In the complex sphere of estate management and will execution, there are essential instruments designed to protect the interests of all parties involved. Probate bonds are one such critical element, ensuring the correct administration of an individual’s assets after their demise. In this article, we will delve into the world of probate bonds, examining their importance, function, and how they serve to protect the heirs and beneficiaries of an estate. Let’s demystify the intricacies of probate bonding and illuminate its role in the domain of estate settlement.

Grasping the Basics of Probate Bonds

When navigating probate bonds, it’s essential to comprehend the basics to effectively manage the process. These bonds are pivotal in ensuring that estates are correctly administered and debts are settled.

One crucial aspect to understand is the different types of probate bonds available:

- Administrator Bonds: These bonds are necessary when the deceased person did not leave a will. They ensure that the appointed administrator performs their duties ethically and legally.

- Executor Bonds: If a will is in place, the executor bond guarantees that the named executor fulfills their responsibilities as outlined in the will.

- Guardian Bonds: When minors or incapacitated individuals need a guardian to manage their affairs, a guardian bond is necessary to protect their assets.

Recognizing the importance of probate bonds in protecting the interests of all parties involved in the estate settlement process is crucial. By understanding these basics, you can ensure a smoother and more efficient probate process.

Advantages of Using Probate Bonds

When it comes to managing a deceased person’s estate, probate bonds play a vital role in protecting the assets and ensuring that all obligations are met. These bonds offer a layer of protection for beneficiaries, creditors, and other parties involved in the probate process. Here are some key benefits:

- Financial Security: Probate bonds offer financial protection by guaranteeing that the estate will be managed and distributed according to the law.

- Trust and Assurance: By requiring the executor or administrator to obtain a probate bond, it instills trust and confidence in the beneficiaries that their interests are safeguarded.

- Legal Compliance: Probate bonds help ensure that the executor follows the proper legal procedures and fulfills their duties in administering the estate.

- Creditor Protection: If the executor mismanages the estate or fails to meet their obligations, creditors can make a claim against the probate bond to recover any losses.

Choosing the Right Probate Bond Provider

When it comes to selecting a probate bond provider, there are several key factors to consider. It’s important to choose a reputable company that can offer the coverage you need at a competitive price. Here are some tips to help you make the right choice:

- Experience: Look for a bond provider with a proven track record in the industry. Choose a company that has been in business for several years and has a good reputation among its clients.

- Customer Service: Ensure the provider offers excellent customer service. You want to work with a company that is responsive to your needs and can address any questions or concerns you may have.

- Financial Stability: Verify that the bond provider is financially stable and has the resources to cover any claims that may arise. Check their financial ratings and make sure they are in good standing.

When comparing probate bond providers, be sure to request quotes from several companies to get an idea of the pricing and coverage options available. Don’t just focus on the cost – consider the level of service and support you will receive as well. By taking the time to research and compare different providers, you can ensure you choose the right one for your needs.

| Company Name | Experience | Customer Service | Financial Stability |

|---|---|---|---|

| ABC Bond Company | 10+ years | Excellent | Strong |

| XYZ Bond Corporation | 5 years | Good | Stable |

Effective Management of Probate Bonds

When it comes to navigating the complex world of probate bonds, following these top tips can help you streamline the process and ensure a successful outcome:

- Understand the Requirements: Take the time to thoroughly research and understand the specific requirements for probate bonds in your jurisdiction. This will help you avoid any potential pitfalls or delays.

- Work with a Reputable Surety Company: Choosing the right surety company can make all the difference when obtaining probate bonds. Look for a company with a strong reputation and proven track record in the industry.

- Stay Organized: Keeping detailed records and staying organized throughout the probate process can help you stay on track and ensure that everything is completed in a timely manner.

| Tip | Description |

|---|---|

| Communication | Ensure clear communication with all parties involved to avoid any misunderstandings. |

| Financial Planning | Consider the financial implications of probate bonds and plan accordingly. |

| Regular Updates | Provide regular updates to all stakeholders to keep them informed of progress. |

By following these key strategies and staying proactive throughout the probate process, you can effectively manage probate bonds and achieve a successful outcome. Remember, proper planning and attention to detail are key when it comes to navigating the complexities of probate bonds.

