As a limited liability company (LLC) beneficiary, you occupy a distinctive place within the company’s framework. Your beneficiary status bestows upon you certain privileges and duties that distinguish you from other stakeholders. In this article, we delve into the role of an LLC beneficiary, the advantages of this position, and the implications for your participation in the company’s operations. Join us as we unravel the complexities of being an LLC beneficiary and how it influences your relationship with the business entity.

Grasping the Roles and Duties of LLC Beneficiaries

Comprehending the roles and duties of LLC beneficiaries is vital for the smooth operation of a limited liability company. Beneficiaries perform crucial roles and have specific duties that contribute to the overall functioning of the business.

One primary function of LLC beneficiaries is to receive profit distributions from the company. These distributions are usually made according to each beneficiary’s ownership percentage. It’s crucial for beneficiaries to understand their rights to these distributions and ensure they are distributed equitably.

Another duty of LLC beneficiaries is to participate in significant decision-making processes that affect the company. This may involve voting on major business decisions, such as securing loans or making substantial investments. By actively participating in these decisions, beneficiaries can help guide the company towards success.

Optimizing the Advantages of Being an LLC Beneficiary

Being an LLC beneficiary comes with its own set of advantages that can be optimized with the right strategies. By understanding how to fully utilize your status as an LLC beneficiary, you can ensure that you are fully exploiting all the benefits this designation offers.

One way to optimize the benefits of being an LLC beneficiary is to actively participate in the decision-making process of the company. By attending meetings, providing input, and staying informed about the company’s operations, you can directly influence its success and growth.

Another way to capitalize on your role as an LLC beneficiary is to exploit any tax benefits associated with this designation. By collaborating closely with a tax professional, you can ensure that you are taking advantage of any tax breaks and deductions available to you as a beneficiary of an LLC.

Furthermore, you can optimize the benefits of being an LLC beneficiary by diversifying your investment portfolio. By spreading your investments across various industries and asset classes, you can mitigate risk and increase your chances of higher returns. This can help you further grow your wealth and secure your financial future.

Selecting the Appropriate Beneficiary for Your LLC

When it comes to choosing the right beneficiary for your LLC, there are several crucial factors to consider. It’s essential to select someone who is not only trustworthy but also has a solid understanding of the business and its operations. Here are some tips to assist you in making the right decision:

- Consider their involvement: Choose a beneficiary who is actively involved in the LLC and comprehends the business model.

- Trustworthiness: Ensure the beneficiary is someone you can trust to make crucial decisions on behalf of the LLC.

- Legal considerations: Verify the legal requirements for naming a beneficiary in your state and ensure they meet all necessary criteria.

It’s important to periodically review your choice of beneficiary to ensure they remain the best fit for the role. By carefully selecting the right beneficiary for your LLC, you can help ensure the continued success and longevity of your business.

Facilitating Seamless Succession Planning for LLC Beneficiaries

When it comes to facilitating a smooth succession planning process for LLC beneficiaries, several key factors need to be considered to ensure a seamless transition of ownership and decision-making within the company.

One crucial aspect to address is clearly defining the roles and duties of each beneficiary within the LLC. This can help prevent any confusion or conflicts that may arise during the succession planning process.

Another vital step is to establish a comprehensive estate plan that clearly outlines how the LLC assets will be distributed among the beneficiaries. This can help avoid potential legal disputes and ensure that the wishes of the original LLC owner are effectively executed.

Moreover, regular communication and collaboration among the beneficiaries can facilitate a smoother transition and enable them to work together towards the continued success and growth of the LLC.

Looking Ahead

As we’ve delved into the concept of an LLC beneficiary, we’ve seen how this unique role can significantly influence the distribution of assets within a limited liability company. By understanding the rights and duties that come with being an LLC beneficiary, individuals can better navigate the complexities of estate planning and ensure that their wishes are effectively executed. Whether you’re considering establishing an LLC or are already a beneficiary within one, it’s crucial to seek guidance from legal and financial professionals to make informed decisions that align with your goals. Remember, being an LLC beneficiary isn’t just a title – it’s a position that carries significance and importance in shaping the legacy you leave behind.

Unlocking the Secrets: Who Can Be a Beneficiary of an LLC?

