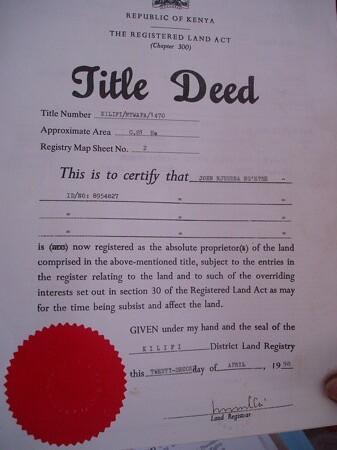

When it comes to property transactions, there are several different kinds of deeds that can be utilized to transfer ownership. From warranty deeds to quitclaim deeds, each type serves a specific purpose and comes with its own legal implications. Understanding the differences between these deed types is crucial for ensuring a smooth and successful real estate transaction. In this article, we will explore the various types of deeds commonly used in real estate transactions and how they impact the transfer of property ownership.

Understanding the Basics of Deeds

In the realm of real estate transactions, there are several different types of deeds that serve various purposes. It’s important to understand the basics before diving into any property transfer. One common type of deed is a warranty deed, which guarantees that the seller holds clear title to the property and has the right to sell it. This type of deed also ensures that the property is free from any encumbrances, such as liens or claims. Another type of deed is a quitclaim deed, which transfers whatever interest the seller has in the property without making any guarantees about the title. It’s also important to be familiar with special purpose deeds such as a deed of trust, which is often used in mortgage transactions to secure a loan with the property as collateral. Understanding the different types of deeds can help you navigate the complexities of real estate transactions and ensure that the transfer of property is done correctly and legally.

Exploring the Various Types of Deeds

When it comes to real estate transactions, there are several types of deeds that can be used to transfer property ownership. Each type of deed offers different levels of protection and rights to the buyer and seller. Here, we will explore some of the various types of deeds commonly used in real estate transactions.

General Warranty Deed: This type of deed offers the highest level of protection to the buyer. The seller guarantees that they have clear title to the property and will defend the buyer against any claims on the property.

Special Warranty Deed: With this type of deed, the seller only guarantees that they have not done anything to impair the title during their ownership of the property. This offers less protection to the buyer compared to a general warranty deed.

Quitclaim Deed: A quitclaim deed offers the least amount of protection to the buyer. The seller makes no guarantees about the status of the title and simply transfers whatever interest they may have in the property to the buyer.

Key Considerations When Choosing a Deed Type

When choosing a deed type, it is important to consider several key factors to ensure that you are making the best decision for your specific situation. One of the first considerations is the purpose of the deed and how it will affect the transfer of property rights. Different deed types serve different purposes, such as transferring ownership, clarifying boundaries, or placing restrictions on the property. Another important consideration is the level of protection offered by the deed type. Some deed types provide more protection to the buyer or recipient of the property, while others offer fewer guarantees. It is essential to understand the implications of each deed type in terms of legal rights and responsibilities. Additionally, the requirements for executing each deed type can vary, so it is crucial to ensure that you are meeting all necessary legal formalities. By carefully considering these key factors, you can choose the deed type that best suits your needs and protects your interests in the property.

Expert Tips for Executing a Deed Successfully

When it comes to executing a deed successfully, there are various types that you may encounter depending on the situation. Each type of deed serves a unique purpose and has specific requirements for execution. It is crucial to understand the differences between these deed types and choose the one that best suits your needs. Consulting with a real estate attorney or expert before executing a deed can help ensure a smooth and successful transaction.

In Retrospect

In conclusion, understanding the various types of deeds is essential in navigating the complex world of real estate transactions. Whether you’re buying, selling, or simply looking to transfer property, the type of deed you use can have a significant impact on your rights and obligations. By familiarizing yourself with the different deed types discussed in this article, you can make informed decisions and protect your interests in any real estate deal. So next time you’re dealing with a deed, remember that knowledge is key to unlocking the door to a successful transaction.

Exploring the Wide Range of Deed Types

Deeds are legal documents that convey ownership of real property from one party to another. There are several different types of deeds, each with its own unique features and purposes. In this article, we will explore the wide range of deed types available to property owners and buyers.