In Conclusion

In conclusion, probate bonds play a vital role in protecting the interests of all parties involved in the probate process. Whether you are a beneficiary, executor, or creditor, these bonds provide an extra layer of security and assurance, ensuring that the estate is handled fairly and responsibly. By understanding the purpose and benefits of probate bonds, you can navigate the complexities of probate with confidence and peace of mind. If you have any further questions or need assistance with probate bonds, do not hesitate to reach out to a trusted financial advisor or legal professional. Remember, in the world of probate, knowledge is power.

# Unlocking the Mystery: Everything You Need to Know About Probate Bonds

# Unlocking the Mystery: Everything You Need to Know About Probate Bonds

Are you puzzled about what probate bonds are and how they work? You’re not alone! Probate bonds can be a confusing and complex topic for many people. In this article, we will break down everything you need to know about probate bonds in a clear and concise manner.

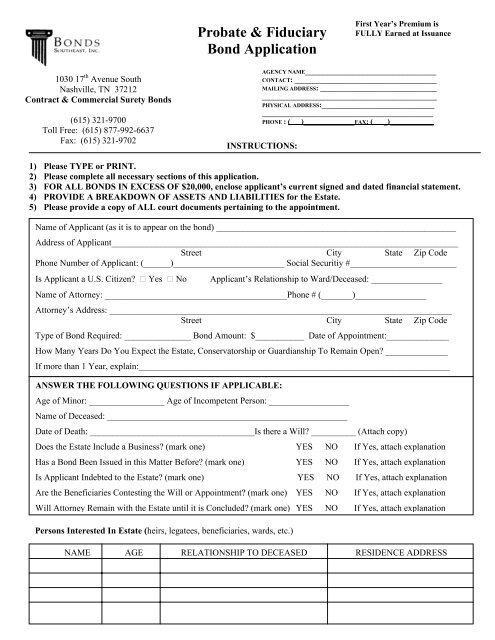

**What are Probate Bonds?**

Probate bonds, also known as executor bonds or fiduciary bonds, are a type of surety bond that is required in some cases when someone is appointed to manage the assets and estate of a deceased person. The purpose of a probate bond is to protect the assets of the estate from mismanagement or fraud by the appointed executor or administrator. In essence, probate bonds provide financial security and assurance that the executor or administrator will fulfill their duties honestly and responsibly.

**How Do Probate Bonds Work?**

When a person is appointed as the executor or administrator of an estate, they are typically required to obtain a probate bond before they can officially begin their duties. The bond is essentially a contract between the executor or administrator, the surety company that issues the bond, and the court overseeing the probate process. If the executor or administrator commits fraud, mismanagement, or negligence in handling the estate, a claim can be filed against the bond to compensate for any financial losses.

**Types of Probate Bonds**

There are several types of probate bonds that may be required depending on the specific circumstances of the estate. Some common types of probate bonds include:

– Executor Bonds: Required when the deceased person had a will and named an executor to manage their estate.

– Administrator Bonds: Required when the deceased person did not have a will or named an administrator to manage their estate.

– Trustee Bonds: Required when a trust is established as part of the estate plan.

**Benefits of Probate Bonds**

– Provides protection: Probate bonds offer financial protection to the beneficiaries of the estate by ensuring that the executor or administrator fulfills their duties.

– Promotes accountability: Knowing that they are financially responsible for any wrongdoing, the executor or administrator is more likely to act responsibly and honestly.

– Peace of mind: Beneficiaries can have peace of mind knowing that the estate is protected from potential mismanagement or fraud.

**Practical Tips for Dealing with Probate Bonds**

If you are appointed as an executor or administrator of an estate and are required to obtain a probate bond, here are some practical tips to help you navigate the process:

1. Research reputable surety companies that specialize in probate bonds.

2. Understand the terms and conditions of the bond before signing any agreements.

3. Keep detailed records of all transactions and communications related to the estate.

4. Seek legal advice if you have any questions or concerns about your duties as the executor or administrator.

**Case Study: John’s Experience with Probate Bonds**

John recently found himself in a challenging situation when he was named the executor of his late grandmother’s estate. Not knowing much about probate bonds, John did some research and learned about the importance of obtaining a probate bond to protect the estate assets. By following the practical tips mentioned above and working with a reputable surety company, John was able to successfully navigate the probate process and fulfill his duties as the executor.

In conclusion, probate bonds play a vital role in ensuring the protection and proper management of an estate. By understanding how probate bonds work, the different types available, and the benefits they provide, you can confidently navigate the probate process and fulfill your duties as an executor or administrator. Remember to seek professional advice if you have any questions or concerns about probate bonds and the probate process.