Picture this: you acquire a stunning property in a prime location without having to make any effort to buy it. This ideal situation can become a reality by becoming a beneficiary of real estate. In this piece, we will delve into the concept of a real estate beneficiary, the duties and privileges that come with this role, and how you can potentially profit from inheriting property. So, sit back, relax, and let’s dive into the fascinating world of real estate beneficiaries.

Grasping the Concept of Real Estate Beneficiaries

Real estate beneficiaries are individuals or organizations who are in line to inherit a property after the original owner’s demise. Grasping the idea of beneficiaries is vital in the realm of real estate, as it establishes who will eventually own the property and how it will be transferred.

Potential beneficiaries can be:

- Relatives

- Business associates

- Non-profit organizations

It is crucial for property owners to explicitly specify their beneficiaries in a will or trust to ensure that their desires are executed. Without a named beneficiary, the property may end up in probate court, leading to delays and complications for the heirs.

Crucial Aspects to Ponder When Selecting a Real Estate Beneficiary

When choosing a real estate beneficiary, several critical aspects should be considered to ensure that your wishes are executed effectively. One significant factor to consider is the relationship between the beneficiary and the property. It is vital to select someone who appreciates the property’s value and is ready to take on the responsibilities that come with being a beneficiary.

Another crucial consideration is the financial stability of the chosen beneficiary. It is vital to choose someone who is financially responsible and capable of handling any expenses or taxes that may arise from inheriting the property. This can help prevent any future financial strains on the beneficiary.

Furthermore, it is essential to consider the long-term consequences of selecting a beneficiary. Think about how the choice of beneficiary could impact your family dynamics or relationships. It may be beneficial to have transparent and candid discussions with all parties involved to ensure that everyone is on the same page.

Optimizing Advantages as a Real Estate Beneficiary

When it comes to being a real estate beneficiary, there are various strategies to optimize the benefits that come with inheriting property. Here are some key tactics to make the most out of your real estate inheritance:

- Know the Property: Spend time getting to know the property you have inherited. This includes understanding its location, condition, and potential value.

- Get Professional Guidance: Consider consulting with real estate professionals such as appraisers, real estate agents, or property managers to gain a better understanding of your options.

- Consider Various Options: Whether you decide to sell, rent, or live in the property, it’s crucial to weigh the advantages and disadvantages of each option to determine the best course of action.

| Option | Advantages | Disadvantages |

|---|---|---|

| Sell the Property | Immediate access to cash | Potential loss if market is down |

| Rent the Property | Generate rental income | Responsibility for maintenance |

| Reside in the Property | No housing expenses | Potential challenges with relocation |

By taking the time to understand the property, seeking professional advice, and exploring different options, you can make informed decisions that will help you optimize the benefits of being a real estate beneficiary.

Guidelines for a Seamless Transition as a Real Estate Beneficiary

When inheriting real estate, it can be a daunting process to navigate. Here are some tips to help ensure a seamless transition as a real estate beneficiary:

- Inform Yourself: Spend time understanding the property you are inheriting, including its value, any outstanding mortgages or liens, and any potential maintenance or repair issues.

- Communicate with Other Beneficiaries: If you are not the only beneficiary, open communication with other heirs is crucial to avoid conflicts and ensure everyone is on the same page.

- Seek Professional Advice: Consider seeking advice from a real estate attorney, financial advisor, or tax consultant to help you navigate the legal and financial aspects of inheriting property.

| Tip: | Contact a real estate agent to help you assess the property and determine the best course of action, whether it’s selling, renting, or occupying the property. |

By staying informed, communicating effectively, and seeking professional advice, you can make the process of inheriting real estate a smoother and less stressful experience.

In Conclusion

As we conclude our exploration of real estate beneficiaries, we hope you have gained a deeper understanding of the crucial role they play in property transactions. Whether you are a beneficiary yourself or simply curious about the intricacies of real estate, understanding this process can make a significant difference in ensuring a smooth and successful transaction. Stay tuned for more enlightening articles on all things real estate!

