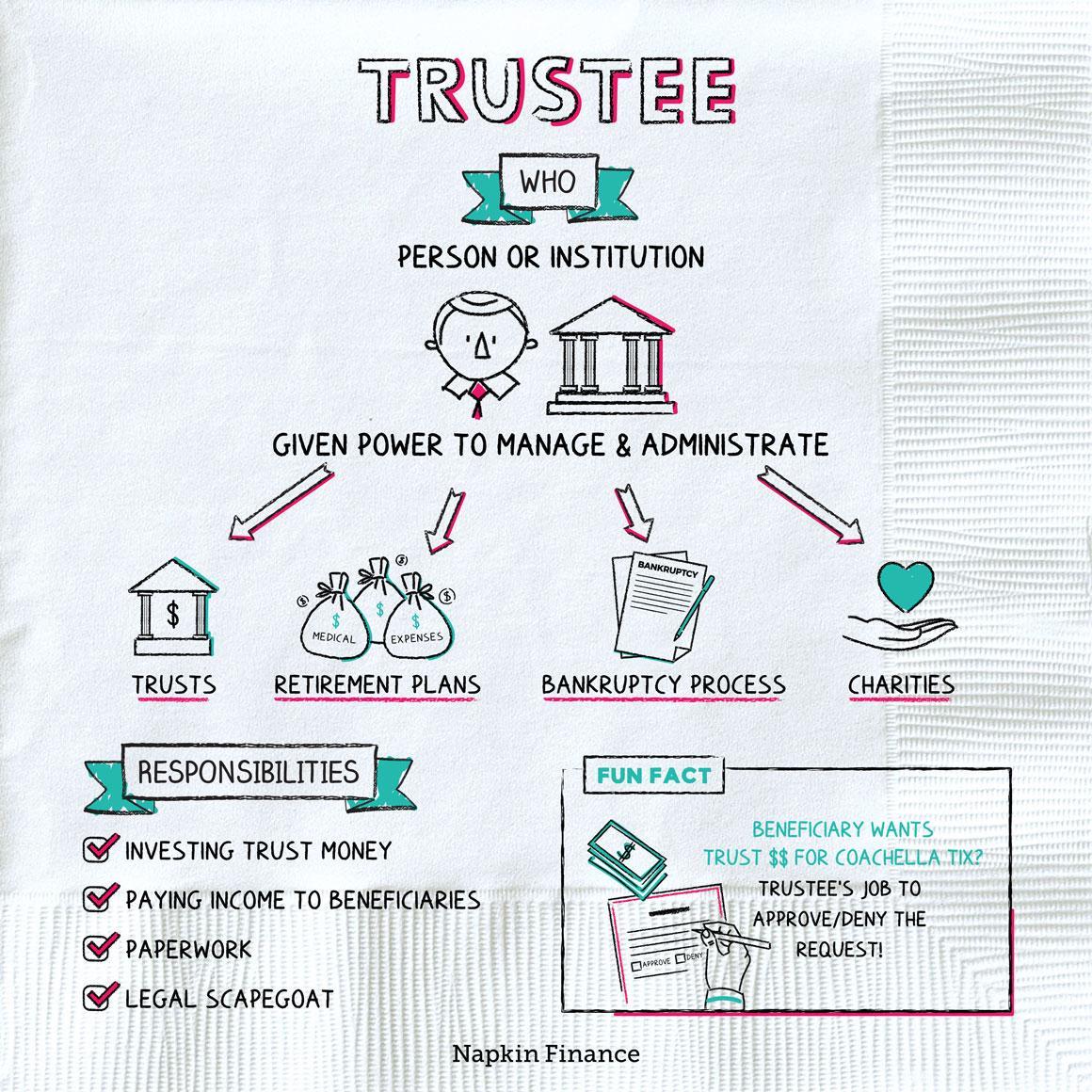

Trustees are crucial in protecting assets and representing the best interests of beneficiaries. The topic of trustee compensation is a complex one that raises many questions. How much should a trustee be paid for their invaluable services? Let’s explore the various factors that influence trustee compensation.

Determining Fair Compensation for Trustees

When it comes to determining fair compensation for trustees, there are several important considerations to keep in mind. These include the level of responsibilities, expertise, and time commitment. The size and complexity of the trust also play a role in determining fair compensation. Ultimately, it is vital to strike a balance between compensating trustees fairly and ensuring that the trust assets are not unnecessarily depleted.

