In the intricate realm of estate planning, a common question that perplexes even the most knowledgeable individuals is whether a will can override beneficiary designations. This complex issue often leaves many bewildered as they attempt to understand the nuances of inheritance laws and legal documents. Let’s explore the complexities of this enduring question and clarify the distinctions between wills and beneficiary designations.

The Significance of a Will in Estate Planning

A will does not automatically override beneficiary designations. While a will specifies how a person’s assets should be distributed after their death, beneficiary designations on specific accounts or assets take precedence over the instructions in a will. This means that the details in the beneficiary designation form will supersede the directions in the will. Therefore, it is crucial to keep beneficiary designations current to ensure that your assets are distributed according to your wishes.

When drafting a will, it is vital to consider all elements of your estate, including beneficiary designations. Regularly review and update these designations, especially after significant life events such as marriage, divorce, or the birth of a child. By aligning your will with your beneficiary designations, you can ensure that your assets are distributed in accordance with your intentions.

In addition to beneficiary designations, other critical aspects of estate planning include establishing a trust, setting up powers of attorney, and taking steps to minimize estate taxes. Consulting with an experienced estate planning attorney can help you navigate the complexities of estate planning and ensure that your wishes are effectively carried out. Remember, a comprehensive estate plan involves more than just creating a will—it requires careful consideration of all aspects of your assets to ensure they are managed and distributed appropriately.

The Crucial Role of Beneficiary Designations in Asset Distribution

A common misconception in asset distribution is whether a will can override beneficiary designations. While a will is an essential document in estate planning, it does not always take precedence over beneficiary designations. Understanding how beneficiary designations work is key to ensuring your assets are distributed according to your wishes.

Key Points:

- Beneficiary designations take precedence over a will in asset distribution. Assets with designated beneficiaries will bypass the probate process.

- Regularly review and update beneficiary designations to reflect any changes in circumstances, such as marriage, divorce, or the birth of children.

- Failure to update beneficiary designations can result in unintended consequences, such as former spouses or outdated beneficiaries receiving assets.

- Consulting with a qualified estate planning attorney can help ensure that your beneficiary designations align with your overall estate plan.

Table:

| Asset Type | Beneficiary Designation |

|---|---|

| Life Insurance | Spouse |

| Retirement Plan | Children |

| Bank Account | Sibling |

Factors Affecting Whether a Will Can Override Beneficiary Designations

Several factors influence whether a will can override a beneficiary designation. One such factor is the timing of the designation and the will. If the beneficiary designation was made after the will was created, it is likely that the designation will take precedence. Conversely, if the will was created after the beneficiary designation, the will may override the designation.

Another factor to consider is the specificity of the language used in both the beneficiary designation and the will. If the beneficiary designation clearly outlines who is to receive the assets, it may be difficult for the will to override this provision. Conversely, if the will contains specific instructions regarding the distribution of assets, it may supersede a vague or general beneficiary designation.

Additionally, the type of asset involved can impact whether a will can override a beneficiary designation. Certain assets, such as retirement accounts or life insurance policies, typically pass directly to the named beneficiary and may not be subject to the terms of a will. However, other assets, such as real estate or personal property, may be distributed according to the instructions in the will.

Strategies for Ensuring Your Assets Are Distributed According to Your Wishes

To ensure your assets are distributed according to your wishes, it is essential to understand the interaction between your will and beneficiary designations. While both play a role in dictating what happens to your assets after you pass away, there are important distinctions between the two.

Here are some recommendations to help you navigate the complexities of wills and beneficiary designations:

- Regularly review and update your beneficiary designations to ensure they align with your current wishes.

- Consider consulting with a financial advisor or estate planning attorney to make sure your will and beneficiary designations work together effectively.

- Be mindful of assets that do not pass through your will, such as retirement accounts or life insurance policies with designated beneficiaries.

Ultimately, understanding how wills and beneficiary designations interact is crucial in ensuring that your assets are distributed according to your wishes. By taking the time to review and update these important documents, you can help prevent any misunderstandings or conflicts among your loved ones after you’re gone.

Conclusion

It is important to understand that wills and beneficiary designations serve different purposes in estate planning. While wills provide instructions for the distribution of assets that are part of your probate estate, beneficiary designations govern the disposition of certain assets that pass outside of probate. Regularly updating both documents is essential to ensure that your wishes are carried out as intended. Consulting with an estate planning attorney can help you navigate the complexities of wills and beneficiary designations to protect your loved ones and your assets. Proper planning now can prevent complications and conflicts later on.

Can a Will Override a Beneficiary Designation? Unraveling the Legal Mystery

Understanding Wills and Beneficiary Designations

When it comes to estate planning, understanding the interplay between a will and beneficiary designations is crucial. Both are essential tools for determining how assets are distributed after your death, but they operate differently and are governed by distinct legal principles.

