In the realm of wealth management and estate planning, discretionary trusts are a valuable tool that allow individuals to control and distribute assets to their beneficiaries in a flexible and customizable manner. Understanding how this type of trust works is crucial for effective estate planning. Let’s explore a hypothetical example that showcases the intricacies and benefits of this often-overlooked financial strategy.

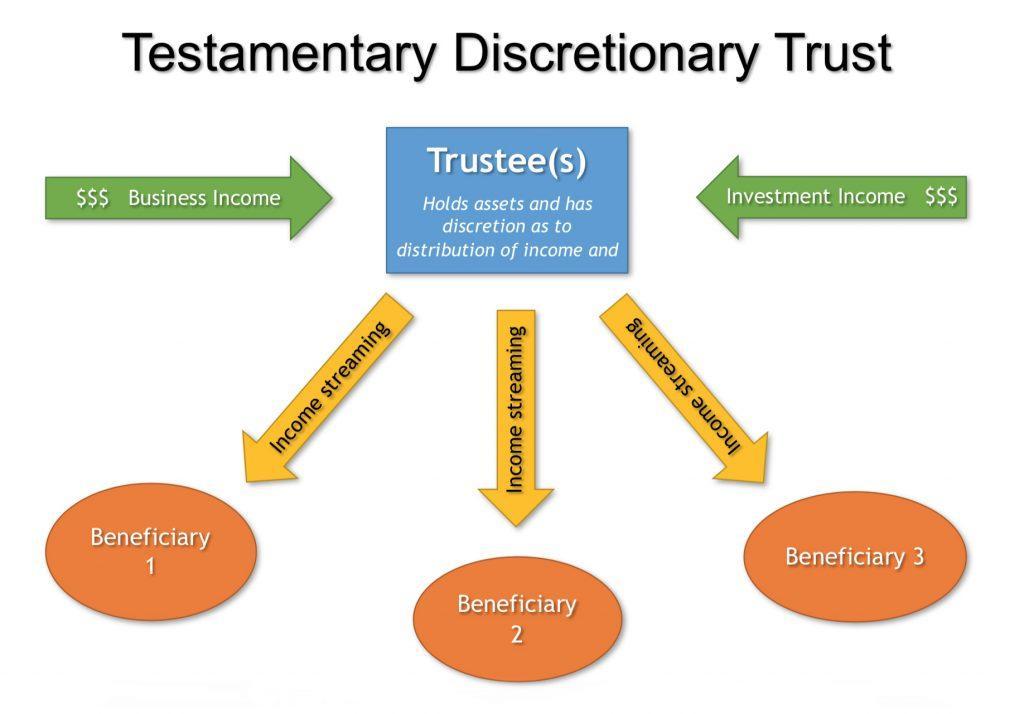

Discretionary trusts are a flexible form of trust where trustees have the discretion to decide how and when beneficiaries will receive their entitlements. Let’s look at a hypothetical example to understand how they work in practice.

In this scenario, Sarah sets up a discretionary trust for her three children, Emily, James, and Mia, and appoints her close friend, Alex, as the trustee. Sarah specifies in the trust deed that Alex has the discretion to distribute income and capital to the beneficiaries as he sees fit. This means that Alex can decide how much each child will receive and when they will receive it.

As the trustee, Alex carefully considers the needs and circumstances of each beneficiary before making any distributions. For example, if Emily is pursuing further education, Alex may allocate funds to support her studies. Similarly, if James is starting a business, Alex may provide him with financial support to get it off the ground. Mia, who is still young, may receive smaller distributions until she reaches a certain age or milestone.

Establishing a discretionary trust for estate planning comes with a variety of benefits that can help ensure your assets are distributed according to your wishes. One key benefit is the flexibility that a discretionary trust provides. With a discretionary trust, the trustee has the discretion to determine how assets are distributed among beneficiaries, allowing for a more personalized approach to estate planning.

