Within the intricate world of estate planning, a lesser-known yet increasingly utilized strategy is the generation-skipping trust. This distinctive instrument allows individuals to leapfrog a generation when transferring their wealth, providing a unique method for safeguarding assets for their descendants. In this article, we will dissect the complexities of generation-skipping trusts, examining their operation and the advantages they offer to astute planners. Join us as we demystify this innovative estate planning method.

Grasping the Idea of Generation Skipping Trust

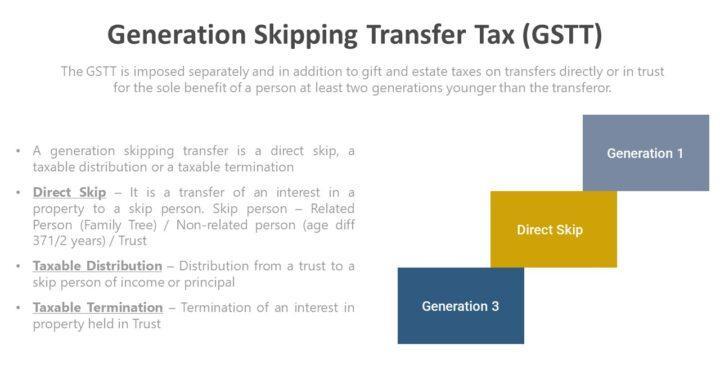

The concept of a generation-skipping trust is unfamiliar to many. This type of trust enables individuals to transfer assets to their grandchildren or even further down the family tree, bypassing a generation in the process. It can be a potent estate planning instrument for families aiming to establish a lasting legacy for future generations.

A key advantage of a generation-skipping trust is its ability to help reduce estate taxes by skipping the intermediate generation. By establishing this type of trust, individuals can ensure their assets are safeguarded and passed down to their grandchildren without incurring additional taxes. This can help maintain wealth for future generations and ensure family assets remain unscathed.

When establishing a generation-skipping trust, it’s crucial to collaborate with a proficient estate planning attorney who can guide through the intricate legal prerequisites. By meticulously crafting the trust document and designating suitable beneficiaries, individuals can ensure their desires are fulfilled and their family’s financial future is safeguarded.

Pros and Cons of Employing a Generation Skipping Trust

When contemplating a generation-skipping trust, there are several advantages and disadvantages to bear in mind. A significant advantage is the capacity to transfer assets to grandchildren or even future generations without incurring additional estate taxes. This can be a strategic method to preserve wealth for the long term within the family.

Conversely, a downside of a generation-skipping trust is its complexity in setup and management. It necessitates a careful selection of trustees and beneficiaries, as well as a comprehensive understanding of tax implications. Moreover, there may be legal fees associated with the establishment and maintenance of the trust.

In summary, the decision to employ a generation-skipping trust should be thoughtfully considered based on individual circumstances and objectives. While it can offer unique advantages in terms of wealth transfer and tax efficiency, it also comes with its own set of challenges and considerations.

Considerations When Establishing a Generation Skipping Trust

When establishing a Generation Skipping Trust, there are several crucial factors to consider to ensure your intentions and desires are effectively executed. Here are some key considerations to bear in mind:

- Beneficiaries: Decide who you want to benefit from the trust, whether it be your grandchildren, great-grandchildren, or even future generations. Clearly define their roles and responsibilities within the trust.

- Trustee: Choose a trustee who is reliable, trustworthy, and capable of managing the trust assets in the best interests of the beneficiaries. Consider appointing a professional trustee if necessary.

- Asset Protection: Assess the assets that will be included in the trust and how they will be shielded from creditors, lawsuits, or unforeseen circumstances that could affect their value.

- Legal and Tax Implications: Consult with legal and financial advisors to understand the legal and tax implications of establishing a Generation Skipping Trust. Ensure compliance with all relevant laws and regulations to avoid any future complications.