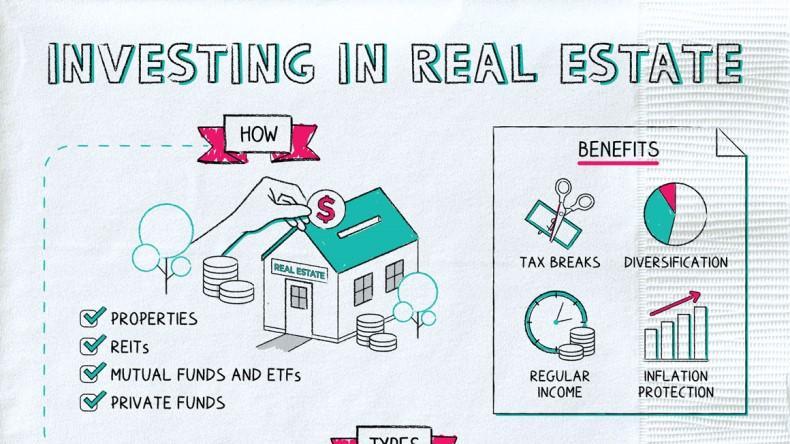

The Benefits of Real Estate Investment

Real estate investment has long been considered one of the most lucrative ways to build wealth and secure financial stability. From rental properties to commercial real estate, there are numerous ways to invest in the real estate market and unlock a variety of benefits. Here are some of the key advantages of real estate investment:

1. Passive Income

One of the primary benefits of investing in real estate is the potential for passive income. By renting out properties, investors can generate a steady stream of income month after month. This passive income can provide financial security and stability, allowing investors to build their wealth over time.

2. Appreciation

Real estate has historically appreciated in value over time, making it a valuable long-term investment. By holding onto properties for an extended period, investors can benefit from the appreciation in value and increase their net worth. This can be particularly advantageous in high-demand markets where property values tend to rise consistently.

3. Tax Benefits

Real estate investors also enjoy a number of tax benefits that can help reduce their tax liability. From deductions for mortgage interest and property taxes to depreciation benefits, there are several ways that real estate investments can provide tax advantages. These tax benefits can ultimately increase the overall return on investment for property owners.

4. Portfolio Diversification

Diversification is key to building a successful investment portfolio, and real estate can be a valuable addition to a diversified investment strategy. By spreading risk across different asset classes, investors can protect themselves against market volatility and achieve more stable returns over time.

Practical Tips for Real Estate Investment Success

While the benefits of real estate investment are clear, success in the market requires careful planning and strategic decision-making. Here are some practical tips to help you maximize your returns on real estate investments:

1. Research the Market

Before investing in real estate, it’s important to thoroughly research the market and understand current trends and opportunities. Look for properties in high-demand areas with strong growth potential to maximize your returns.

2. Crunch the Numbers

Evaluate potential investment properties carefully and calculate projected returns based on rental income, expenses, and appreciation potential. Make sure to factor in all costs, including maintenance, property management, and financing expenses, to get a clear picture of your potential ROI.

3. Build a Strong Network

Networking is crucial in the real estate industry, so make an effort to build relationships with other investors, lenders, real estate agents, and property managers. A strong network can provide valuable insights, opportunities, and support to help you succeed in the market.

Real Estate Investment Case Studies

To illustrate the benefits of real estate investment in action, let’s take a look at some real-world case studies:

| Case Study | Investment Strategy | Results |

|---|---|---|

| Case Study 1 | Buy and Hold Rental Properties | Generated $5000/month in passive income |

| Case Study 2 | Flip Properties for Quick Profits | Netted $50,000 in profits in 6 months |

First-Hand Experience: Unlocking the Benefits of Real Estate Investment

For many investors, real estate has proven to be a rewarding and profitable investment strategy. By leveraging the benefits of passive income, appreciation, tax advantages, and portfolio diversification, investors can build wealth and secure their financial future through real estate. By following best practices, conducting thorough research, and learning from successful case studies, investors can maximize their returns and achieve success in the real estate market.

Whether you’re a seasoned investor or just getting started, real estate investment offers a wealth of opportunities to grow your wealth and achieve your financial goals. With the right strategies and a solid understanding of the market, you can unlock the benefits of real estate investment and build a successful portfolio that stands the test of time.