As the financial planning landscape continues to evolve, irrevocable trusts remain a reliable choice for many individuals looking to safeguard their assets for the future. However, are these trusts truly infallible, or are there potential pitfalls hidden beneath the surface? Let’s delve into the intricacies of irrevocable trusts and assess their viability in today’s intricate world of wealth management.

Crucial Factors to Consider Before Establishing an Irrevocable Trust

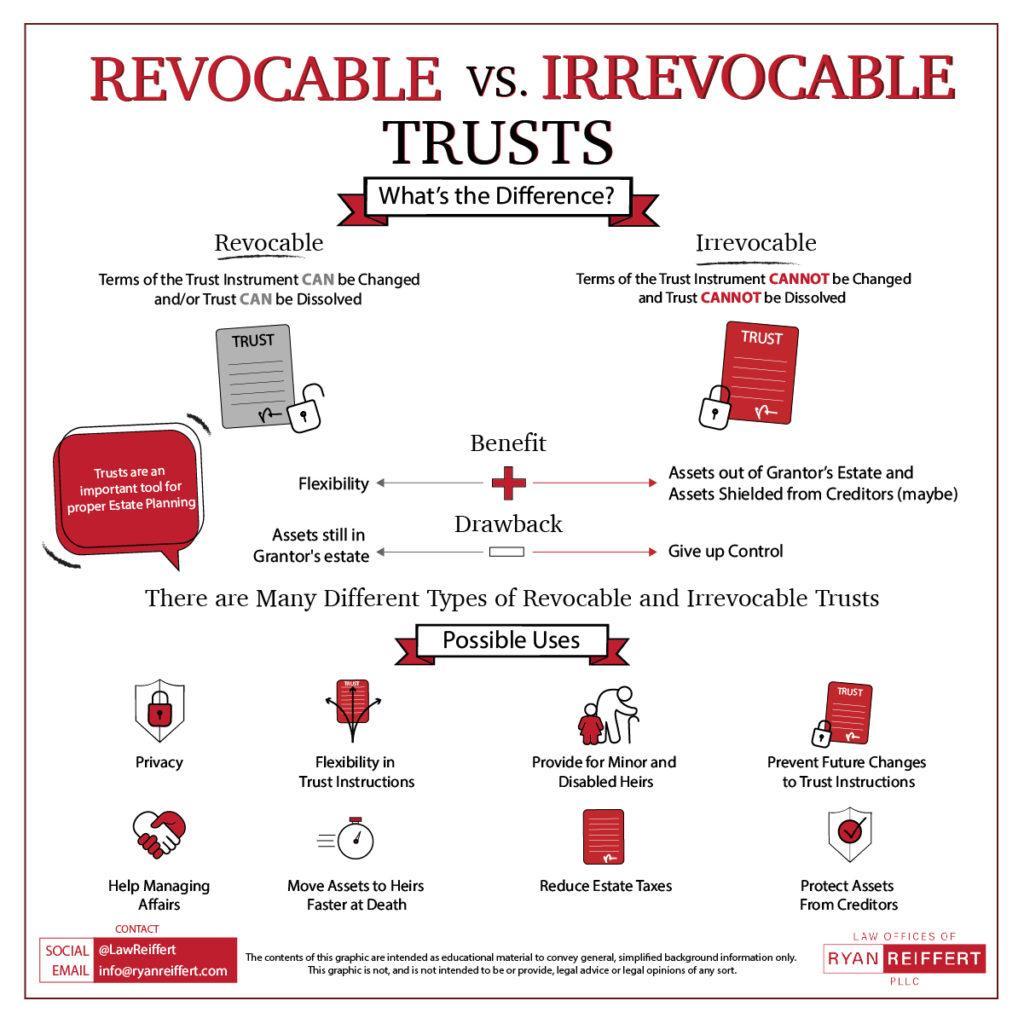

When considering the creation of an irrevocable trust, there are several key elements to ponder before making this significant decision. Primarily, it’s vital to comprehend that once an irrevocable trust is established, you forfeit control over the assets placed within it. This relinquishment of control is irreversible and cannot be reversed, hence the term “irrevocable.”

Another critical factor is the potential tax consequences associated with irrevocable trusts. Assets held in an irrevocable trust may be protected from estate taxes, which can ultimately benefit beneficiaries. However, transferring assets into an irrevocable trust can trigger gift tax implications, so it’s crucial to consult with a tax advisor before proceeding.

Moreover, consider the long-term objectives you hope to accomplish with an irrevocable trust. Are you aiming to shield assets from creditors or secure a financial future for your loved ones? Understanding your goals will help determine whether an irrevocable trust aligns with your overall estate planning strategy.

In summary, the decision to establish an irrevocable trust should be made after careful consideration and consultation with legal and financial experts. While irrevocable trusts can offer numerous advantages, it’s essential to balance the potential drawbacks and ensure that this estate planning tool aligns with your specific needs and objectives.

Advantages and Disadvantages of Irrevocable Trusts for Estate Planning

Irrevocable trusts provide several benefits that can make them a valuable tool for estate planning. A significant advantage is asset protection – once assets are transferred into an irrevocable trust, they are no longer considered part of the grantor’s estate, which can protect them from creditors. Additionally, irrevocable trusts can help reduce estate taxes, as the assets are no longer owned by the grantor.

