Establishing a trust fund for your child can be a crucial step in safeguarding their financial stability in the future. Trust funds provide a structured approach to asset management and protection for a child, offering reassurance and tranquility for both parents and beneficiaries. This article will delve into the advantages of creating a trust fund for your child and the process involved in its establishment.

Grasping the Fundamentals of Child Trust Funds

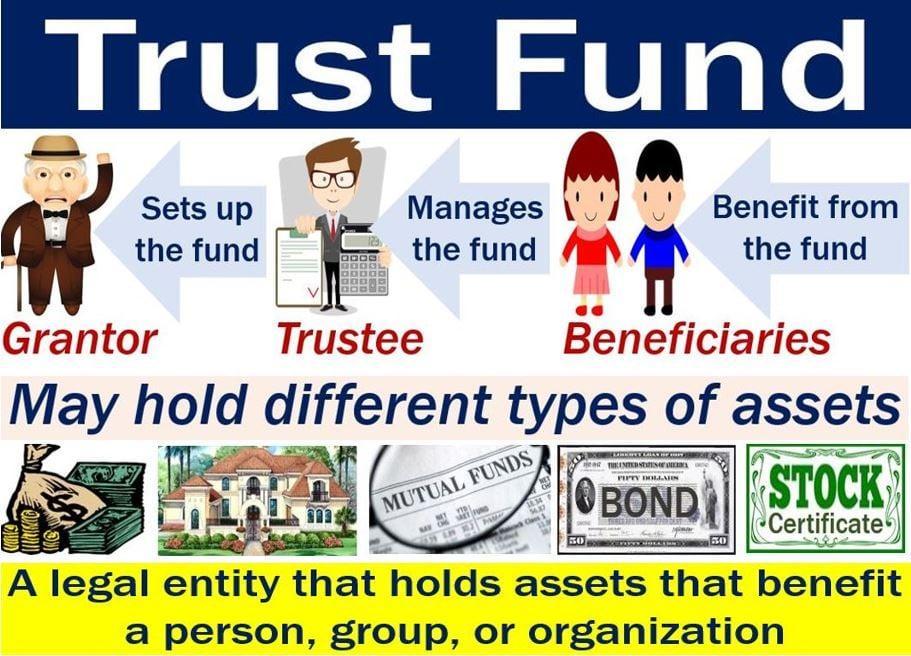

When initiating a trust fund for your child, it’s crucial to grasp the fundamentals to guarantee their financial future is safeguarded. A trust fund is a legal setup that permits a trustee to manage assets on behalf of a beneficiary, in this case, your child. By establishing a trust fund, you can dictate the manner and timing of your child’s inheritance, offering financial safety and assurance.

A significant advantage of a trust fund is its ability to shield your child’s assets from creditors or legal conflicts. Moreover, trust funds can offer tax benefits, as income generated within the trust is usually taxed at a lower rate than personal income. By initiating a trust fund for your child, you can guarantee that they have financial resources at their disposal for significant life events, such as education costs or home acquisition.

When creating a trust fund for your child, you will need to contemplate the following critical elements:

- Trustee: Select a reliable individual or financial institution to administer the trust fund on your child’s behalf.

- Assets: Identify the assets to be included in the trust fund, such as cash, investments, or property.

- Terms: Specify the terms of the trust, including how and when your child can access the funds.

- Legal Documentation: Collaborate with a lawyer to draft a trust agreement that details the specifics of the trust fund.

Advantages of Creating a Trust Fund for Your Child’s Future

Establishing a trust fund for your child’s future can equip them with a financial safety net that lasts a lifetime. By creating a trust fund, you can ensure that your child has access to funds for significant milestones like college fees, home purchase, or business startup.

A key advantage of a trust fund is the ability to control the distribution of funds to your child. This can help shield your child from impulsive financial decisions and ensure that the money is utilized wisely. Additionally, a trust fund can offer tax benefits, aiding your child in maximizing their inheritance.

By establishing a trust fund for your child, you can also safeguard their assets from creditors or legal conflicts. This can provide you with tranquility, knowing that your child’s financial future is secure. Creating a trust fund is a valuable investment in your child’s future that can offer them financial stability and opportunities for success.

