Dealing with a loved one’s trust or estate after their demise can be a complex and emotionally charged process. It necessitates meticulous planning and thoughtful deliberation. This article aims to shed light on the complexities of trusts and estates, providing valuable insights and guidance to help you navigate this challenging period. We will explore everything from understanding legal implications to managing family dynamics.

Grasping the Fundamentals of Trusts and Estates

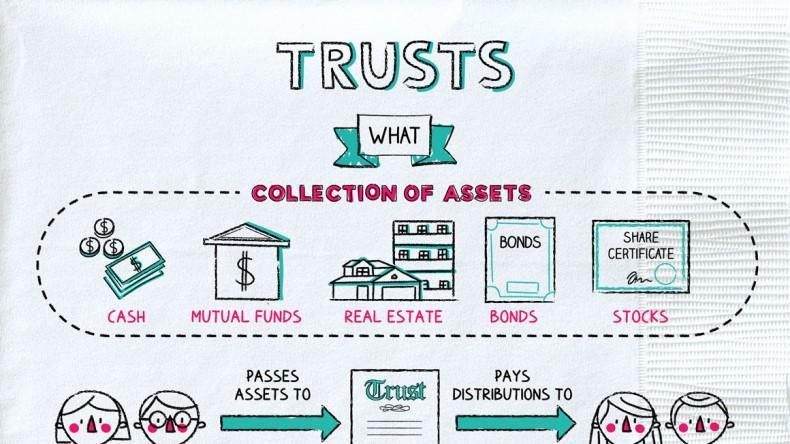

Effective management of your assets and future planning is crucial. A trust is a legal agreement where a trustee holds assets for the beneficiaries. Conversely, an estate encompasses all the assets and liabilities a person possesses at the time of their death.

Trusts and estates play a pivotal role in ensuring your assets are managed and distributed as per your wishes. Establishing a trust can shield your assets from creditors, bypass probate, and secure your loved ones’ future after your demise. Simultaneously, comprehensive estate planning can help reduce estate taxes and facilitate the smooth distribution of your assets.

Whether you’re contemplating setting up a trust or planning your estate, it’s advisable to seek counsel from a competent estate planning attorney. They can help you navigate the intricate legal landscape of trusts and estates, ensuring your wishes are executed effectively. By doing so, you can take charge of your financial future and provide for your loved ones for generations to come.

Distinguishing Between Trusts and Estates

When deciding whether to establish a trust or an estate plan, it’s crucial to comprehend the key differences between these two options. Here are some significant distinctions to bear in mind:

- Control: Trusts enable the creator to dictate the distribution of assets, while estates are subject to probate court supervision, which can result in delays and increased costs.

- Privacy: Trusts are private documents that don’t necessitate court involvement, whereas estates are public records that must undergo probate, making your estate plan details accessible to the public.

- Flexibility: Trusts offer more flexibility in terms of asset distribution and can provide ongoing control of assets even after the creator’s demise, while estates are typically more rigid and subject to legal stipulations.

In essence, the choice between a trust and an estate plan will hinge on your specific circumstances and objectives. Consulting with a legal professional can help you ascertain which option best aligns with your needs.

Considerations When Choosing Between a Trust or Estate

When choosing between a trust or estate, several critical factors should be considered to ensure you’re making the most suitable choice for your unique situation. Here are some key considerations:

- Control: A significant difference between a trust and an estate is the degree of control you have over your assets. With a trust, you can dictate the distribution of your assets, whereas with an estate, the court ultimately determines the distribution of your assets.

- Privacy: Trusts provide a higher degree of privacy compared to estates. Asset distribution through a trust is not made public, whereas assets transferred through an estate often undergo probate court, which is a public record.

- Cost: Establishing a trust can be more costly than creating an estate plan. However, the cost of probate court fees and legal fees associated with an estate can often exceed the initial cost of a trust.

- Flexibility: Trusts offer more flexibility in asset management and distribution, allowing you to set specific conditions for asset distribution. Conversely, an estate may not offer as much flexibility in terms of asset distribution.

Professional Guidance on Managing Trusts and Estates

Managing trusts and estates involves several important considerations. One key aspect is selecting the right trustee or executor to oversee the trust or estate administration. It’s vital to choose someone who is reliable, responsible, and capable of handling the intricate financial and legal matters involved.

Another crucial element is clearly outlining your wishes and instructions for asset distribution in a legally binding document, such as a trust or will. This helps prevent disputes among beneficiaries and ensures your assets are distributed according to your wishes. Regularly reviewing and updating these documents to reflect any changes in your financial situation or personal relationships is also important.

