When it comes to transferring property ownership, the choice of deed can significantly impact the transaction. Two prevalent types are the quitclaim deed and the warranty deed. Although both facilitate the transfer of property rights, they do so in distinct ways. Let’s delve into the specifics of each and highlight the primary differences between a quitclaim deed and a warranty deed.

Comparing Quitclaim Deeds and Warranty Deeds

In the realm of real estate transactions, understanding the distinctions between a quitclaim deed and a warranty deed is essential. Both deeds transfer property ownership, but they offer varying levels of buyer protection. Here are some critical differences:

- Ownership Assurance: A warranty deed ensures that the seller owns the property outright and has the legal authority to sell it. Conversely, a quitclaim deed provides no such guarantees regarding the seller’s ownership status.

- Legal Safeguards: Buyers receive greater protection with a warranty deed, as it allows them to seek legal recourse if ownership issues arise. In contrast, a quitclaim deed offers limited legal protection.

- Typical Applications: Warranty deeds are commonly used in traditional real estate transactions where the buyer seeks assurances about the property’s title. Quitclaim deeds are often utilized in transfers between family members or in divorce settlements.

| Quitclaim Deed | Warranty Deed |

|---|---|

| No ownership guarantee | Ownership guarantee |

| Limited legal protection | Higher legal protection |

| Common in family transfers | Common in traditional transactions |

Legal Implications of Quitclaim and Warranty Deeds

Understanding the legal ramifications of the deed type used in property transfers is vital. Quitclaim deeds and warranty deeds each have their own benefits and potential drawbacks that should be carefully evaluated.

Quitclaim Deed:

- Transfers the current owner’s interest in the property

- Does not guarantee the property’s title status or history

- Often used in situations where the parties involved have mutual trust

Warranty Deed:

- Guarantees that the property is free of any encumbrances

- Provides the highest level of protection for the buyer

- Typically used in real estate transactions where a higher level of assurance is required

Considerations for Choosing the Right Deed

When deciding between a quitclaim deed and a warranty deed, several factors should be considered to ensure the best choice for your real estate transaction. Here are some key considerations:

- Protection Level: A warranty deed offers the most protection, as the seller guarantees clear title and will defend against any claims. A quitclaim deed only transfers the seller’s interest without any ownership guarantees.

- Title Certainty: If there are concerns about potential title issues or encumbrances, a warranty deed is generally safer as it ensures the seller has a good and marketable title. A quitclaim deed, lacking such assurances, is often used when the parties trust each other.

- Cost: Transferring property with a quitclaim deed may be less expensive due to reduced documentation and title research. However, the potential risks associated with a quitclaim deed might outweigh any cost savings in the long term.

Expert Advice on Choosing the Right Deed

Choosing the appropriate deed for your property transaction requires a thorough understanding of the differences between a quitclaim deed and a warranty deed.

A quitclaim deed is a legal document that transfers someone’s interest in a property to another person without making any guarantees about the property’s title history. This type of deed is often used when the grantor wants to transfer their interest in a property quickly and without assurances.

In contrast, a warranty deed guarantees that the grantor has clear ownership of the property and the right to transfer it. This deed provides more protection to the grantee, ensuring that the grantor will defend against any future claims on the property.

While a quitclaim deed offers a faster and simpler way to transfer property, a warranty deed provides greater protection and guarantees a clear title. It’s crucial to consider your specific situation and consult with a legal professional to determine the best type of deed for your property transaction.

Conclusion

Understanding the differences between a quitclaim deed and a warranty deed is essential in real estate transactions. Both serve as legal documents for transferring property ownership, but they differ in the level of protection they offer to the grantee. Whether you opt for a quitclaim deed for a quick transfer or a warranty deed for added security, consulting with a real estate professional is crucial to ensure the transaction meets your needs. By understanding the nuances of each type of deed, you can make informed decisions and protect your interests in property transactions.

Quit Claim Deed vs. Warranty Deed: What’s the Real Difference?

Are you confused about the differences between a quit claim deed and a warranty deed? You’re not alone. Understanding these two types of property deeds can make a significant difference when buying or selling real estate. In this article, we’ll break down the key distinctions, benefits, and practical tips for using each type.

What is a Quit Claim Deed?

A quit claim deed is a legal document that transfers the interest or rights the grantor has in a property to another party, known as the grantee. However, it does not provide any guarantee or warranty of clear ownership or title. This type of deed is often used in non-sale transactions, such as between family members or to remove a cloud on a title.

Key Features of a Quit Claim Deed:

- No Warranties: It does not guarantee that the grantor owns the property or has the right to transfer it.

- Quick Transfers: Often used for quick and straightforward transfers of property.

- Common Among Family: Frequently used for property transfers within families, such as adding or removing a family member from the deed.

What is a Warranty Deed?

