates over a specific value, while others employ a progressive model that increases rates with larger estates.

Here are some varied approaches:

- Flat Rate Taxes: States like Indiana implement a consistent tax rate on all estates surpassing a certain threshold, simplifying the taxation process.

- Progressive Rate Structures: In contrast, states such as New York use a tiered tax system where estates are taxed at escalating rates based on their value, significantly increasing the tax burden for larger estates.

- Exemptions and Deductions: States like Florida have no state estate tax at all, while others offer substantial exemptions that allow smaller estates to avoid taxation entirely.

Moreover, the treatment of certain assets can greatly influence wealth distribution. Here’s a summary highlighting key differences:

| State | Tax Rate | Exemption Limit | Notes |

|---|---|---|---|

| California | No Estate Tax | N/A | California abolished estate tax in 1982. |

| Massachusetts | 0.8% – 16% | $1 million | Uses a progressive system with multiple tax brackets. |

| New Jersey | 0% – 16% | $675,000 | One of the highest estate tax rates in the nation. |

| Florida | No Estate Tax | N/A | Attracts wealthy individuals for residency. |

Decisions regarding estate tax can significantly impact wealth distribution among heirs and influence individuals’ choice of residence. Developing tax strategies should reflect a comprehensive understanding of these state-specific regulations, enabling individuals and families to better secure their legacies.

Strategies to Reduce Estate Tax Impact on Inheritance

Estate taxes can substantially affect the inheritance received by beneficiaries, but strategic planning can help minimize this financial burden. Understanding the intricacies of state estate taxes is crucial for effective planning. Here are some strategies to consider:

- Establishing Trusts: Utilizing various types of trusts, such as irrevocable life insurance trusts (ILITs) or charitable remainder trusts (CRTs), can effectively reduce the taxable value of an estate. By placing assets in these trusts, you can remove them from your taxable estate and provide for your heirs while potentially benefiting charitable organizations.

- Annual Gift Allowances: Taking advantage of the annual gift tax exclusion allows you to give away a certain amount each year without incurring taxes. By gifting assets over time, you can reduce the overall value of your estate, thereby lowering potential estate taxes.

- Utilizing Tax Exemptions: Many states offer exemptions or deductions for estates that fall below a certain value. Make it a priority to stay informed about current laws and consider restructuring your assets to qualify for these exemptions.

- Family Limited Partnerships (FLPs): These entities can effectively transfer wealth while minimizing tax liabilities. By placing assets into an FLP, you can control how they are distributed and potentially discount their value for estate tax purposes.

Implementing these strategies can significantly reduce the impact of estate taxes on inherited wealth. It’s advisable to collaborate with financial professionals to tailor these approaches to your specific situation.

Advisors or estate planning attorneys to customize these strategies to your unique financial circumstances. The right plan can help preserve more of your wealth for future generations, ensuring they fully benefit from your legacy.

Illustrating the Impact of Estate Taxes

| Asset Type | Estimated Value | Potential Estate Tax |

|---|---|---|

| Real Estate | $600,000 | $50,000 |

| Investment Accounts | $300,000 | $25,000 |

| Business Interests | $200,000 | $15,000 |

| Total | $1,100,000 | $90,000 |

This table highlights the potential estate tax liabilities associated with various asset types and their estimated values. As shown, effective estate planning can significantly reduce the tax burden on beneficiaries, allowing them to retain a larger portion of their inheritance.

Final Thoughts

As we conclude our discussion on state estate taxes, it is evident that this topic is as complex as the families it impacts. These taxes, often overshadowed by federal regulations, have profound effects on wealth distribution, economic planning, and the legacies we leave behind. They function as both a revenue-generating mechanism for state governments and a potential financial strain on heirs, mirroring broader societal values and priorities.

The influence of state estate taxes prompts us to consider the balance between funding essential public services and respecting the wishes of those who have passed away. As debates around taxation and wealth inequality continue to evolve, the conversation about estate taxes remains vital. It challenges us to think about not only how we manage our resources but also how we envision our collective future. By navigating these complexities, we can shape a more equitable landscape for future generations.  #

#

How State Estate Taxes Shape Your Financial Legacy

Understanding State Estate Taxes

Estate taxes, commonly known as “death taxes,” can significantly impact the financial legacy you leave behind. While the federal estate tax often receives more attention, many states have their own estate taxes and inheritance taxes, which can add further complexity to your estate planning. Familiarizing yourself with these state-imposed taxes is essential for effective estate planning and ensuring your heirs receive the maximum benefit.