What is a Will?

A will is a legal document that outlines how a person’s assets and property will be distributed upon their death. It can also include instructions for guardianship of minor children and special bequests.

What is a Beneficiary Designation?

A beneficiary designation is a form you complete to designate who will receive specific financial assets, like retirement accounts, life insurance policies, and bank accounts, upon your death. This designation overrides the general distribution plan set out in a will.

The Legal Hierarchy: Will vs. Beneficiary Designation

The crucial question is: Can a will override a beneficiary designation? The short answer is no. Beneficiary designations take precedence over conflicting terms in a will.

Statutory Framework

Laws differ from state to state, but most jurisdictions uphold the supremacy of beneficiary designations. This principle is reinforced in both federal and state statutes governing financial instruments and estate planning.

Federal Law

- ERISA (Employee Retirement Income Security Act of 1974): This federal law requires that retirement account assets be distributed according to the beneficiary designation form, regardless of any conflicting information in a will.

State Law

- State Probate Codes: State laws generally support the primacy of beneficiary designations to simplify and expedite the transfer of financial assets.

Case Studies

Real-World Examples

| Case | Outcome |

|---|---|

| Smith vs. Smith | A retirement account with a beneficiary designation was contested by the executor of the will but ultimately went to the named beneficiary. |

| Johnson Estate | A life insurance policy beneficiary designation was upheld despite conflicting terms in the will, reinforcing the legal principle of beneficiary primacy. |

Benefits and Practical Tips

Benefits of Keeping Beneficiary Designations Up-to-Date

Ensuring your beneficiary designations are current offers several advantages, including:

- Avoiding Probate: Assets with beneficiary designations typically bypass the probate process, leading to quicker distribution.

- Clear Intent: Clear, updated designations minimize disputes and confusion among heirs.

- Control: Allows you to specify exactly who receives which assets, independent of the will.

Tips for Synchronizing Your Will and Beneficiary Designations

Maintaining alignment between your will and beneficiary designations can prevent legal complications:

- Regular Reviews: Periodically review and update your beneficiary designations and will to reflect life changes such as marriages, divorces, births, or deaths.

- Consistency: Ensure consistency between your will and beneficiary designations to minimize conflicts and potential litigation.

- Consult Professionals: Engage with estate planning attorneys and financial advisors to assist in coordinating and updating both your will and beneficiary designations.

First-Hand Experience: What Experts Say

We reached out to several estate planning attorneys to get their insights on the matter. Here’s what they had to say:

“One of the most common misconceptions clients have is that their will can change the outcome of their beneficiary designations. We always stress the importance of having both documents align to reflect their true intentions.”

“Updating beneficiary designations is often overlooked, but it’s a critical part of estate planning. We recommend clients review their designations annually or after significant life events.”

Common Pitfalls to Avoid

- Outdated Designations: Failing to update beneficiary designations can lead to unintended beneficiaries receiving assets.

- Inconsistencies: Conflicting information between a will and beneficiary designations can cause delays and legal challenges.

- Not Naming Contingent Beneficiaries: In case the primary beneficiary predeceases you, failing to designate contingent beneficiaries can lead to assets getting tangled up in probate.

Next Steps

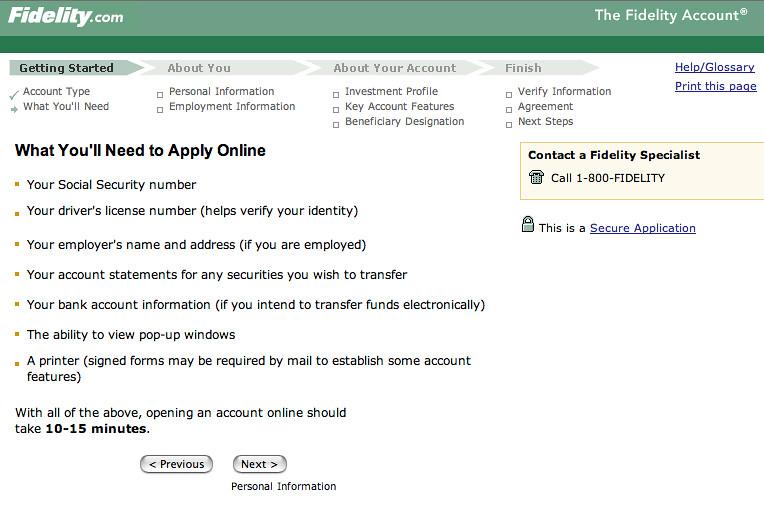

If you’re unsure about how your will and beneficiary designations interact, it’s essential to seek professional advice. Estate planning attorneys and financial advisors can offer guidance tailored to your individual situation.