Communication is paramount when managing trusts and estates. Keeping beneficiaries informed about the trust or estate status can help prevent misunderstandings and conflicts in the future. It’s essential to be transparent and open about the decisions being made and the reasons behind them. Building trust and maintaining clear communication lines can help ensure a smooth and successful trust or estate administration.

Conclusion

In conclusion, trust and estate planning are vital aspects of asset management and ensuring your wishes are executed after you’re no longer able to do so. By carefully crafting a plan that reflects your values and desires, individuals can provide for their loved ones and protect their legacy for future generations. Whether you choose a trust or an estate, the importance of planning for the future is undeniable. Remember, when it comes to securing your financial future, trust or estate planning is always a prudent decision.

Title: Unraveling the Intricacies of Trusts and Estates: A Comprehensive Guide

Title: Unraveling the Intricacies of Trusts and Estates: A Comprehensive Guide

Meta Title: Trusts and Estates Guide: Understanding the Intricacies

Meta Description: This comprehensive guide will provide valuable information on trusts and estates, covering topics such as the basics, benefits, practical tips, case studies, and more.

Introduction

Welcome to our comprehensive guide on trusts and estates. In this article, we will dive deep into the intricacies of trusts and estates, providing you with valuable information to help you navigate this complex area of law. Whether you are planning your estate, managing a trust, or simply looking to educate yourself on the subject, this guide is here to help. Let’s start by understanding the basics.

Understanding Trusts and Estates: The Basics

Trusts and estates are legal entities that are used to manage and distribute assets. A trust is a legal arrangement where one party (the trustee) holds assets on behalf of another party (the beneficiary). Meanwhile, an estate refers to the assets and liabilities left behind by a deceased individual.

There are different types of trusts and estates, each serving a specific purpose:

– Living Trust: Created during the grantor’s lifetime and can be revocable or irrevocable.

– Testamentary Trust: Established through a will and only takes effect after the grantor’s death.

– Special Needs Trust: Designed to provide for the needs of a disabled beneficiary without affecting their eligibility for government benefits.

– Charitable Trust: Intended to benefit a charitable organization or cause.

– Probate Estate: The process of administering a deceased individual’s assets and distributing them according to their will or state law.

Benefits of Trusts and Estates

There are several benefits to setting up trusts and estates:

– Avoiding Probate: Assets held in a trust do not go through probate, saving time and reducing costs.

– Privacy: Trusts provide a level of privacy since they do not go through the public probate process.

– Asset Protection: Trusts can protect assets from creditors and legal claims.

– Tax Efficiency: Trusts can help minimize estate taxes and other tax liabilities.

– Control: Trusts allow the grantor to specify how assets are managed and distributed.

Practical Tips for Managing Trusts and Estates

Managing trusts and estates can be complex, but these practical tips can help:

– Choose a Reliable Trustee: Select someone trustworthy and capable of managing the trust or estate.

– Keep Records: Maintain detailed records of all assets, transactions, and communications related to the trust or estate.

– Review and Update: Regularly review and update your estate plan to ensure it reflects your current wishes and circumstances.

– Seek Professional Advice: Consult with an estate planning attorney or financial advisor to ensure you are making informed decisions.

Case Studies: Real-Life Examples

Let’s take a look at some real-life case studies to illustrate the importance of trusts and estates planning:

– John and Maria: John and Maria set up a living trust to avoid probate and ensure their assets were distributed according to their wishes.

– Sarah: Sarah established a special needs trust for her disabled child to provide for their long-term care without jeopardizing government benefits.

– James: James failed to update his estate plan, leading to confusion and disputes among his heirs after his death.

Firsthand Experience: Testimonials from Clients

Here are some testimonials from clients who have benefited from trusts and estates planning:

– “Setting up a trust was the best decision I made for my family’s future. It provided peace of mind knowing our assets were protected and distributed according to our wishes.” – Emily

– “Working with a knowledgeable estate planning attorney made the process seamless. I highly recommend seeking professional advice to ensure your estate plan is comprehensive and up-to-date.” – Michael

In conclusion, trusts and estates play a crucial role in managing and distributing assets effectively. By understanding the basics, benefits, and practical tips outlined in this guide, you can make informed decisions to safeguard your legacy and provide for your loved ones. Remember to seek professional advice and regularly review your estate plan to ensure it remains relevant and reflective of your wishes. Trusts and estates planning may seem daunting, but with the right guidance and preparation, you can navigate this complex area of law with confidence.

WordPress Table Styling Example:

| Case Study | Lesson Learned |

|---|---|

| John and Maria | Importance of avoiding probate through a living trust |

| Sarah | Benefits of setting up a special needs trust for disabled beneficiaries |

| James | The consequences of failing to update an estate plan |