State Estate Taxes vs Federal Estate Taxes

Understanding the difference between state estate taxes and federal estate taxes is crucial for comprehensive estate planning. The federal estate tax only applies to estates exceeding a certain threshold—currently $12.06 million for individuals in 2023. However, many states have their own estate taxes with much lower thresholds, impacting a larger number of estates.

| State | Estate Tax Exemption | Top Estate Tax Rate |

|---|---|---|

| Massachusetts | $1 million | 16% |

| New York | $5.93 million | 16% |

| Washington | $2.193 million | 20% |

As seen from the table, estate tax thresholds and rates vary significantly among states, necessitating a personalized approach to estate planning.

The Impact of State Estate Taxes on Your Financial Legacy

State estate taxes can significantly reduce the value of the assets your heirs receive. This reduction not only affects your immediate heirs but can also influence long-term financial stability across generations.

Intergenerational Wealth Transfer

State estate taxes can diminish the capital passed down to future generations. This reduction can impact the financial well-being of your descendants, potentially hindering opportunities for education, homeownership, and entrepreneurship.

Charitable Giving

High estate taxes can also impact charitable contributions specified in your will. Higher taxes could necessitate liquidating assets meant for charitable causes, reducing the overall effectiveness of your philanthropic goals.

Strategies to Minimize State Estate Taxes

Estate planning attorneys often recommend various strategies to mitigate the impact of state estate taxes. Below are some practical tips to consider:

Utilize Irrevocable Trusts

An irrevocable trust can remove assets from your taxable estate, thereby reducing the overall value subject to estate taxes. This strategy can help you manage the distribution of your estate more effectively.

Gifting

You can lower the taxable value of your estate by gifting assets during your lifetime. The annual gift tax exemption—currently $15,000 per recipient in 2023—allows you to transfer significant wealth without incurring additional taxes.

Establish a Family Limited Partnership

By consolidating family-owned assets into a Family Limited Partnership (FLP), you can reduce the value of your estate through valuation discounts. FLPs also offer control over how assets are managed and distributed.

Case Study: The Smith Family Estate

The Smith family faced the challenge of hefty state estate taxes when planning their financial legacy. Mr. Smith, a Massachusetts resident with an estate valued at $3 million, sought to minimize the tax burden.

By establishing an irrevocable trust and making annual gifts to his children, Mr. Smith successfully reduced his estate’s taxable value to below $1 million. This strategy not only alleviated the tax burden but also ensured that a larger portion of the estate could be enjoyed by future generations.

Lessons Learned

– The importance of starting early: By initiating estate planning well before his death, Mr. Smith had ample time to implement effective strategies.

– Leverage professional advice: Working with a qualified estate planning attorney can offer personalized solutions tailored to individual circumstances.

– Consider state-specific laws: Understanding local regulations is crucial for effective planning and strategy execution.

Practical Tips for Navigating State Estate Taxes

Stay Informed

Tax laws can change frequently. Staying informed about current regulations in your state can help you adapt your estate planning strategies accordingly.

Consult Financial Advisors

Estate planning can be complicated, requiring a nuanced understanding of tax laws and financial structures. Professional advisors can provide guidance tailored to your unique circumstances.

Plan for the Long Term

Effective estate planning is an ongoing process rather than a one-time event. Regularly review and update your estate plan to reflect changes in your financial situation and tax laws.

Consider Relocation

In some cases, relocating to a state without estate taxes can be a viable strategy, particularly for retirees. However, this decision should be weighed carefully against other lifestyle factors.

Additional Considerations

Age and Health Status

Your age and health can influence the urgency and type of estate planning measures to adopt. Younger individuals may focus more on asset growth, while older individuals may prioritize tax reduction strategies.

Family Dynamics

Family dynamics, including relationships and individual financial needs, should also inform your estate planning decisions. A balanced approach can help mitigate potential conflicts and ensure equitable asset distribution.

Digital Assets

In today’s digital age, consider how digital assets like cryptocurrencies, online investments, and intellectual property will be managed and transferred. Ensuring access to passwords and proper identification can simplify the process for your heirs.

By thoroughly understanding how state estate taxes affect your financial legacy and utilizing strategic planning, you can maximize the benefits for your heirs while minimizing the tax burden. Regularly revisiting and updating your estate plan ensures it remains effective and aligned with your goals. Adjustments like gifting, establishing trusts, and seeking professional advice are essential steps in safeguarding your financial legacy.