In the complex realm of trust funds, a key figure ensures the seamless operation and management of these financial instruments. This individual, often cloaked in confidentiality, is vital in protecting assets and honoring the intentions of the beneficiaries. But who is this enigmatic custodian of wealth, and what are their duties? Let’s explore the world of trust fund management and reveal the true identity of this guardian of prosperity.

The Crucial Role of a Trustee

In the administration of a trust fund, the trustee is pivotal in managing the assets and ensuring they align with the trust creator’s wishes. A trustee can be an individual, a professional trustee, or a trust company, tasked with executing the trust’s terms and acting in the beneficiaries’ best interests.

One of the primary duties of a trustee is to oversee the assets within the trust. This includes investing the assets, distributing income to beneficiaries, and making decisions on behalf of the trust. Trustees must also maintain precise records of all transactions and provide regular reports to beneficiaries.

Trustees are held to a high standard of duty and loyalty to the trust and its beneficiaries. They must act prudently, honestly, and in good faith when making decisions regarding the trust. Failure to fulfill these duties can result in the trustee being held personally liable for any resulting losses.

Essential Duties in Trust Fund Management

Managing a trust fund involves several critical responsibilities to ensure the proper administration and distribution of the assets within the trust. Here are some key tasks that a trustee or trust manager should handle:

- Asset Management: Overseeing the investment and management of the trust’s assets is a primary responsibility. This involves making strategic decisions to grow the trust’s wealth while minimizing risks.

- Record-Keeping: Maintaining accurate and detailed records of all transactions, investments, distributions, and communications related to the trust is crucial for transparency and accountability.

- Communication: Keeping open and clear communication with beneficiaries, co-trustees, and other involved parties is essential. Providing regular updates, responding to inquiries, and ensuring all parties are informed about the trust’s status are key duties.

| Responsibility | Description |

|---|---|

| Legal Compliance | Ensuring that all actions taken in managing the trust fund comply with relevant laws and regulations. |

| Beneficiary Support | Providing support and guidance to beneficiaries, addressing their concerns and needs. |

