When a loved one passes away without leaving a will, the responsibility of managing their estate falls to an appointed individual known as the executor. But what happens when there is no will to specify who should take on this crucial role? In such cases, the process of determining the executor can be intricate and must adhere to legal protocols. Let’s delve into the complexities of this scenario and identify who typically steps up to fulfill the executor’s duties in the absence of a will.

Understanding the Role of the Executor in Intestate Situations

When someone dies without a will, the court appoints an executor to manage the estate. This person is usually a close family member, such as a spouse, child, or sibling. The executor’s responsibilities include settling the deceased’s affairs, distributing assets to beneficiaries, and paying off debts.

A primary duty of the executor in intestate cases is to locate and catalog the deceased’s assets. This can include bank accounts, real estate, vehicles, and personal belongings. The executor must also appraise these assets and ensure they are distributed according to state laws.

Additionally, the executor must notify creditors and potential heirs of the deceased’s passing. They may also need to file tax returns on behalf of the estate and handle any outstanding bills or debts. It is crucial for the executor to act in the estate’s best interest and comply with all legal requirements to ensure a smooth probate process.

Criteria for Appointing an Executor Without a Will

When a person dies intestate, the court appoints an executor to manage their estate. The decision on who becomes the executor is typically based on several key factors:

- Relationship to the deceased: Family members often have priority in being appointed as the executor. Spouses, children, or parents are commonly chosen for this role.

- Availability and willingness: The court considers whether the potential executor is willing and able to take on the responsibilities of managing the estate. They must be organized, trustworthy, and capable of completing the necessary tasks.

- Previous experience: If a person has prior experience in managing estates or legal matters, they may be more likely to be chosen as the executor.

In some instances, if no suitable family member or individual steps forward to act as the executor, the court may appoint a professional executor, such as a lawyer or a trust company. It is essential to choose someone who can handle the complexities of managing an estate and make decisions in the best interest of the deceased and their beneficiaries.

Challenges and Duties of an Executor Without a Will

Without a will, the process of determining who becomes the executor can be challenging and filled with responsibility. One of the main challenges faced by an executor without a will is the uncertainty surrounding the deceased’s wishes and intentions. This can lead to confusion and disagreements among family members, complicating the probate process.

Another responsibility that falls on the executor without a will is identifying and locating the deceased’s assets and debts. This can be a time-consuming and complex process, especially if the deceased’s financial records are not well-organized. The executor must also handle any outstanding bills, taxes, and other financial obligations of the estate.

Furthermore, without a will, the executor may have to make difficult decisions regarding the distribution of the estate’s assets. This can lead to potential conflicts among beneficiaries and family members, making the executor’s role even more challenging. Being an executor without a will requires careful attention to detail, strong communication skills, and the ability to navigate complex legal processes.

Guidelines for Choosing the Right Executor in the Absence of a Will

When there are no testamentary instructions, selecting the right executor can be a daunting task. It is crucial to consider various factors before appointing someone to handle the estate and ensure that the individual is capable and trustworthy.

Considerations for selecting the right executor:

- Relationship to the deceased

- Competency and organizational skills

- Availability and willingness to take on the role

- Understanding of legal and financial matters

It is important to choose someone who is familiar with the deceased’s wishes and can carry out their responsibilities efficiently. While family members are often chosen as executors, it is essential to evaluate their ability to handle the complexities associated with estate administration.

Future Outlook

In the absence of a will, the court will appoint an executor to handle the deceased person’s estate. This individual is typically a family member or close friend, but in some cases, a professional may be appointed. It is important to remember the responsibility that comes with being an executor and to handle the estate with care and diligence. If you find yourself in this situation, seek legal advice to ensure that you fulfill your duties effectively. Thank you for reading.

Who Takes Charge When There’s No Will? Discover the Surprising Answer!

Understanding Intestate Succession

When a person dies without a will, they are said to have died “intestate.” In such cases, the inheritance process follows intestate succession laws, which vary by jurisdiction. These laws determine how the deceased’s assets will be distributed and who will manage the estate.

The Role of the Administrator

In the absence of a will, the court typically appoints an administrator to handle the estate. The administrator’s responsibilities include:

- Identifying and collecting the deceased’s assets.

- Paying outstanding debts and taxes.

- Distributing the remaining property to the rightful heirs according to state laws.

How Is an Administrator Chosen?

Court-appointed administrators are usually close relatives of the deceased, such as:

- A surviving spouse.

- Adult children.

- Siblings or other close family members.

If no family members are available or suitable, the court may appoint a neutral third-party, such as a public administrator.

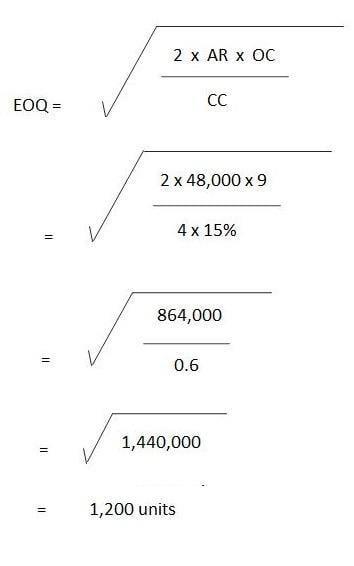

Intestate Succession Hierarchy

The distribution of the deceased’s assets follows a specific hierarchy established by intestate succession laws. Common scenarios include:

| Relationship | Share of Estate |

|---|---|

| Spouse (no children) | Entire estate |

| Spouse and children | 50% to spouse, remainder divided among children |

| Children (no spouse) | Equally divided among children |

| Parents (no spouse or children) | Equally divided among parents |

| Siblings (no spouse, children, or parents) | Equally divided among siblings |

Benefits of Having a Will

Creating a will provides numerous advantages, including the following:

- Control over asset distribution: You decide who inherits your property and how much they get.

- Avoiding family disputes: Clear instructions in your will can prevent potential conflicts among heirs.

- Choosing an executor: You select a trusted person to manage your estate instead of leaving it up to the court.

- Protecting minor children: You can designate guardians for your minor children, ensuring their well-being after your passing.

Practical Tips for Managing an Estate Without a Will

If you find yourself in the position of managing an estate without a will, consider the following tips:

- Consult an attorney: Seek legal advice to understand your rights and obligations.

- Secure the estate: Immediately secure valuable assets and important documents to prevent loss or theft.

- Inventory the assets: Create a detailed list of all assets, including real estate, bank accounts, and personal property.

- Notify beneficiaries: Inform potential heirs of the deceased’s passing and the status of the estate.

- Pay debts: Settle outstanding debts and taxes before distributing the remaining assets to heirs.

Case Study: Handling an Intestate Estate

Consider the case of Jane Doe, who recently passed away without a will. With no immediate family, her brother, John, was appointed as the administrator. Here’s how he managed the estate:

- John secured Jane’s home and valuables.

- He hired an attorney for guidance on state intestate laws.

- John inventoried Jane’s assets and identified a few bank accounts and a property.

- He paid off Jane’s remaining debts using funds from her accounts.

- With a court’s approval, he sold the property and divided the proceeds among eligible relatives as per state laws.

Conclusion

Handling an estate without a will can be complex, but understanding the intestate process and your legal responsibilities can make it manageable. While intestate succession ensures a fair distribution of assets, creating a will offers greater control and peace of mind.