Factors Influencing Trustee Payment

Several factors can influence trustee compensation. The complexity and size of the trust, the experience and expertise of the trustee, and the frequency of trustee duties and responsibilities are all significant factors that should be considered. Trustee compensation should reflect the time and effort required to fulfill all necessary duties and obligations.

Balancing Compensation with Trustee Responsibilities

The question of how much a trustee should be paid is a complex one. Trustees are expected to fulfill their duties with care, loyalty, and honesty while also being entitled to fair compensation for their time, effort, and expertise. It’s essential to consider factors such as the size and complexity of the trust, the time commitment required, and the trustee’s level of experience and expertise when determining fair compensation.

Recommendations for Setting Trustee Compensation

When determining trustee compensation, it’s important to conduct a comparative analysis to establish a benchmark for what is considered reasonable and customary. Factors such as responsibilities and time commitment, as well as expertise and experience, should be taken into account. Open communication with trustees about compensation expectations and rationale can help ensure transparency and buy-in from all parties involved.

In Retrospect

Determining the appropriate compensation for a trustee is a multifaceted decision that requires careful consideration of various factors, including the complexity of the trust, the trustee’s responsibilities, and the prevailing market rates. While it is important to ensure fair compensation for trustees in order to attract qualified individuals to serve in this critical role, it is equally crucial to strike a balance that does not compromise the integrity of the trust or erode the trust’s assets. Ultimately, the question of how much a trustee should be paid requires thoughtful deliberation and a keen eye towards maintaining the trust’s best interests at heart.

What’s the Right Pay for a Trustee?

As a trustee, you play a crucial role in managing and overseeing the assets of a trust. It’s a position that comes with significant responsibility, and it’s only natural to wonder what the right pay for a trustee should be. Determining fair compensation for trustees can be a complex and nuanced process, but it’s important to ensure that trustees are fairly compensated for their time and expertise.

The Basics of Trustee Compensation

Trustee compensation can vary depending on several factors, including the size of the trust, the complexity of the assets, the duties required of the trustee, and local laws and regulations. In general, trustees are typically compensated for their time and effort in managing the trust, as well as for any expenses incurred in the course of their duties.

There are several common methods for determining trustee compensation:

- Flat fee: Some trustees are paid a flat fee for their services, regardless of the size of the trust or the amount of work required.

- Percentage fee: In some cases, trustees are paid a percentage of the assets under management, as a way to align their interests with the beneficiaries of the trust.

- Hourly rate: Some trustees are paid an hourly rate for their time, much like a consultant or attorney.

Factors to Consider When Determining Trustee Compensation

When determining the right pay for a trustee, there are several factors to take into account:

- Size and complexity of the trust

- Level of expertise and experience required of the trustee

- Time commitment involved in managing the trust

- Market rates for trustee services in your area

It’s important to strike a balance between fair compensation for the trustee and ensuring that the trust’s assets are not eroded by excessive fees. Trustees have a fiduciary duty to act in the best interests of the trust beneficiaries, which includes being mindful of costs and fees.

Benefits and Practical Tips

There are several benefits to compensating trustees fairly:

- Attracting and retaining qualified trustees

- Motivating trustees to perform their duties effectively

- Aligning the interests of the trustee with the beneficiaries

Here are some practical tips for determining trustee compensation:

- Consult with an attorney or financial advisor who specializes in trust administration

- Research market rates for trustee services in your area

- Consider the size and complexity of the trust when determining compensation

Case Studies

Here are a few examples of trustee compensation arrangements:

| Trustee | Compensation |

|---|---|

| John Smith | Flat fee of $5,000 per year |

| Jane Doe | Percentage fee of 1% of assets under management |

| Sam Jones | Hourly rate of $150 per hour |

First-Hand Experience

As a trustee myself, I have found that open communication with the trust beneficiaries is key when it comes to determining fair compensation. Transparency about fees and expenses can help build trust and ensure that all parties are on the same page. It’s also important to document any decisions regarding trustee compensation in writing to avoid misunderstandings or disputes down the line.

Ultimately, the right pay for a trustee will depend on a variety of factors, and it’s important to consider all aspects of the trustee’s role when determining fair compensation. By striking the right balance between compensation and accountability, you can ensure that the trust is managed effectively and in the best interests of all parties involved.