Choosing the Right Trustee

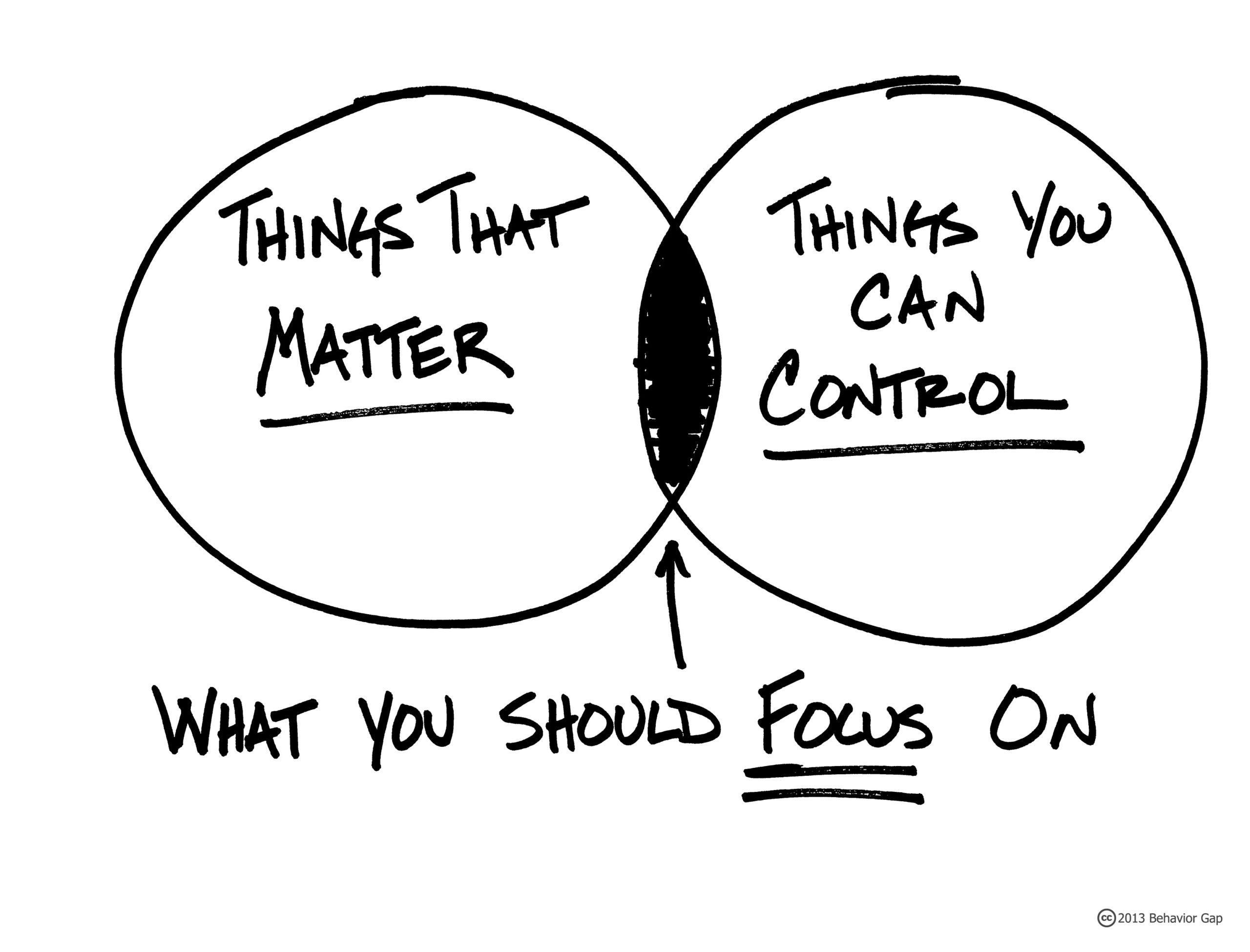

When selecting a trustee to manage a trust fund, several important factors must be considered. One key factor is the trustee’s level of experience and expertise in financial matters. It is essential to choose someone with a solid understanding of investments, tax laws, and estate planning.

Another crucial factor is the trustee’s trustworthiness and integrity. The trustee will have control over the assets in the trust fund, so it is vital to select someone who is honest, reliable, and ethical. Trust is a fundamental component of the trustee-beneficiary relationship.

Additionally, consider the trustee’s availability and willingness to fulfill the responsibilities of managing the trust fund. The trustee should be able to dedicate the necessary time and effort to make informed decisions and communicate effectively with beneficiaries. Trust administration requires regular monitoring, reporting, and decision-making, so selecting a committed and responsive trustee is crucial for the trust fund’s success.

Strategies for Effective Trust Fund Management

Trust funds are typically managed by a trustee responsible for overseeing the assets within the fund and ensuring they are managed according to the trust agreement. The trustee is often a professional such as a lawyer or financial advisor but can also be a family member or friend of the grantor.

When it comes to trust fund management, here are a few key principles to keep in mind:

- Diversification: It’s important to spread investments across different asset classes to minimize risk.

- Regular Monitoring: Trustees should regularly review the performance of the trust fund and make adjustments as needed.

- Communication: Keeping beneficiaries informed about the trust fund’s performance and decisions can help prevent misunderstandings or conflicts.

| Strategy | Description |

| Diversification | Spread investments across different asset classes |

| Regular Monitoring | Review performance and make adjustments |

| Communication | Keep beneficiaries informed |

Future Outlook

Understanding who manages a trust fund is essential for anyone looking to establish or benefit from one. Whether it’s a trustee, trust protector, investment advisor, or even a combination of these roles, managing a trust fund requires careful consideration and expertise. By entrusting the right individuals with this responsibility, you can ensure that your assets are protected and managed effectively for the benefit of your beneficiaries. Trust funds are powerful financial tools that can provide stability and security for generations to come, so it’s important to choose your managers wisely. If you have any further questions or would like to learn more about trust fund management, don’t hesitate to seek professional advice and guidance. Your financial future may well depend on it.

Who Holds the Reins of a Trust Fund?

Understanding the Role of a Trustee

A trustee is an individual or entity appointed to manage and administer the assets or property held in a trust fund. Trustees carry significant responsibilities, such as ensuring the trust is managed according to its terms and in the best interests of the beneficiaries.

Key Responsibilities of a Trustee

- Asset Management: Managing investments and other trust assets prudently.

- Compliance: Adhering to the terms of the trust and relevant laws.

- Record Keeping: Maintaining clear and accurate records of trust activities.

- Distributions: Disbursing funds to beneficiaries as per the trust document.