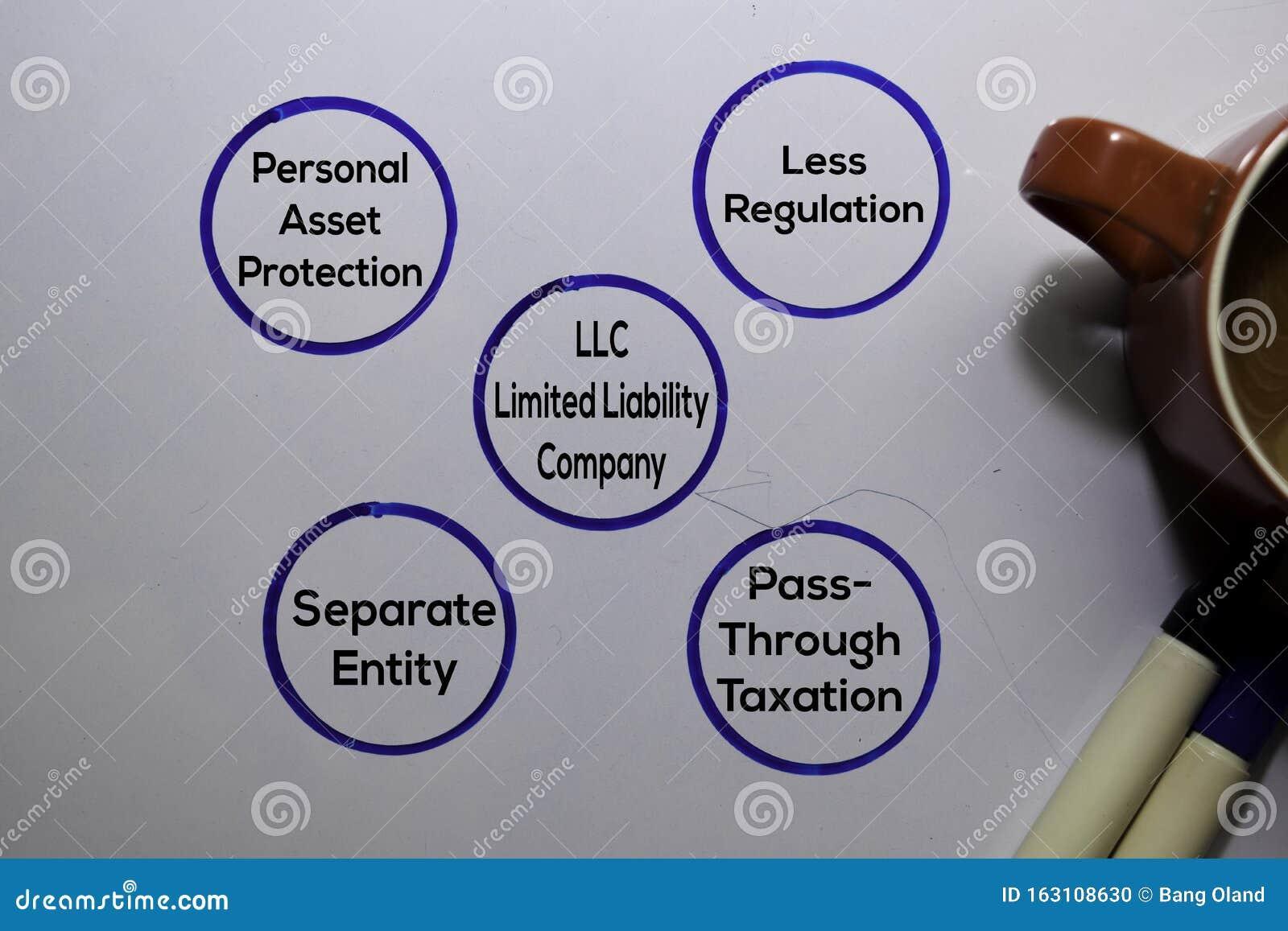

Limited Liability Companies (LLCs) are a popular choice for entrepreneurs and business owners due to their flexibility and liability protection. One aspect of LLCs that is often misunderstood is the concept of beneficiaries. In this article, we will explore who can be a beneficiary of an LLC and the benefits of this legal structure.

Who Can Be a Beneficiary of an LLC?

Unlike a corporation, which has shareholders, an LLC has members. Members are the owners of the LLC and are entitled to share in its profits and losses. However, members can also designate beneficiaries who are not directly involved in the day-to-day operations of the business but who can still benefit from the LLC’s success.

Beneficiaries can include:

- Family members

- Trusts

- Charities

- Other businesses

Having beneficiaries can provide additional flexibility in estate planning and asset protection strategies. It allows for the distribution of profits and assets to designated individuals or entities without requiring them to be active members of the LLC.

Benefits of Having Beneficiaries in an LLC

There are several benefits to having beneficiaries in an LLC:

- Asset protection: Designating beneficiaries can help shield assets from creditors and lawsuits.

- Estate planning: Beneficiaries can simplify the distribution of assets upon the death of a member.

- Tax advantages: Certain beneficiaries may have tax advantages when receiving distributions from an LLC.

- Flexibility: Beneficiaries do not need to be actively involved in the business, allowing for a more diverse ownership structure.

Practical Tips for Choosing Beneficiaries

When choosing beneficiaries for your LLC, consider the following:

- Define the purpose: Determine why you are designating beneficiaries and what you hope to achieve.

- Consult with a legal expert: It’s important to seek advice from a lawyer or financial advisor to ensure your beneficiaries are properly designated.

- Update as needed: Review and update your beneficiary designations periodically to reflect any changes in your business or personal circumstances.

Case Study: XYZ LLC

| Member | Beneficiary |

|---|---|

| John Doe | Smith Family Trust |

| Jane Smith | ABC Charity |

In the case of XYZ LLC, John Doe has designated the Smith Family Trust as his beneficiary, while Jane Smith has chosen ABC Charity. This allows for the seamless transfer of assets and profits to their chosen beneficiaries without requiring them to be active members of the LLC.

Final Thoughts

Having beneficiaries in an LLC can offer additional protection, flexibility, and tax advantages for business owners. By carefully selecting and designating beneficiaries, you can ensure that your assets are distributed according to your wishes and provide for your loved ones in the future. Consult with a legal expert to determine the best strategy for your specific situation.