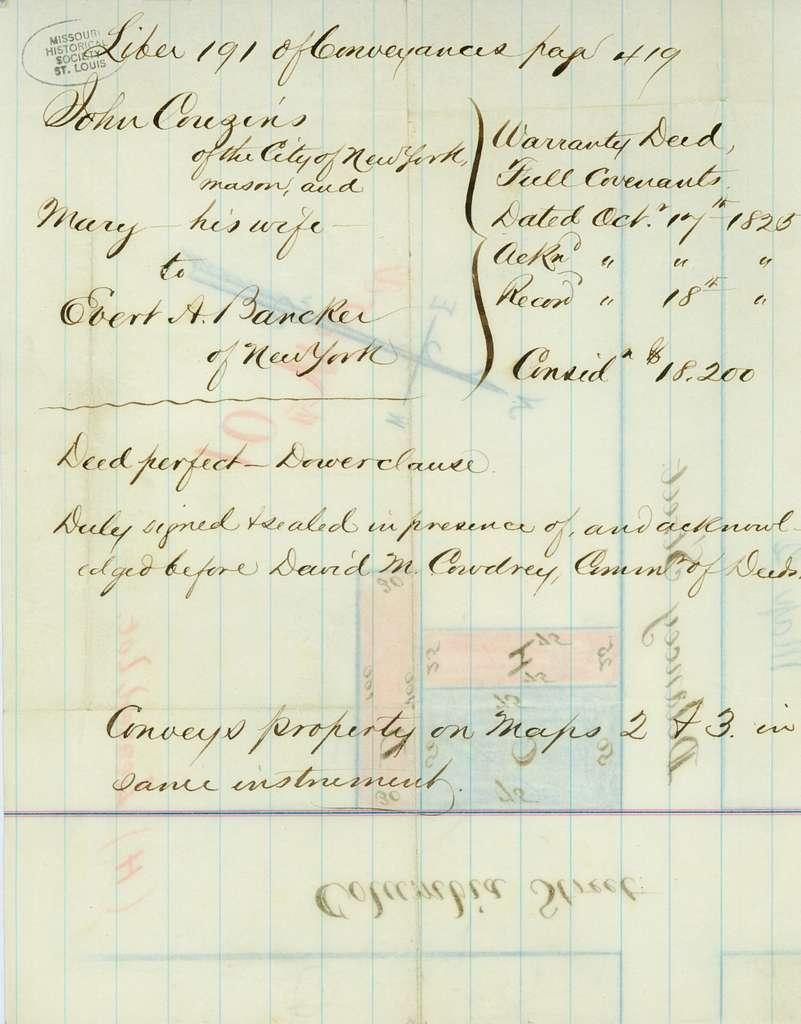

A warranty deed provides a higher level of protection for the grantee. In this deed, the grantor guarantees that they hold clear title to the property and have the right to transfer it to the grantee. If any defect in the title arises, the grantor is responsible for resolving it.

Key Features of a Warranty Deed:

- Full Warranties: Includes a full guarantee that the property title is clear and transferable.

- Protection for Grantee: Offers the grantee legal protection against title defects or claims.

- Common in Sales: Usually used in property sales transactions to ensure the buyer receives a clear title.

Key Differences Between Quit Claim Deeds and Warranty Deeds

| Feature | Quit Claim Deed | Warranty Deed |

|---|---|---|

| Ownership Guarantee | No guarantee of ownership | Full guarantee of ownership |

| Common Use | Non-sale transactions, family transfers | Property sales, ensuring clear title |

| Grantee Protection | Minimal protection | High level of protection against claims |

| Legal Liability | Grantor has no legal liability after transfer | Grantor can be held liable for any title issues |

| Speed of Transfer | Quick and straightforward | Typically involves more due diligence and legal work |

When to Use a Quit Claim Deed

Non-Sale Transfers

Quit claim deeds are ideal for non-sale transfers where the relationship between the parties reduces the need for strong legal protection. Examples include:

- Transferring property between family members.

- Adding or removing a spouse from the deed.

- Removing a cloud from a title.

Practical Tips for Quit Claim Deeds:

- Thorough Documentation: Ensure that all paperwork is accurately completed and legal advice is sought to avoid unforeseen issues.

- Limited Scope: Understand that quit claim deeds offer no protection against future claims, so use them wisely.

When to Use a Warranty Deed

Property Sales

Warranty deeds are typically used in property sales transactions where the buyer needs assurance that there are no other claims on the property. Examples include:

- Purchasing a new home.

- Securing a mortgage.

- Exchanging commercial real estate.

Benefits of Warranty Deeds:

- Protection against Claims: Guarantees clear title and provides remedies if issues arise.

- Legal Assurance: Offers peace of mind to buyers, which can facilitate smoother transactions.

- High Marketability: Properties sold with warranty deeds are more attractive to potential buyers due to the assurances they provide.

Real-World Examples

Case Study: Family Transfer with a Quit Claim Deed

Sarah wants to gift a property to her brother. Since it is a non-sale transaction within the family, she uses a quit claim deed. The process is quick, and the property is successfully transferred without the need for extensive legal checks or warranties.

Case Study: Home Purchase with a Warranty Deed

John is buying his first home and needs financial assurance. The seller provides a warranty deed guaranteeing that the property title is clear. This gives John peace of mind, knowing that he’s protected against future claims or defects in the title.

Potential Pitfalls of Each Deed

Quit Claim Deed Pitfalls:

- Limited Protection: Grantees are exposed if there are any title defects or third-party claims.

- Not for Transactions Involving Large Sums: Risky for high-value property exchanges.

Warranty Deed Pitfalls:

- Higher Costs and Complexity: Due diligence and legal processes can make the transaction costlier and lengthier.

- Grantor Liability: Grantors can be held liable for future title disputes or claims, creating a potential legal risk.

Practical Advice for Deed Usage

For Grantors:

- Seek Legal Counsel: Always consult with a real estate attorney to ensure the deed type matches the nature of the transaction.

- Full Disclosure: Be transparent about any known issues related to the property title.

For Grantees:

- Conduct Title Searches: Even with a warranty deed, conducting a title search can provide additional reassurance.

- Understand the Deed Type: Know the protections and limitations offered by the deed used in your property transfer.

By understanding the differences between quit claim deeds and warranty deeds, both grantors and grantees can make informed decisions that align with their needs and reduce potential risks in property transactions.