In today’s complex financial and legal landscape, the role of a professional fiduciary stands out as a symbol of trust and integrity. But what does it truly mean to be a professional fiduciary? Let’s dive into the realm of fiduciary duty and examine the essential responsibilities and characteristics of these protectors of financial well-being.

The Significance of a Professional Fiduciary

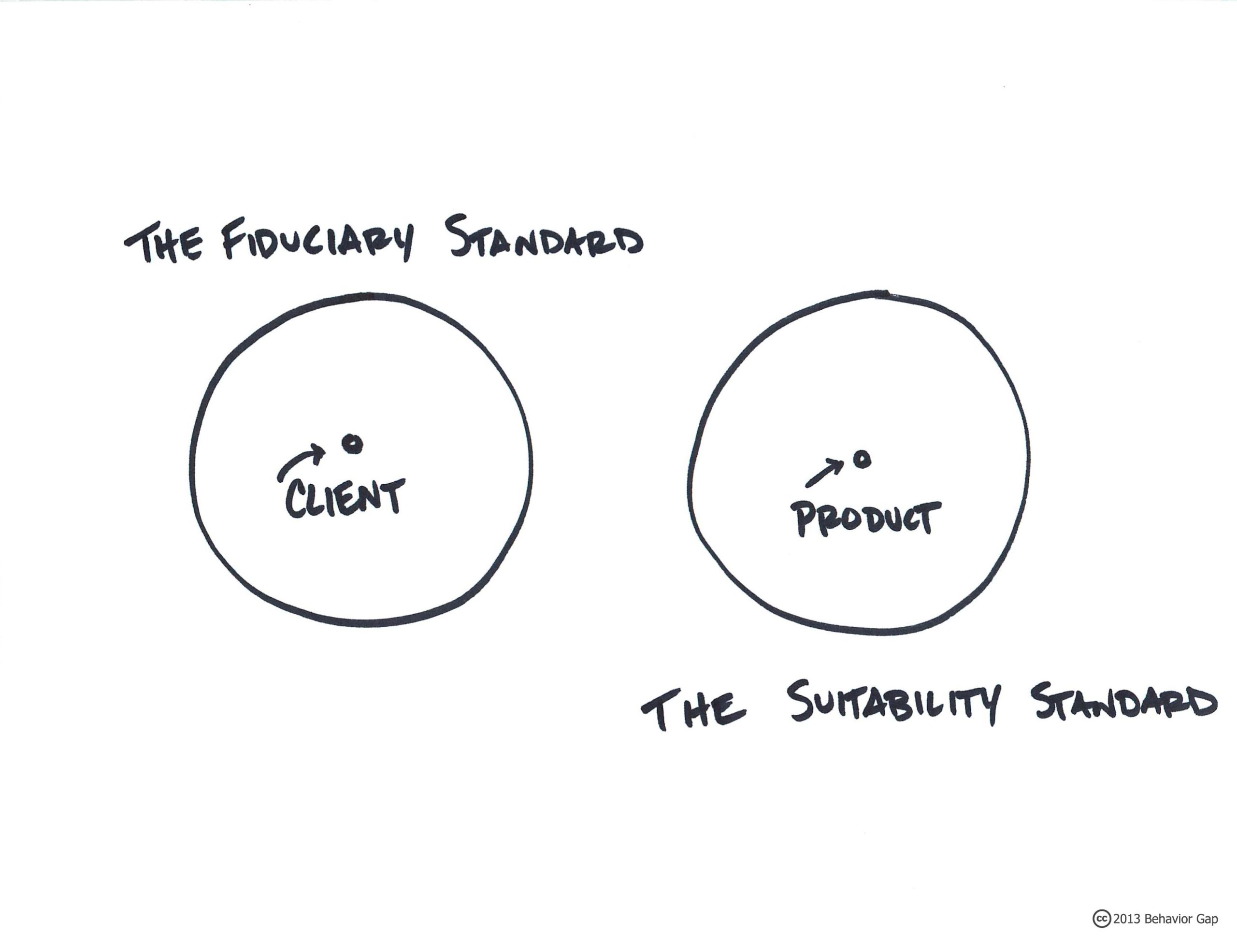

A professional fiduciary is an individual or organization entrusted with managing the financial affairs and making decisions on behalf of another person, known as the principal. Fiduciaries are legally bound to act in the best interests of their clients and must follow a stringent code of ethics. They are often appointed in scenarios where individuals cannot manage their own affairs due to incapacity, age, or other reasons.