In conclusion, careful consideration of these factors will assist you in establishing a Generation Skipping Trust that aligns with your future goals and objectives. By addressing these key aspects, you can lay a solid foundation for the trust that will provide enduring benefits for your descendants.

| Beneficiaries | Trustee | Asset Protection | Legal/Tax |

|---|---|---|---|

| Grandchildren | Professional | Diversified | Consultation |

| Great-Grandchildren | Reliable | Insurance | Advisors |

| Future Generations | Trustworthy | Estate Planning | Compliance |

Optimizing the Benefits of a Generation Skipping Trust Through Strategic Planning

Optimizing the benefits of a generation-skipping trust requires careful and strategic planning to ensure that the assets are efficiently transferred to future generations. By employing various techniques and tools, you can maximize the benefits of this type of trust and create a lasting legacy for your family.

A crucial aspect of strategic planning for a generation-skipping trust is to consider the tax implications. By structuring the trust in a tax-efficient manner, you can minimize the amount of taxes that future generations will have to pay on the assets they inherit. This can help maintain the value of the assets and ensure they are passed down intact to your grandchildren or great-grandchildren.

Another important factor to consider is the investment strategy for the trust assets. By diversifying the investments and regularly reviewing and adjusting the portfolio, you can help ensure that the trust continues to grow and provide for future generations. Working with a financial advisor can help you develop a customized investment strategy that aligns with your goals for the trust.

Concluding Thoughts

As we wrap up our discussion on generation-skipping trusts, it’s clear that this estate planning strategy can offer numerous benefits for both the grantor and their beneficiaries. By effectively leveraging this tool, individuals can secure the financial future of their loved ones while minimizing tax liabilities. If you’re considering incorporating a generation-skipping trust into your estate plan, be sure to consult with a proficient estate planning attorney to explore your options and ensure your wishes are effectively executed. Thank you for reading and happy planning!

Unraveling the Mystery: A Comprehensive Guide to Understanding Generation Skipping Trusts

Generation Skipping Trusts (GSTs) are a powerful estate planning tool that can help families preserve wealth for future generations while minimizing taxes. However, they can be complex and intimidating for those who are unfamiliar with them. In this comprehensive guide, we will dive deep into what GSTs are, how they work, their benefits, and practical tips for implementing them effectively.

What is a Generation Skipping Trust?

A Generation Skipping Trust is a type of irrevocable trust that allows individuals to pass assets to their grandchildren or more remote descendants without incurring estate or gift taxes at each generation. This can be a valuable strategy for families with substantial wealth who want to preserve assets for future generations.

How Does a Generation Skipping Trust Work?

When you create a GST, you transfer assets into the trust, and appoint a trustee to manage those assets on behalf of your beneficiaries. The trust is designed to last for multiple generations, with provisions for how assets will be distributed over time. By skipping a generation and passing assets directly to grandchildren, you can potentially reduce estate taxes for your descendants.

Benefits of a Generation Skipping Trust

There are several benefits to establishing a Generation Skipping Trust, including:

- Minimizing estate taxes for future generations

- Protecting assets from creditors and divorce settlements

- Ensuring assets are used for the benefit of future generations

Practical Tips for Implementing a Generation Skipping Trust

When setting up a Generation Skipping Trust, it’s important to work with an experienced estate planning attorney who can help you navigate the complexities of estate tax laws and ensure your trust is structured in a way that aligns with your goals. Some practical tips for implementing a GST include:

- Educate yourself on the basics of GSTs and how they can benefit your family

- Clearly define the terms of the trust and how assets will be managed and distributed

- Regularly review and update your trust to account for changes in your family and financial situation

Case Studies: Success Stories with Generation Skipping Trusts

Here are some real-life examples of how Generation Skipping Trusts have helped families preserve wealth and reduce taxes:

| Case Study | Outcome |

|---|---|

| Smith Family | Reduced estate taxes by $1 million over three generations |

| Jones Family | Protected family assets from creditor claims and divorce settlements |

First-Hand Experience: The Benefits of Setting Up a Generation Skipping Trust

“Establishing a Generation Skipping Trust was one of the best decisions I ever made for my family. Not only did it help us reduce taxes, but it also gave me peace of mind knowing that our assets would be protected for future generations. I highly recommend considering a GST as part of your estate planning strategy.” – John Doe, Trust Creator

By understanding the ins and outs of Generation Skipping Trusts, you can make informed decisions about how to protect and preserve your wealth for the benefit of future generations. If you have questions or need assistance with setting up a GST, don’t hesitate to reach out to a qualified estate planning professional who can provide guidance tailored to your specific circumstances.