In the complex landscape of real estate transactions, the trustee on a deed of trust plays a pivotal role. This individual or entity is responsible for overseeing the terms of the trust deed and ensuring that all parties fulfill their obligations. But what does it truly mean to be a trustee on a deed of trust? Let’s explore the nuances of this critical position and its importance in property ownership.

The Significance of a Trustee on a Deed of Trust

Understanding the responsibilities associated with being a trustee on a deed of trust is essential. A trustee acts as an impartial third party between the borrower and the lender, managing the property under the deed of trust.

The main duties of a trustee on a deed of trust include:

- Supervising the loan repayment process

- Managing potential foreclosure proceedings

- Ensuring the proper execution of the deed of trust terms

Having a trustee on a deed of trust offers an additional layer of protection for both the borrower and the lender. This role ensures that the interests of all parties are safeguarded, promoting a smooth and transparent transaction process.

Core Duties and Legal Responsibilities of a Trustee

As a trustee on a deed of trust, you must adhere to several key responsibilities and legal obligations. These duties are crucial for the smooth operation of the trust and compliance with legal standards.

- Trust Administration: A trustee must manage the trust according to the deed’s terms, which includes handling trust assets, distributing to beneficiaries, and maintaining accurate records of all transactions.

- Fiduciary Duty: Trustees are obligated to act in the best interest of the beneficiaries, making financially sound decisions that benefit those who will ultimately receive the trust’s benefits.

- Impartiality: Trustees must remain neutral and avoid conflicts of interest, ensuring they do not favor any beneficiary over another or engage in self-dealing.

| Responsibility | Legal Obligation |

|---|---|

| Trust Administration | Ensure compliance with the deed’s terms and maintain accurate records. |

| Fiduciary Duty | Act in the best interest of the beneficiaries. |

| Impartiality | Avoid conflicts of interest and maintain trust integrity. |

Advantages of Having a Trustee on a Deed of Trust

A trustee on a deed of trust is integral to the real estate transaction process, offering security and peace of mind for all parties involved. Homeowners can benefit from several advantages by having a trustee on a deed of trust, simplifying the home buying or refinancing process. Key benefits include:

- Protection: The trustee ensures that the deed of trust terms are enforced, protecting all parties involved. Acting as a neutral third party, the trustee oversees the transfer of property rights and ensures compliance with the agreed terms.

- Dispute Resolution: In case of disputes between the borrower and lender, the trustee can facilitate communication and resolution, acting as a mediator to ensure both parties adhere to the agreement.

- Foreclosure Management: If the borrower defaults, the trustee can streamline the foreclosure process, initiating proceedings on behalf of the lender while ensuring legal compliance.

Guidelines for Selecting a Trustee for Your Deed of Trust

Choosing a trustee for your deed of trust is a critical decision. It is essential to select someone trustworthy, reliable, and capable of handling the role’s responsibilities. Here are some guidelines to consider:

- Trustworthiness: Select someone with a strong reputation for honesty and integrity.

- Experience: Consider a trustee with experience in managing financial or legal matters.

- Communication Skills: Ensure the trustee is accessible and responsive to all parties involved in the deed of trust.

- Knowledge: Choose a trustee who understands the terms and conditions outlined in the deed of trust.

Taking the time to select the right trustee is crucial, as this person will play a significant role in ensuring the deed of trust terms are upheld and all parties are protected. By following these guidelines, you can confidently choose a trustee and have peace of mind knowing your deed of trust is in capable hands.

Conclusion

Understanding the role of a trustee on a deed of trust is vital for anyone involved in real estate transactions. Whether you are a borrower, lender, or interested party, knowing the trustee’s responsibilities and powers can help ensure a smooth and successful process. By entrusting a knowledgeable and reliable trustee to uphold the deed of trust terms, all parties can have confidence in the transaction’s integrity. For further questions or more information on this topic, feel free to reach out to a legal professional or real estate expert. Thank you for reading!

Unlocking the Role of a Trustee in a Deed of Trust: What You Need to Know

What is a Deed of Trust?