Key roles and responsibilities of a professional fiduciary include:

- Overseeing investments and financial assets

- Handling bill payments and daily financial management

- Making healthcare decisions

- Ensuring the principal’s wishes are honored

Professional fiduciaries can serve in various roles, such as trust officers, estate planners, or guardians. They are vital in protecting the financial health and personal welfare of their clients. By appointing a professional fiduciary, individuals can rest assured that their interests are safeguarded by a competent and reliable professional.

Core Duties and Responsibilities of a Professional Fiduciary

Professional fiduciaries are pivotal in managing the financial affairs and assets of those who cannot do so themselves. These professionals are entrusted with significant responsibilities that demand a high level of trust and integrity. Key duties and responsibilities include:

- Trust and Estate Management: Fiduciaries oversee and manage trusts and estates for their clients, including asset distribution, bill payments, and ensuring the client’s wishes are fulfilled as per the trust or will.

- Financial Planning: They develop and implement financial plans, assess the client’s financial situation, create investment strategies, and manage assets to achieve the client’s financial objectives.

- Accounting and Reporting: Fiduciaries maintain detailed records of all financial transactions and provide regular reports to clients or beneficiaries, tracking expenses, income, and other financial activities related to the trust or estate.

- Legal Compliance: They ensure all actions taken on behalf of their clients comply with legal requirements, adhering to relevant regulations and guidelines related to trusts, estates, and financial planning.

Professional fiduciaries act as trusted advisors and advocates, helping to protect and grow their clients’ assets while ensuring their wishes are carried out responsibly and ethically.

Attributes to Consider When Selecting a Professional Fiduciary

Choosing the right professional fiduciary is crucial for ensuring your finances and assets are well-managed. Here are some key qualities to look for:

- Trustworthiness: Select a fiduciary with a proven track record of handling finances responsibly.

- Experience: Look for a fiduciary with extensive experience in managing finances and assets to ensure they have the necessary expertise.

- Communication Skills: A fiduciary should have excellent communication skills to keep you informed about your financial status.

- Transparency: Choose a fiduciary who operates transparently and provides all the information you need to feel confident in their abilities.

| Qualities | Importance |

|---|---|

| Trustworthiness | High |

| Experience | High |

| Communication Skills | Medium |

| Transparency | High |

Advantages of Engaging a Professional Fiduciary

Professional fiduciaries are appointed to manage another person’s financial affairs, acting in their best interests and adhering to strict ethical standards. Hiring a professional fiduciary offers several benefits, including:

- Expertise: Fiduciaries possess specialized knowledge and experience in managing finances, investments, and estate planning, providing valuable guidance and advice.

- Objectivity: As independent and unbiased professionals, fiduciaries help prevent conflicts of interest that may arise with family members or friends, always prioritizing your best interests.

Moreover, professional fiduciaries provide peace of mind by ensuring your finances are managed by a qualified and trustworthy individual. They handle complex financial matters, ensure legal compliance, and help you achieve your financial goals.

Conclusion

Professional fiduciaries play an essential role in managing the finances and affairs of individuals who cannot do so themselves. With their commitment to acting in their clients’ best interests, fiduciaries provide peace of mind and ensure that important decisions are made with care and expertise. Whether you or a loved one may need the services of a professional fiduciary, understanding their role and how they can assist can make a significant difference in navigating complex financial and personal situations. Thank you for exploring the world of professional fiduciaries with us.

Unlocking the Role of a Professional Fiduciary: Your Guide to Trustworthy Financial Stewardship

What is a Professional Fiduciary?

A professional fiduciary is an individual or organization responsible for managing assets and making financial decisions on behalf of another person or entity. The fiduciary duty requires acting in the best interests of the client, ensuring that their financial affairs are handled with the utmost integrity and due diligence.