Another benefit of establishing a discretionary trust is the potential tax savings it can offer. By transferring assets into a trust, you may be able to minimize estate taxes and other taxes that would otherwise be incurred through the transfer of assets to beneficiaries. This can lead to greater overall wealth preservation for future generations.

Furthermore, a discretionary trust can provide added protection for beneficiaries who may not be capable of managing their inheritance responsibly. By appointing a trustee to oversee the distribution of assets, you can ensure that beneficiaries receive their inheritance in a way that aligns with your intentions and safeguards their financial well-being.

When selecting trustees for a discretionary trust, it is crucial to carefully consider the individuals or entities that will be responsible for managing the trust assets and making important decisions on behalf of the beneficiaries. Factors to consider include trustworthiness, financial acumen, communication skills, and conflict resolution abilities.

Maximizing the flexibility and protection offered by a discretionary trust is essential for effective estate planning. One way to maximize flexibility is by including a wide range of potential beneficiaries, and enhancing protection can be achieved by including provisions that shield the assets from creditors or legal disputes.

In conclusion, discretionary trusts offer a flexible and versatile way to manage and distribute assets for the benefit of beneficiaries. By giving the trustee discretionary powers, this type of trust can adapt to changing circumstances and provide protection for vulnerable individuals. With proper planning and guidance, a discretionary trust can be a powerful tool for achieving financial security and fulfilling long-term goals. Consider exploring this option with a qualified professional to see if it’s the right fit for your unique situation. Trust in discretion, trust in the possibilities.

The Power of a Discretionary Trust

When it comes to estate planning and asset protection, a discretionary trust can be a powerful tool. This type of trust allows the trustee to make decisions on how to distribute the trust assets, giving them flexibility and control over when and how beneficiaries receive their inheritance. In this article, we will explore the benefits of a discretionary trust through a real-life case study.

Case Study: The Smith Family

Let’s consider the Smith family, consisting of parents John and Sarah and their three children, Emily, Adam, and Lily. John and Sarah want to ensure that their children are taken care of financially both now and in the future. They decide to set up a discretionary trust to manage their assets and provide for their children’s needs.

Benefits of a Discretionary Trust for the Smith Family

- Asset Protection: By placing their assets in a discretionary trust, the Smith family can protect them from creditors or legal claims.

- Tax Benefits: A discretionary trust can provide tax advantages, allowing the Smith family to minimize their tax liability and maximize their wealth.

- Flexibility: The trustee has the discretion to distribute assets to the beneficiaries as needed, ensuring that each child’s unique needs are met.

- Privacy: The details of a discretionary trust are kept confidential, offering the Smith family privacy and discretion in their financial affairs.

- Succession Planning: Through a discretionary trust, the Smith family can plan for future generations and ensure that their wealth is passed down according to their wishes.

Practical Tips for Setting Up a Discretionary Trust

If you are considering setting up a discretionary trust for your family, here are some practical tips to keep in mind:

- Consult with a Trusts and Estates Attorney: It is essential to seek professional advice when establishing a discretionary trust to ensure that it aligns with your financial goals and objectives.

- Choose a Trustee Wisely: Select a trustee who is trustworthy, competent, and capable of managing the trust assets effectively.

- Communicate with Beneficiaries: Keep the beneficiaries informed about the trust and its provisions to avoid misunderstandings or disputes in the future.

First-hand Experience: The Smith Family’s Journey

For the Smith family, setting up a discretionary trust has proven to be a beneficial decision. They have peace of mind knowing that their assets are protected, their children’s needs are provided for, and their wealth will be passed down to future generations according to their wishes.

Conclusion

In conclusion, a discretionary trust can offer numerous benefits for individuals and families looking to protect their assets, minimize tax liability, and plan for the future. By utilizing the flexibility and control that a discretionary trust provides, you can ensure that your wealth is managed and distributed according to your wishes. Consider consulting with a trust and estates attorney to explore how a discretionary trust can benefit you and your loved ones.