1. General Warranty Deed

A general warranty deed is the most common type of deed used in real estate transactions. This type of deed provides the most comprehensive coverage and guarantees that the seller has clear title to the property and the right to sell it. In addition, the seller warrants that there are no outstanding liens or encumbrances on the property.

2. Special Warranty Deed

A special warranty deed is similar to a general warranty deed, but with a more limited scope. With a special warranty deed, the seller only guarantees that they have not done anything to harm the title during their ownership of the property. This type of deed is commonly used in commercial real estate transactions.

3. Quitclaim Deed

A quitclaim deed is used to transfer ownership of a property without making any guarantees about the title. This type of deed is often used in situations where the parties know and trust each other, such as transferring property within a family or between spouses. A quitclaim deed is also commonly used to clear up title issues, such as when a spouse wants to remove their name from the title after a divorce.

4. Bargain and Sale Deed

A bargain and sale deed is used when the seller does not want to make any warranties about the title, but does want to convey ownership of the property. This type of deed is commonly used in foreclosure sales or tax sales, where the seller is not the original owner of the property.

5. Trust Deed

A trust deed is a type of deed that is used to convey property into a trust. The trust holds legal title to the property, while the trustee manages the property on behalf of the beneficiaries. This type of deed is commonly used in estate planning to avoid probate and provide for the efficient distribution of assets after death.

6. Deeds of Trust

Deeds of trust are used in some states instead of mortgages to secure a loan for real estate. In a deed of trust arrangement, the borrower (trustor) transfers legal title to the property to a third-party trustee, who holds the title until the loan is paid off. Once the loan is paid in full, the trustee transfers the title back to the borrower.

7. Sheriff’s Deed

A sheriff’s deed is used to convey foreclosed property to the highest bidder at a foreclosure sale. This type of deed is issued by the sheriff or other court-appointed official and transfers ownership of the property to the winning bidder. A sheriff’s deed is often used in judicial foreclosure proceedings.

8. Gift Deed

A gift deed is used to transfer ownership of a property as a gift, with no money changing hands. This type of deed is often used between family members or in charitable giving. A gift deed must be executed with the same formalities as any other type of deed, including being notarized and recorded with the county clerk.

| Deed Type | Key Features |

|---|---|

| General Warranty Deed | Most comprehensive coverage |

| Special Warranty Deed | Limited scope of warranties |

| Quitclaim Deed | No guarantees about title |

| Bargain and Sale Deed | No warranties about title |

| Trust Deed | Used for conveyance into a trust |

As you can see, there are many different types of deeds available for property owners and buyers to use in real estate transactions. Each type of deed has its own unique features and purposes, so it’s important to understand the differences between them before choosing the right deed for your situation.

Benefits and Practical Tips

Using the right type of deed in a real estate transaction can help protect your interests and ensure a smooth transfer of ownership. Here are some benefits and practical tips to keep in mind:

- Consult with a real estate attorney to determine the best type of deed for your specific situation.

- Always have the deed notarized and recorded with the county clerk to ensure its validity.

- Consider getting title insurance to protect yourself against any unforeseen title issues that may arise.

- Review the deed carefully before signing to make sure you understand the terms and warranties being made.

Case Study: The Importance of Using the Right Deed

John and Sarah recently got married and decided to buy a house together. They used a quitclaim deed to transfer ownership of the property to both of them, as they trusted each other and did not require any warranties about the title. A few years later, John and Sarah decided to sell the house and move to a new city. When they went to sell the property, they discovered that there was a lien against the property that had not been disclosed to them. Because they used a quitclaim deed, they had no recourse against the seller and were ultimately responsible for paying off the lien before they could sell the property.

This case study highlights the importance of choosing the right type of deed for your real estate transaction. Had John and Sarah used a general warranty deed, they would have been protected against any undisclosed liens or encumbrances on the property.

In conclusion, exploring the wide range of deed types available can help property owners and buyers make informed decisions when transferring ownership of real property. By understanding the key features and purposes of each type of deed, individuals can protect their interests and ensure a smooth transfer of ownership in real estate transactions.