However, there are also disadvantages to consider when using an irrevocable trust for estate planning. A significant drawback is that once assets are transferred into the trust, the grantor loses control over them. This means that decisions about how the assets are managed and distributed are made by the trustee, not the grantor. Additionally, irrevocable trusts can be complex to establish and maintain, requiring the assistance of a lawyer or financial advisor.

Ultimately, whether an irrevocable trust is a suitable choice for your estate planning needs will depend on your specific circumstances and goals. It’s crucial to carefully balance the benefits and drawbacks before making a decision.

Professional Guidance on When to Choose an Irrevocable Trust

A crucial factor to consider when deciding whether to choose an irrevocable trust is the level of control you are willing to surrender over your assets. With an irrevocable trust, you transfer ownership of your assets to the trust, which means you cannot change or revoke the trust without the consent of the beneficiaries. This can be a good option if you want to protect your assets from creditors or ensure that they are not subject to estate taxes.

Another factor to consider is the potential tax benefits of an irrevocable trust. By transferring assets to an irrevocable trust, you may be able to reduce your estate tax liability and potentially save your beneficiaries money in the long run. This can be especially beneficial if you have a large estate or anticipate significant growth in the value of your assets over time.

However, it’s important to balance these benefits against the potential drawbacks of an irrevocable trust. For example, once assets are transferred to an irrevocable trust, they are no longer accessible for your own use. Additionally, the process of setting up an irrevocable trust can be complex and costly, so it’s important to consult with a financial planner or estate planning attorney to determine if this option is right for you.

Effective Strategies for Managing an Irrevocable Trust

When evaluating whether irrevocable trusts are a suitable choice for your financial situation, it’s essential to balance the benefits and drawbacks. These types of trusts can offer significant advantages in terms of asset protection, estate tax reduction, and privacy. However, they also come with some limitations that need to be carefully considered.

Here are some practical tips:

- Select the Right Trustee: Choosing a reliable and competent trustee is vital for the long-term success of the trust.

- Diversify Trust Investments: To minimize risk and maximize returns, consider diversifying the trust’s investments across different asset classes.

- Regularly Review and Update the Trust: Circumstances and laws may change over time, so it’s essential to periodically review and update the trust documents accordingly.

| Tip | Benefit |

| Engage a Financial Advisor | Professional guidance can help ensure the trust is being managed effectively. |

| Understand the Tax Implications | Consult with a tax professional to understand the tax consequences of the trust. |

Conclusion

In conclusion, the decision of whether or not irrevocable trusts are a suitable choice ultimately depends on individual circumstances and goals. While they offer certain benefits such as asset protection and estate tax savings, they also come with restrictions and limitations that may not be suitable for everyone. It is important to carefully consider all factors and consult with legal and financial experts before creating an irrevocable trust. Ultimately, the best decision is one that aligns with your financial objectives and long-term plans. rnrn

What is an Irrevocable Trust?

An irrevocable trust is a legal arrangement where assets are transferred to a trustee, who then manages them on behalf of the beneficiaries. Once the trust is established, the terms cannot be changed by the grantor, making it a powerful estate planning tool.

Benefits of Irrevocable Trusts

- Asset Protection: Assets placed in an irrevocable trust are typically shielded from creditors and lawsuits, providing a layer of protection for your wealth.

- Tax Benefits: Irrevocable trusts can help minimize estate taxes, gift taxes, and generation-skipping transfer taxes, allowing you to pass on more of your wealth to your beneficiaries.

- Probate Avoidance: Assets held in a trust can bypass the probate process, saving time and money for your loved ones after your passing.

- Privacy: Trusts are private documents that do not go through probate, keeping your affairs confidential and out of the public record.

Practical Tips for Setting Up an Irrevocable Trust

While irrevocable trusts offer numerous benefits, they are complex legal documents that require careful planning. Consider the following tips when setting up an irrevocable trust:

- Consult with a qualified estate planning attorney to ensure the trust aligns with your goals and meets legal requirements.

- Select a trustworthy and competent trustee to manage the assets according to your wishes.

- Choose the right type of trust for your specific needs, whether it’s a charitable trust, life insurance trust, or special needs trust.

- Regularly review and update the trust as needed to accommodate changes in your financial situation or family dynamics.

Case Studies: Real-Life Examples of Irrevocable Trusts in Action

Here are a few examples of how irrevocable trusts have benefited individuals and families:

| Name | Benefit |

|---|---|

| John Smith | Reduced estate taxes by transferring assets to an irrevocable trust. |

| Emily Johnson | Protected assets from creditors by placing them in a trust. |

| David Brown | Avoided probate and ensured privacy for his estate by creating a trust. |

Firsthand Experience: Testimonials from Trust Beneficiaries

Listen to what individuals have to say about their experiences with irrevocable trusts:

“I never realized how much money I could save on taxes until I set up an irrevocable trust. It’s been a game-changer for my estate planning strategy.” – Sarah M.

“Thanks to the asset protection provided by my irrevocable trust, I can sleep soundly knowing my hard-earned wealth is secure.” – Michael P.

Overall, irrevocable trusts can be a valuable tool for safeguarding your assets, minimizing taxes, and ensuring a smooth transfer of wealth to your heirs. Consult with a knowledgeable estate planning attorney to see if an irrevocable trust is the right choice for your financial situation. With careful planning and expert guidance, you can secure your legacy and protect your loved ones for generations to come.