The Deceptive Promise of Green Energy

Lessons Learned

Protecting Your Investments

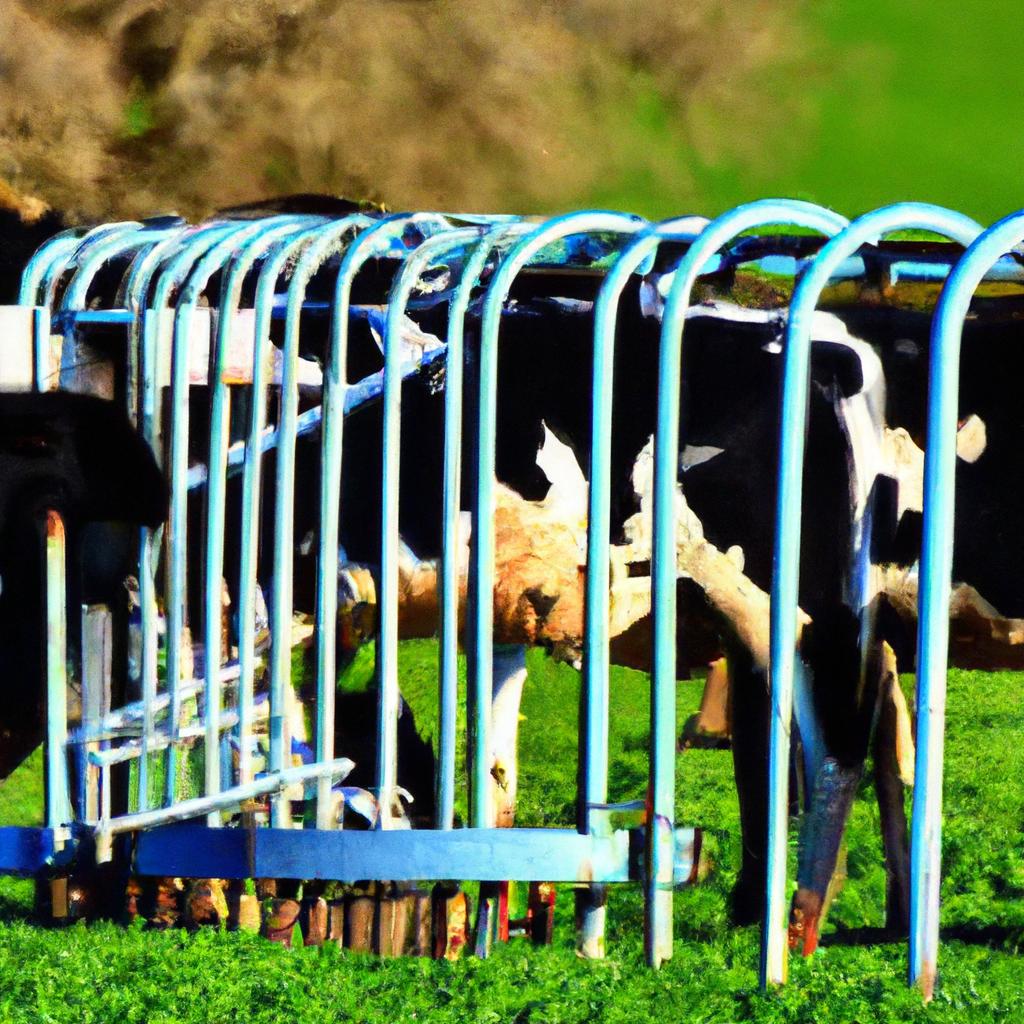

California man Ray Brewer was recently sentenced to prison for running a Ponzi scheme that duped investors out of millions of dollars. Brewer claimed that he had developed a revolutionary process to turn cow manure into green energy, but in reality, he was simply using new investor funds to pay off earlier investors.

The scheme operated under the guise of a company called Green Energy Enterprises, which promised investors high returns on their money by investing in the production of renewable energy from cow manure. Brewer used slick marketing materials and persuasive sales pitches to convince unsuspecting investors to hand over their hard-earned cash, promising them a share of the profits from this innovative venture.

Unfortunately, the whole operation was nothing more than a fraud, with Brewer using the money from new investors to pay off earlier ones and fund his own lavish lifestyle. When the scheme inevitably collapsed, investors were left high and dry, losing millions of dollars in the process.

Brewer’s sentencing sends a strong message that financial fraud will not be tolerated, and that those who seek to cheat and deceive others for personal gain will face severe consequences. Ponzi schemes like the one Brewer ran not only harm the victims who lose money, but also erode trust in legitimate investment opportunities and damage the reputation of the financial industry as a whole.

Despite the negative impact of this case, there are valuable lessons that investors can learn from it. By being aware of the red flags of investment fraud and conducting thorough due diligence before handing over any money, individuals can protect themselves from falling victim to schemes like the one Brewer orchestrated. Here are some practical tips to help investors avoid becoming prey to Ponzi schemes:

1. Research the Company: Before investing in any opportunity, take the time to research the company and its founders. Look for information on their track record, reputation, and any past legal issues. If a company’s claims seem too good to be true, they probably are.

2. Beware of High Returns: Be wary of investment opportunities that promise unusually high returns with little to no risk. A healthy skepticism can go a long way in protecting your hard-earned money from fraudulent schemes.

3. Seek Professional Advice: When in doubt, seek the advice of a trusted financial advisor or investment professional. They can help you evaluate the legitimacy of an investment opportunity and provide guidance on whether it is worth pursuing.

In conclusion, the case of Ray Brewer serves as a cautionary tale about the dangers of investment fraud and the importance of conducting due diligence before investing your money. By being vigilant, asking the right questions, and seeking professional advice when needed, investors can protect themselves from falling victim to Ponzi schemes and other financial scams. Remember, if something sounds too good to be true, it probably is. Stay informed, stay safe, and protect your financial future.