Have you ever found yourself in a position where your name is on the title of a property, but not on the mortgage? This common occurrence can result in a complicated mix of financial and legal consequences. In this article, we will delve into the intricacies of being on the title but not the mortgage, and what it signifies for your ownership rights and obligations. Let’s dive in and demystify this unique arrangement.

Grasping the Legal Consequences of Being on the Title but Not the Mortgage

Being on the title of a property but not the mortgage can have both benefits and drawbacks. It’s crucial to comprehend the legal consequences of this situation to safeguard your rights and interests. Here are some key factors to consider:

**Benefits:**

- Ownership Rights: As a co-owner on the title, you have a legal claim to the property and can reside in it or sell it based on your ownership percentage.

- Asset Protection: Your ownership of the property can be utilized as an asset to secure loans or investments without being directly accountable for the mortgage payments.

**Drawbacks:**

- Financial Responsibility: Even though you are not on the mortgage, you could still be held accountable for property taxes, utilities, and maintenance costs if the other owner defaults on the mortgage.

- Limited Control: Without being on the mortgage, you may not have control over the refinancing, sale, or other financial decisions related to the property.

Pros and Cons of Being on the Title Only

When it comes to real estate ownership, being on the title but not the mortgage can have both benefits and drawbacks. Let’s examine some of the pros and cons more closely:

Benefits:

- Ownership: Being on the title signifies that you have legal ownership of the property, which can provide a sense of security and stability.

- Equity: As a title holder, you may be able to accumulate equity in the property over time, which can be advantageous if you ever decide to sell.

- Decision-making: Being on the title may give you a say in certain decisions related to the property, such as renovations or upgrades.

Drawbacks:

- Financial Responsibility: Even if you’re not on the mortgage, you may still be liable for certain financial obligations related to the property, such as taxes or maintenance costs.

- Risk: If the mortgage holder defaults on the loan, you could potentially lose your stake in the property, even if you’ve been making regular payments.

- Limited Control: While being on the title may give you some decision-making authority, ultimately, the mortgage holder has the final say in most matters related to the property.

How to Secure Your Interest in the Property When Not on the Mortgage

If you find yourself in a situation where you are on the title but not the mortgage of a property, it’s important to take measures to secure your interest in the property. While not being on the mortgage can seem like a disadvantage, there are still ways to protect your investment.

One way to secure your interest in the property is to have a formal agreement in place with the person whose name is on the mortgage. This agreement can outline your rights to the property, including your share of any equity that may accumulate over time. It’s vital to have this agreement in writing and signed by both parties for legal protection.

Additionally, you can consider taking out a home equity line of credit (HELOC) on the property. This can give you access to funds that can be used to pay for any expenses related to the property, while also establishing a financial stake in the home. Be sure to consult with a financial advisor to determine if this option is suitable for you.

Another option to secure your interest in the property is to keep detailed records of any financial contributions you make towards the property. This can include payments for maintenance, repairs, or property taxes. Having a clear paper trail can help you prove your investment in the property in the event of any disputes.

Key Considerations for Co-ownership Without Mortgage Responsibility

When entering into a co-ownership arrangement without being responsible for the mortgage, there are several important considerations to keep in mind to protect your interests:

- Legal Agreement: It is vital to have a legally binding agreement in place that outlines each party’s rights and responsibilities in the property.

- Property Maintenance: Determine how ongoing costs such as property taxes, insurance, and maintenance will be divided between co-owners.

- Exit Strategy: Discuss and agree on what will happen if one party wants to sell their share of the property or if one party defaults on their financial obligations.

- Communication: Open and honest communication is key to resolving any conflicts or issues that may arise in the co-ownership arrangement.

| Consideration | Importance |

|---|---|

| Legal Agreement | Extremely Important |

| Property Maintenance | Essential |

| Exit Strategy | Crucial |

| Communication | Indispensable |

In Conclusion

In summary, being on the title but not the mortgage can lead to a unique set of circumstances and potential risks to consider. It is important to fully understand your rights and responsibilities in such situations to protect your investment and ensure a smooth property ownership experience. Remember to consult with legal and financial professionals to help navigate any potential challenges that may arise. Thank you for reading and best of luck in your real estate endeavors!

What Does it Mean to Be on the Deed but Not the Mortgage? Unraveling the Mystery!

Being on the deed but not the mortgage can be a confusing situation for many homeowners. It’s important to understand the differences between being on the deed and being on the mortgage, as they have important legal and financial implications. In this article, we will unravel the mystery of what it means to be on the deed but not the mortgage.

Deed vs. Mortgage: What’s the Difference?