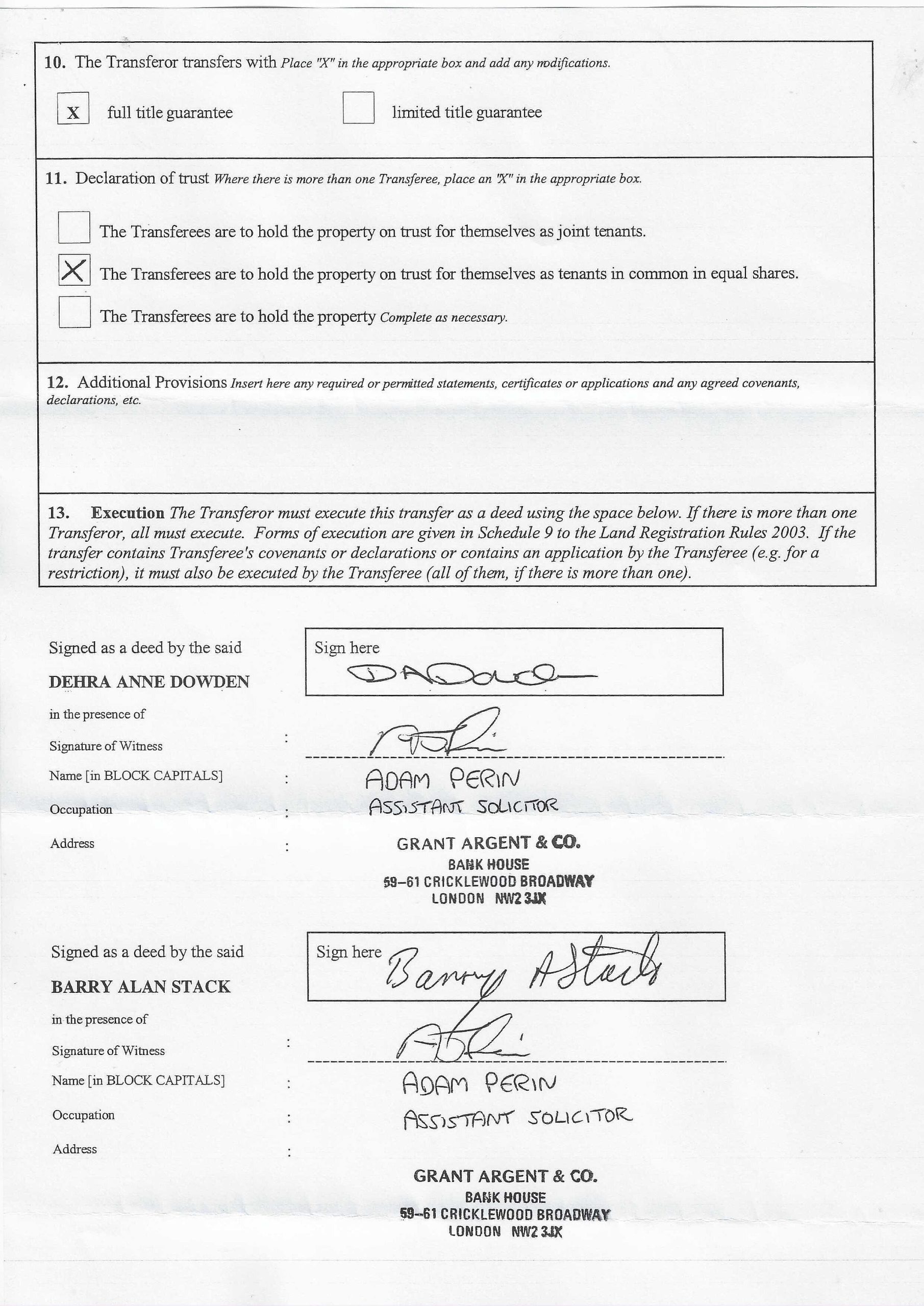

A deed of trust is a legal document in real estate used in place of a traditional mortgage to secure a property loan. This document involves three parties:

- Borrower (Trustor): The individual or entity receiving the loan.

- Lender (Beneficiary): The entity providing the loan.

- Trustee: A neutral third party holding the trust.

The Role of the Trustee

The trustee in a deed of trust plays a critical role in ensuring the integrity and enforcement of the lending process. Their duties include:

- Holding the property title in trust until the loan is paid off.

- Managing the sale of the property in the event of default.

- Ensuring that the rights of both the borrower and lender are preserved.

Responsibilities of the Trustee

The trustee’s responsibilities extend beyond simple title holding. Here are their core duties:

Maintaining Impartiality

The trustee must act impartially, ensuring fairness to both the borrower and lender.

Executing Foreclosures

In the event the borrower defaults, the trustee has the authority to initiate foreclosure proceedings according to state-specific guidelines.

Releasing the Deed

Once the loan is fully repaid, the trustee is responsible for reconveying the deed to the borrower, thereby returning full property ownership.

Benefits and Practical Tips

Understanding the role of a trustee in a deed of trust offers numerous advantages:

- Ensures Clear Ownership: The trustee maintains an accurate record of ownership and loan status.

- Streamlined Foreclosure Process: Trustees can expedite the foreclosure process, reducing potential delays.

- Legal Protection: Trustees provide a legal cushion for both parties through documentation and compliance with state laws.

When working with trustees, consider the following practical tips:

- Ensure the trustee is a neutral party without conflicts of interest.

- Understand the timelines and processes involved in foreclosure.

- Communicate regularly with the trustee to stay informed about your loan status and any potential issues.

Case Studies: Real-World Examples

Case Study 1: Successful Foreclosure

Jane Doe, a lender, faced a situation where the borrower defaulted on their loan. By working with a diligent and neutral trustee, Jane was able to foreclose on the property efficiently, minimizing her financial losses.

Case Study 2: Smooth Loan Completion

John Smith, a borrower, successfully paid off his property loan. The trustee facilitated the reconveyance of the deed seamlessly, ensuring John received his property title without any issues.

Common Misconceptions

Many people hold misconceptions about the role of a trustee in a deed of trust. Let’s clear some common myths:

- Myth: The trustee acts in favor of the lender.

- Fact: Trustees must remain neutral and fair to both parties.

- Myth: Trustees can change loan terms.

- Fact: Trustees don’t have the authority to alter loan terms established in the deed of trust.

Table: Key Differences Between a Trustee and a Mortgage

| Criteria | Deed of Trust (Trustee) | Mortgage |

|---|---|---|

| Parties Involved | Borrower, Lender, Trustee | Borrower, Lender |

| Foreclosure Process | Non-judicial | Judicial |

| Speed of Foreclosure | Faster | Slower |

| Title Holding | Trustee | Lender |

Conclusion

By now, you should have a comprehensive understanding of the crucial role a trustee plays in a deed of trust. Whether you are a borrower or a lender, acknowledging and respecting the responsibilities of a trustee will streamline your real estate transactions and protect your interests effectively.