Crucial Aspects to Consider When Establishing a Trust Fund

When initiating a trust fund for your child, there are several crucial aspects to consider to ensure that their financial future is safeguarded. One key consideration is choosing the right trustee to administer the trust on behalf of your child. A trustee should be someone you trust implicitly, who has financial expertise, and who can act in the best interests of your child.

Another vital aspect to consider is the type of assets you want to include in the trust fund. You may want to include a mix of investments such as stocks, bonds, real estate, and cash to provide diversification and growth opportunities for the trust fund. It’s important to carefully consider the risk tolerance of the investments and how they align with your child’s financial needs.

Furthermore, you will need to decide on the terms of the trust fund, such as when and how your child can access the funds. You may want to set specific milestones or age thresholds for when distributions can be made, or you may choose to allow the trustee discretion in making distribution decisions. By carefully considering these factors and planning ahead, you can establish a trust fund that will provide financial security for your child for years to come.

Expert Advice for Managing and Expanding Your Child’s Trust Fund

One crucial aspect to consider when managing and expanding your child’s trust fund is to diversify investments. By spreading the money across a variety of assets such as stocks, bonds, real estate, and mutual funds, you can help minimize risks and maximize returns over time.

Another expert tip is to regularly review and adjust the trust fund’s investment strategy as your child matures. Their financial needs and goals will evolve, so it’s essential to ensure the trust fund aligns with their changing circumstances. This can help ensure that the fund continues to grow and provide financial security for your child in the future.

Additionally, it’s crucial to involve your child in discussions about their trust fund as they mature. Educating them about financial responsibility and the importance of managing their wealth can help them make informed decisions and be prepared to manage the trust fund when it’s eventually transferred to their control. Encouraging financial literacy from a young age can empower your child to make wise choices with their money and secure their financial future.

The Path Ahead

Establishing a trust fund for your child is a considerate and practical way to secure their financial future. By investing in their education, providing for their needs, and protecting their inheritance, you are laying a robust foundation for their success. Remember, the best gift you can give your child is the gift of financial stability and peace of mind. So take the necessary steps to establish a trust fund today and watch as your child’s future unfolds with confidence and certainty. Trust in the power of planning for tomorrow, today.

Establishing a Trust Fund for Your Child: A Comprehensive Guide

Setting up a trust fund for your child can be a great way to secure their financial future and ensure they have the resources they need to succeed. Whether you’re looking to save for their education, provide for their care in the event of your passing, or simply give them a head start in life, a trust fund can be a powerful tool. In this comprehensive guide, we’ll walk you through everything you need to know about establishing a trust fund for your child.

Benefits of a Trust Fund

- Protecting assets for your child’s future

- Providing financial security and stability

- Minimizing tax implications

- Avoiding probate and ensuring privacy

- Control over how and when assets are distributed

Practical Tips for Setting Up a Trust Fund

When it comes to setting up a trust fund for your child, there are a few key steps to keep in mind:

- Identify your goals and objectives for the trust fund

- Determine the type of trust that best suits your needs (e.g., revocable trust, irrevocable trust, special needs trust)

- Select a trustee who will manage the trust assets and ensure your wishes are carried out

- Consult with a financial advisor or estate planning attorney to create a detailed trust agreement

- Fund the trust with assets such as cash, investments, or real estate

- Review and update the trust as needed to reflect changes in your circumstances or your child’s needs

Case Studies

Here are a few examples of how trust funds have benefited children in different situations:

| Case Study | Outcome |

|---|---|

| Case Study 1 | Child was able to graduate from college debt-free thanks to a trust fund set up by their parents |

| Case Study 2 | Trust fund provided for a child with special needs after their parents passed away |

| Case Study 3 | Family avoided costly probate proceedings by transferring assets to a trust fund |

Firsthand Experience

As a parent who has set up a trust fund for my child, I can attest to the peace of mind it brings knowing that their future is secure. By carefully planning and making thoughtful decisions about the trust, I feel confident that my child will have the resources they need to thrive. I highly recommend exploring the option of setting up a trust fund for your child to ensure their financial well-being.

establishing a trust fund for your child can provide a wide range of benefits and help you achieve your long-term financial goals. By following the practical tips outlined in this guide and seeking advice from financial professionals, you can create a solid foundation for your child’s future success.