Ending Tip Taxes? Why Restaurant Workers and Advocates Have Bigger Fish to Fry

The ongoing discussion around ending tip taxes has captured the attention of many, from restaurant workers to industry advocates. However, while the concept sounds beneficial on the surface, the reality may be more complex. In this article, we delve into the issues related to tip taxes, the broader challenges faced by restaurant workers, and what we can do to support fair labor practices in the hospitality industry.

Understanding Tip Taxes

The taxation of tips adds layers of complexity to the already challenging lives of restaurant workers. Tips are considered taxable income, which means they must comply with federal and state tax regulations. In the United States, the IRS requires employers to withhold income taxes on tips, meaning that these earnings are subject to the same tax rules as regular wages.

Impact on Income

- Reported Tips: Tipped employees are required to report their tips to their employers.

- Income Tax Withholding: Employers are obligated to withhold income taxes, Social Security, and Medicare taxes on these reported tips.

- Lower Take-Home Pay: The tax withholding can significantly reduce the take-home pay of the workers.

Bigger Fish to Fry: Key Issues for Restaurant Workers

While the elimination of tip taxes could offer some financial relief, it pales in comparison to other systemic issues that deeply affect the livelihoods of those in the restaurant industry.

Fair Wage Implementation

The minimum wage for tipped workers remains a contentious issue. As of now, the federal hourly tipped minimum wage in the US is $2.13, far below the standard federal minimum wage of $7.25. Many states have their own minimum wages for tipped workers, but disparities still exist.

| State | Tipped Minimum Wage | Standard Minimum Wage |

|---|---|---|

| California | $15.00 | $15.00 |

| New York | $10.00 | $13.20 |

| Texas | $2.13 | $7.25 |

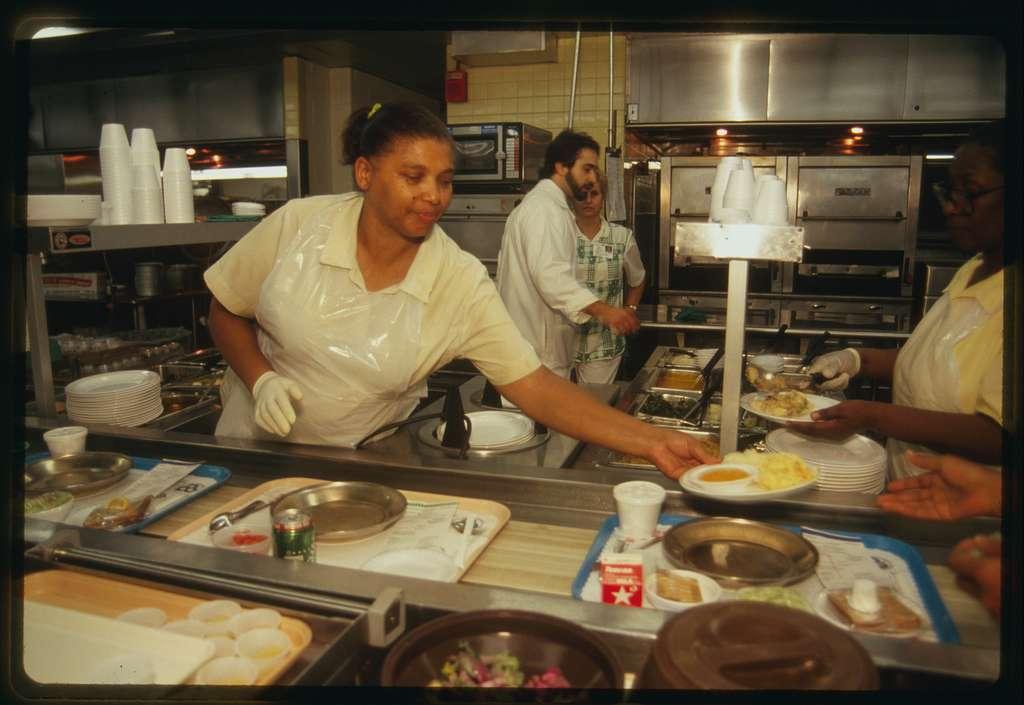

Improving Working Conditions

Health and safety concerns in the hospitality industry are often overlooked. Workers frequently face long hours, inadequate breaks, and high-stress environments. Addressing these issues would require more comprehensive policies and employer accountability.

Benefits and Practical Tips

- Health Insurance: Advocating for employer-sponsored health insurance for all employees.

- Paid Sick Leave: Ensuring workers have access to paid sick leave to take time off without the risk of losing income.

- Stress Management Programs: Implementing programs to help employees manage stress more effectively.

Job Security and Benefits

Job security is another pressing issue. The fluctuating nature of the hospitality industry can lead to sporadic employment, creating financial instability for workers. Additionally, many restaurant employees lack access to essential benefits such as healthcare and retirement plans.

Case Studies

Learn from real-life examples on how different approaches can make a substantial change:

- Unionized Restaurants: Certain unionized restaurants in major cities provide various benefits and better working conditions.

- Service Charge Model: Some restaurants have shifted to a service charge model instead of tipping, which allows for more stable employee wages.

First-Hand Experience: Voices from the Industry

It’s essential to hear directly from the people affected by these policies. Restaurant workers provide unique insights into their everyday challenges and the changes they hope to see:

“Working long hours without certainty about my income makes planning for the future almost impossible,” says Ana, a waitress from Los Angeles. “Having a stable wage and benefits would make a massive difference in my life.”

“The idea of ending tip taxes sounds good, but if we don’t address the root issues like low wages and unsafe working conditions, it won’t change much,” adds Michael, a chef from New York.

Role of Advocates and Organizations

Advocacy groups play a vital role in championing the rights of restaurant workers. Organizations such as the Restaurant Opportunities Centers United (ROC United) work tirelessly to promote policies and practices that create fairer, happier work environments.

How You Can Support

- Support Legislation: Encourage local and national representatives to support legislation that improves wages and working conditions.

- Choose Fair Restaurants: Opt for restaurants known for their fair labor practices. Websites and advocacy groups often maintain lists of such establishments.

- Spread Awareness: Educate others about the challenges faced by restaurant workers and the importance of supporting fair wage initiatives.