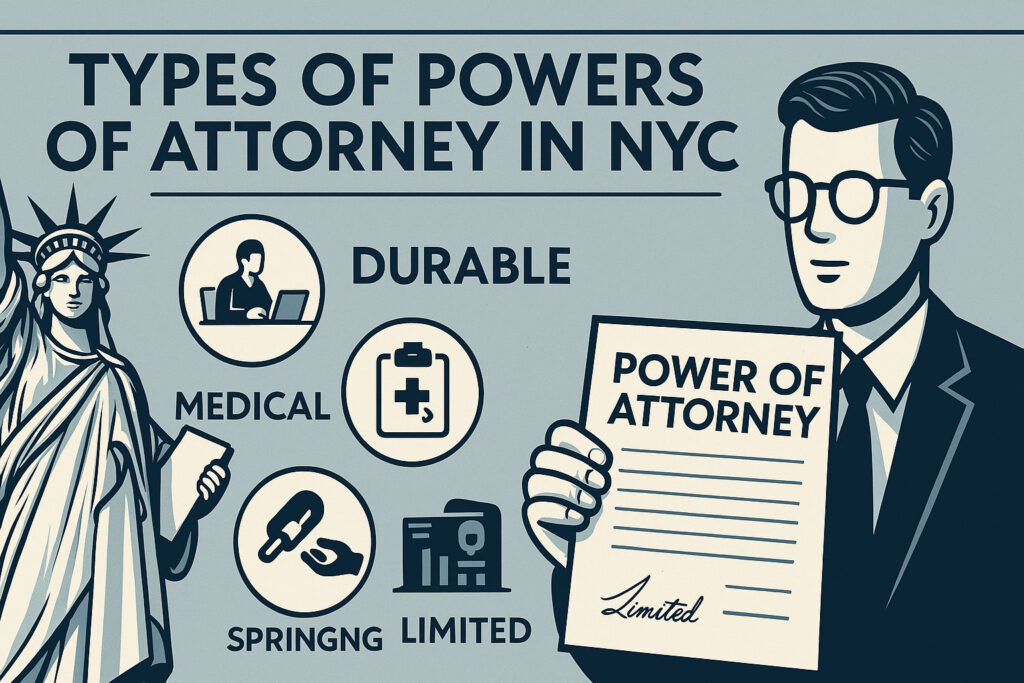

Types of Trustees

Trustees can vary depending on the nature of the trust. Here are common types:

- Individual Trustee: A family member or trusted friend.

- Corporate Trustee: A professional entity such as a bank or trust company.

- Co-Trustee: A combination of individuals and corporate entities working together.

Benefits of Having a Trust Fund

Creating a trust fund offers various benefits such as:

- Financial Security: Provides a steady income for beneficiaries.

- Tax Benefits: May offer tax advantages depending on jurisdiction.

- Estate Planning: Ensures assets are distributed according to your wishes.

- Protection: Shields assets from creditors under certain conditions.

Choosing the Right Trustee

Selecting the appropriate trustee is crucial for the proper management of your trust fund. Consider the following points:

- Trustworthiness and Integrity

- Experience and Expertise in Financial Management

- Availability and Willingness to Serve

- Understanding of Legal Obligations

Practical Tips for Managing a Trust Fund

- Regular Reviews: Conduct periodic reviews of the trust activities and investments.

- Clear Communication: Maintain open and transparent communication with beneficiaries.

- Legal Consultation: Seek legal advice to remain compliant with trust and tax laws.

Case Study: Successfully Managed Trust Fund

The Johnson Family Trust

The Johnson Family Trust was established in 2010 with the intent to provide educational funding for future generations. The appointed trustee, a corporate entity, managed the fund efficiently, ensuring regular disbursements and investment growth over time.

| Year | Initial Value | Disbursements | Growth (%) | Ending Value |

|---|---|---|---|---|

| 2010 | $100,000 | $0 | 5% | $105,000 |

| 2015 | $110,000 | $20,000 | 6% | $96,600 |

| 2020 | $120,000 | $50,000 | 7% | $74,100 |

This case exemplifies how proper trust management can provide substantial long-term benefits to the beneficiaries.

First-Hand Experience: A Trustee’s Perspective

As a trustee with seven years of experience, I can attest to the importance of diligence, honesty, and clear communication. Trustees must constantly balance the needs of the beneficiaries with the terms of the trust, ensuring sound investment strategies and compliance with legal obligations.

Common Challenges Faced by Trustees

- Managing Diverse Expectations: Balancing the interests of multiple beneficiaries.

- Complex Legal Requirements: Navigating varying legal rules and tax implications.

- Investment Decisions: Making optimal investment choices in fluctuating markets.

Successful Strategies for Trustees

Here are some strategies that have proven effective:

- Enlist Financial Advisors: Seek expert advice for optimal asset management.

- Frequent Updates: Provide regular updates to beneficiaries about trust activities.

- Adopt a Fiduciary Standard: Always act in the best interest of the beneficiaries.