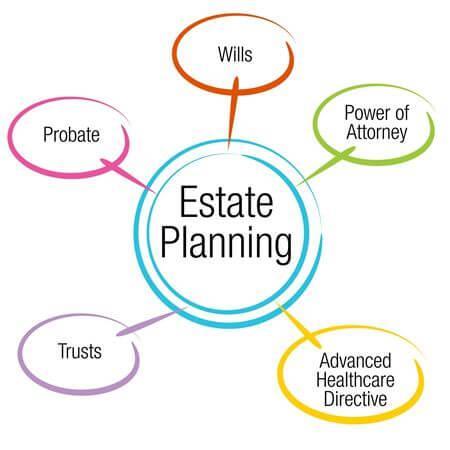

Ever pondered the workings of estate trusts? These legal instruments are potent mechanisms that can facilitate the smooth and efficient transfer of your assets to your heirs. This article will delve into the intricacies of estate trusts, their operation, and why they could be a crucial component of your estate planning approach. So, sit back, relax, and let’s navigate the intriguing realm of estate trusts.

Grasping the Fundamentals of Estate Trusts

An estate trust is a legal framework that enables an individual (the grantor) to transfer their assets to a trustee. The trustee then manages and distributes these assets as per the grantor’s directives. Trusts are frequently employed in estate planning to ensure that assets are safeguarded and transferred to beneficiaries in a structured and efficient way.

The operation of an estate trust involves the grantor drafting a trust document that stipulates the trust’s terms and conditions. This document details the beneficiaries, the assets included in the trust, and the manner and timing of asset distribution. The trustee is tasked with executing the directives in the trust document and managing the trust assets.

A significant advantage of an estate trust is its ability to circumvent the probate process, which can be time-consuming and expensive. Trusts also offer privacy to the grantor, as trust details remain confidential and do not become public record. Furthermore, trusts can provide protection from creditors and lawsuits, as trust assets are generally immune from such claims.

In essence, estate trusts are a valuable instrument in estate planning that can assist individuals in safeguarding and managing their assets during their lifetime and beyond. By understanding what they are and how they function, individuals can make informed decisions about their financial future and the legacy they leave behind.

Essential Elements of an Estate Trust

An estate trust is a legal setup where a trustee holds assets for the beneficiaries’ benefit. Several key elements constitute an estate trust, each serving a specific purpose to ensure the smooth management and distribution of assets.

- Trustee: The trustee is tasked with managing the trust as per the directives in the trust document. They have a fiduciary duty to act in the beneficiaries’ best interest.

- Beneficiaries: These are the individuals or entities who will ultimately benefit from the trust. They are entitled to receive the assets held in the trust as per the terms in the trust document.

- Trust Document: This legal document outlines the terms and instructions for the trust’s management and distribution. It includes details such as the beneficiaries, trustee powers, and specific directives for asset distribution.

- Assets: These are the properties, investments, or other valuables held within the trust. The trustee is tasked with managing these assets and ensuring they are distributed to the beneficiaries as per the trust document.

Navigating the Process of Creating an Estate Trust

Establishing an estate trust can be a complex process, but understanding its workings can simplify the journey. A crucial aspect of an estate trust is appointing a trustee, who is responsible for managing the trust assets and distributing them as per the terms in the trust document. The trustee can be an individual, a group of individuals, or a professional institution.

Another vital step in creating an estate trust is funding the trust, which involves transferring assets such as property, investments, and savings accounts into the trust. This ensures that the assets are protected and distributed as per your wishes after your demise. Properly funding the trust can help avoid probate and minimize estate taxes.

It’s crucial to carefully consider who you want to include as beneficiaries in your estate trust. Beneficiaries are the individuals or organizations who will ultimately receive the trust assets. You can choose to distribute the assets in various ways, such as lump-sum distributions, regular payments, or specific conditions that must be met for distributions to occur.

Advantages and Considerations of Establishing an Estate Trust

When contemplating establishing an estate trust, there are several advantages and considerations to bear in mind. One of the main benefits of setting up an estate trust is the ability to avoid probate, which can save time and reduce costs for your beneficiaries. Additionally, an estate trust allows for greater control over how your assets are distributed after your demise.