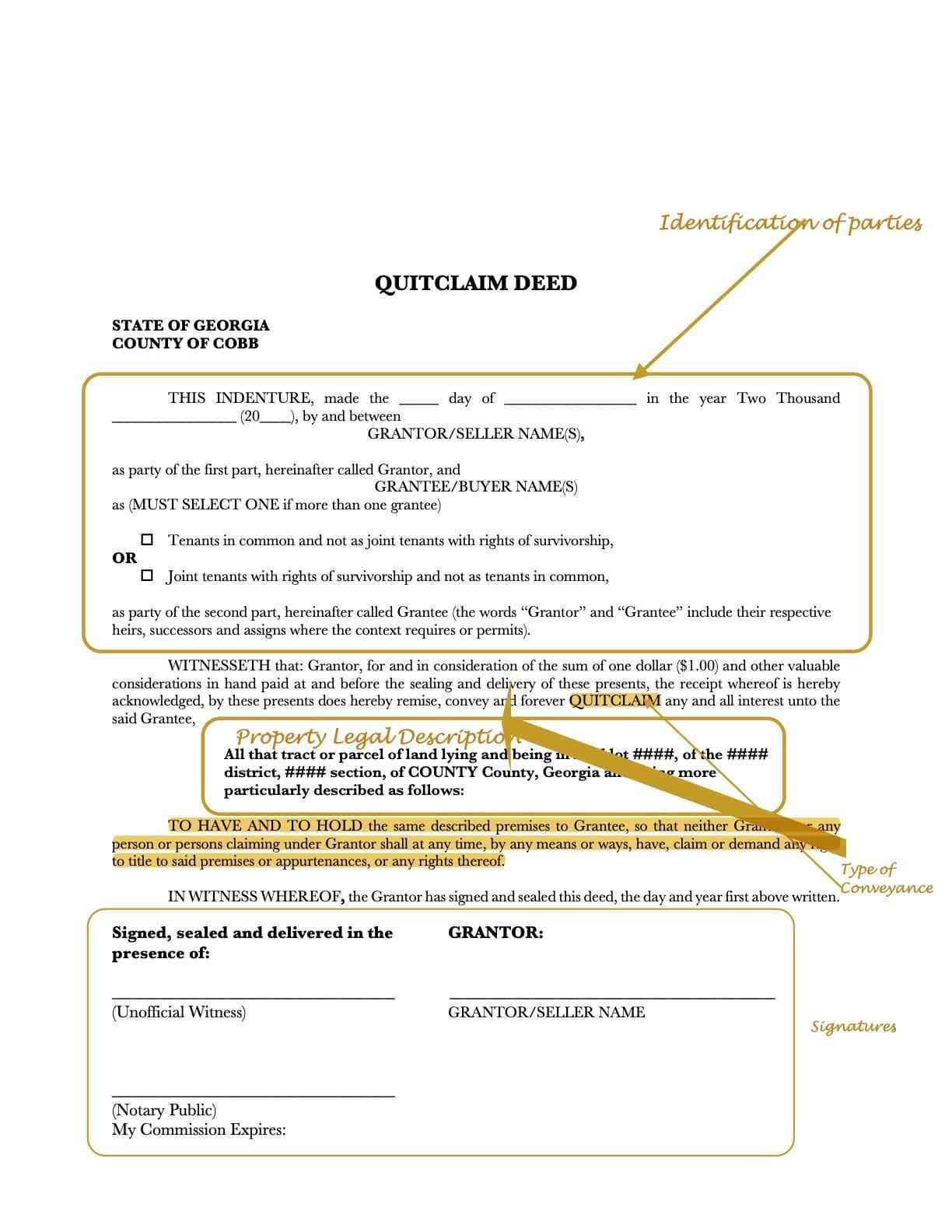

Before we delve into what it means to be on the deed but not the mortgage, it’s crucial to understand the difference between the two:

- Deed: A deed is a legal document that establishes ownership of a property. When you are on the deed, you have legal rights to the property and are considered a co-owner.

- Mortgage: A mortgage is a loan that is used to purchase a property. When you are on the mortgage, you are responsible for making the mortgage payments.

What Does it Mean to Be on the Deed but Not the Mortgage?

When you are on the deed but not the mortgage, it means that you have ownership rights to the property, but you are not financially responsible for the mortgage. This can happen in various situations, such as:

- One person may be on the deed for estate planning purposes.

- A family member may be added to the deed for inheritance reasons.

- Divorced couples may choose to keep one person on the deed but not the mortgage.

Benefits and Practical Tips

Being on the deed but not the mortgage can have its advantages, such as:

- Ensuring that ownership rights are protected.

- Allowing for estate planning and inheritance purposes.

- Providing legal rights to the property without the financial burden of a mortgage.

Case Studies

Let’s take a look at a few case studies to better understand what it means to be on the deed but not the mortgage:

| Case Study | Description |

|---|---|

| Case Study 1 | John and Jane are married, but only John’s name is on the mortgage. Jane is on the deed to ensure ownership rights in the event of John’s passing. |

| Case Study 2 | Susan and Tom are siblings who inherit a property from their parents. Susan is on the deed, but Tom is responsible for the mortgage payments. |

First-Hand Experience

Many homeowners find themselves in the situation of being on the deed but not the mortgage. It’s essential to communicate openly with all parties involved to ensure everyone understands their rights and responsibilities.

Ultimately, being on the deed but not the mortgage can offer a unique balance of ownership and financial flexibility. It’s essential to consult with a legal professional to understand your specific rights and obligations in this situation.