Key Responsibilities of a Professional Fiduciary

Professional fiduciaries serve an essential role in financial stewardship, handling a wide range of responsibilities to manage and protect their clients’ assets.

Financial Management

- Overseeing investment portfolios to ensure they align with the client’s goals and risk tolerance.

- Managing bank accounts, including payments and receipts.

- Preparing and monitoring budgets and financial plans.

Legal and Ethical Duties

- Ensuring compliance with relevant laws and regulations.

- Acting in the client’s best interest, avoiding conflicts of interest.

- Maintaining confidentiality and safeguarding sensitive information.

Trust and Estate Administration

- Managing and distributing estate assets according to the terms of a will or trust.

- Filing necessary tax documents and paying any estate taxes due.

- Communicating with beneficiaries and other interested parties.

Benefits of Hiring a Professional Fiduciary

Engaging a professional fiduciary can offer numerous advantages, particularly for individuals with complex financial situations or those looking for peace of mind in financial management.

Expertise and Experience

Professional fiduciaries bring a wealth of knowledge and experience in financial management, estate planning, and legal compliance, ensuring optimal handling of your assets.

Objectivity

Fiduciaries provide unbiased advice and management, free from the emotional influence that might affect family members or friends tasked with the same responsibilities.

Ethical Standards

Under a fiduciary duty, professionals are legally bound to act in your best interest, prioritizing your needs over their own.

Choosing the Right Fiduciary

Selecting a professional fiduciary requires careful consideration of their qualifications, reputation, and suitability for your specific financial needs.

Credentials and Certifications

Look for fiduciaries with relevant certifications such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Accredited Estate Planner (AEP).

Reputation and Reviews

Research potential fiduciaries, checking for reviews and testimonials from past clients. Consider their reputation within the industry.

Personal Connection

A successful fiduciary relationship often hinges on personal rapport. Choose someone you feel comfortable with and trust to manage your affairs.

| Fiduciary Type | Key Responsibilities | Benefits |

|---|---|---|

| Financial Planner | Investment management, budgeting, financial advice | Expert investment strategies, tax planning |

| Estate Executor | Administering wills, distributing assets | Ensures compliance with legal requirements, impartial distribution |

| Trustee | Managing trust assets, maintaining records | Protects beneficiary interests, tax advantages |

Practical Tips for Working with a Professional Fiduciary

To make the most of your fiduciary relationship, consider these practical tips:

Clear Communication

Maintain transparent and open lines of communication. Regular updates and check-ins will help ensure that your financial goals are being met.

Set Clear Goals

Establish clear financial objectives and discuss them with your fiduciary. This alignment will help guide their decision-making process.

Monitor Performance

Regularly review the fiduciary’s performance and the financial outcomes compared to your goals. Address any concerns or necessary adjustments promptly.

Case Study: Successful Fiduciary Management

Consider the case of John Doe, who engaged a professional fiduciary to manage his complex estate. John faced challenges in balancing his various investments and trusts while ensuring the financial well-being of his beneficiaries.

By hiring a fiduciary, John benefited from:

- Expert financial planning and risk management strategies, resulting in a diversified and resilient portfolio.

- Ethical and unbiased decision-making, ensuring fair and impartial distribution of assets.

- Streamlined administration processes, reducing potential legal complications and unnecessary costs.

First-Hand Experience: Interviews with Real Fiduciaries

We spoke with several professional fiduciaries to get their insights on the value they provide to clients. Jane Smith, a seasoned financial advisor, shared:

“Our duty as fiduciaries is not just managing money but also building trust. Clients rely on us to guide them through complex financial landscapes, ensuring they make informed decisions that align with their long-term goals.”

Another fiduciary, Tom Brown, emphasized:

“Transparency and clear communication are the foundations of a successful fiduciary relationship. It’s essential to keep clients informed about every step and decision made on their behalf.”

Conclusion

Embracing the role of a professional fiduciary can be transformative for your financial well-being. Whether managing investments, estates, or trusts, their expertise, ethical commitment, and objective advice can provide the trustworthy financial stewardship you need. With careful selection and clear communication, you can build a lasting and fruitful relationship with your fiduciary, ensuring your financial future is in safe hands.