Benefits:

- Asset protection

- Privacy

- Tax benefits

- Control over distribution

Conversely, there are some considerations to ponder before setting up an estate trust. It’s important to carefully consider who you appoint as the trustee, as they will be responsible for managing your assets as per your wishes. Additionally, you’ll need to decide on the trust’s terms, including how and when the assets will be distributed to your beneficiaries.

The Path Forward

In conclusion, estate trusts offer individuals a valuable mechanism for managing their assets and ensuring their wishes are fulfilled after they pass away. By understanding how estate trusts operate and the benefits they provide, individuals can better protect their loved ones and secure their legacies for future generations. If you have any questions or would like to explore the possibility of setting up an estate trust, be sure to consult with a qualified estate planning attorney who can guide you through the process. Remember, planning for the future today can bring peace of mind tomorrow. Thank you for reading.

Unraveling the Mystery: How Does an Estate Trust Really Work?

If you’re like many individuals, the concept of an estate trust can seem complex and intimidating. However, by breaking down the components and understanding the processes involved, the mystery surrounding estate trusts can be easily unraveled. In this comprehensive guide, we will delve into the workings of an estate trust, shedding light on its purpose, benefits, and practical tips for creating and managing one effectively.

What is an Estate Trust?

Before we explore how an estate trust functions, let’s first define what it is. An estate trust is a legal arrangement where a trustee holds assets on behalf of a beneficiary or beneficiaries. The assets placed in the trust are managed according to the terms outlined in the trust document, which specifies how the assets are to be distributed and under what conditions.

How Does an Estate Trust Work?

An estate trust is typically established by an individual, known as the grantor, who transfers ownership of assets into the trust. The grantor also appoints a trustee, who is responsible for managing the trust assets and ensuring they are distributed according to the wishes of the grantor. The beneficiaries of the trust are the individuals who will ultimately receive the assets held in the trust.

- The grantor creates a trust document outlining the terms and conditions of the trust.

- The grantor transfers ownership of assets into the trust.

- The trustee manages the assets in the trust on behalf of the beneficiaries.

- The trustee distributes the assets according to the terms specified in the trust document.

Benefits of an Estate Trust

There are several benefits to establishing an estate trust, including:

- Probate Avoidance: Assets held in a trust are not subject to the probate process, allowing for a quicker and more private distribution of assets.

- Asset Protection: Trusts can provide protection for assets from creditors and lawsuits.

- Control Over Distribution: The grantor has the ability to specify how and when assets are distributed to beneficiaries.

- Tax Benefits: Certain types of trusts can offer tax advantages for both the grantor and beneficiaries.

Practical Tips for Creating and Managing an Estate Trust

When establishing an estate trust, it’s important to consider the following tips:

- Consult with a qualified estate planning attorney to ensure the trust is effectively drafted and aligned with your goals.

- Select a trustee who is trustworthy, competent, and capable of managing the assets in the trust.

- Regularly review and update the trust document to reflect any changes in your circumstances or wishes.

- Communicate openly with beneficiaries about the terms of the trust to avoid misunderstandings or disputes.

Case Study: The Smith Family Trust

Let’s consider a hypothetical example of how an estate trust, such as the Smith Family Trust, might work:

| Grantor: | Mr. Smith |

|---|---|

| Trustee: | Mrs. Smith |

| Beneficiaries: | Children of Mr. and Mrs. Smith |

In this scenario, Mr. Smith establishes the trust, appoints Mrs. Smith as the trustee, and specifies that the trust assets are to be distributed to their children upon his passing. Mrs. Smith manages the assets in the trust and distributes them according to Mr. Smith’s wishes, providing financial security for their children.

Firsthand Experience: Creating an Estate Trust

Many individuals who have established an estate trust find it to be a valuable tool for protecting their assets and providing for their loved ones. By working closely with an estate planning attorney and carefully outlining their wishes in a trust document, individuals can ensure that their assets are managed and distributed according to their desires.

In conclusion, estate trusts play a crucial role in estate planning, offering numerous benefits and opportunities for asset protection and distribution. By understanding the workings of an estate trust and following practical tips for creating and managing one effectively, individuals can navigate the complexities of trust administration with confidence and peace of mind.