Ever pondered the remuneration an estate executor receives for their time and effort? Managing the distribution of assets and settling the affairs of a deceased individual can be a challenging task. However, understanding the remuneration structure can bring some clarity to this often complex process. Let’s explore the details of executor remuneration to illuminate this frequently neglected aspect of estate administration.

Grasping the Role of an Executor

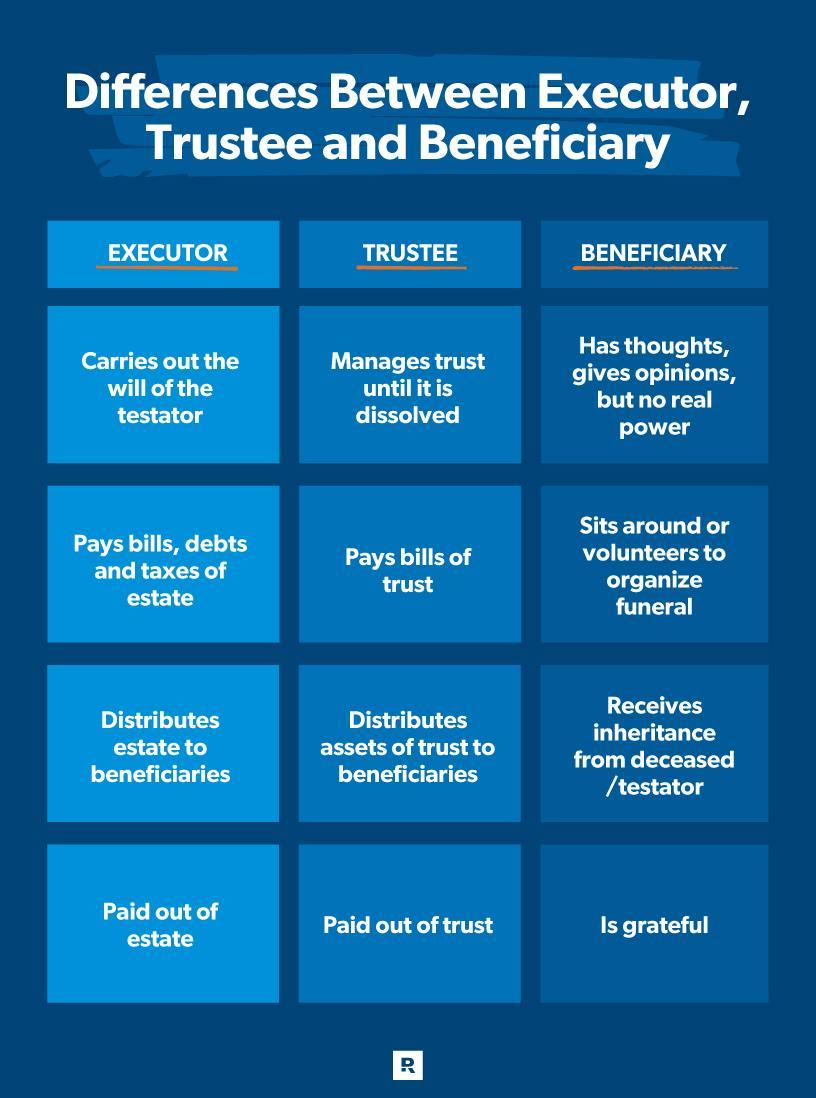

Being designated as an executor of an estate is a substantial responsibility that entails managing the distribution of assets and settling any remaining debts of the deceased. While the role is a great honor and trust, many people are curious about the financial aspect of being an executor, including how much they are compensated for their services.

Executors are generally entitled to a fee for their services, which is typically a percentage of the estate’s total value. The exact amount can fluctuate depending on the state laws and the complexity of the estate. In some instances, the executor may opt to forgo their fee, particularly if they are a close relative or friend of the deceased.

It’s crucial to note that the executor’s fee is distinct from any expenses incurred during the estate administration process, such as legal fees, court costs, or property maintenance. These expenses are typically paid out of the estate before any distributions are made to beneficiaries.

Elements that Affect Executor Fees

When it comes to determining the fees for an executor of an estate, there are several key elements that come into play. These elements can vary depending on the complexity of the estate and the responsibilities involved. Here are some of the main influences on executor fees:

- Estate Size: The larger the estate, the higher the executor fees are likely to be. This is because larger estates often require more time and effort to manage and distribute assets.

- Complexity of the Estate: Estates with intricate assets or legal issues may require additional work on the part of the executor, which can also impact their fee.

- State Laws: Some states have specific guidelines or limitations on executor fees, which can influence how much an executor is able to charge for their services.

- Executor’s Experience: Executors with more experience and expertise in managing estates may demand higher fees than those who are less experienced.

It’s important for both the executor and the beneficiaries of the estate to be aware of these factors when negotiating executor fees. By understanding the various influences on fees, all parties can work together to ensure a fair and reasonable compensation for the executor’s services.

Guidelines for Negotiating Executor Compensation

When negotiating executor compensation for handling an estate, it’s important to consider several factors to ensure fair payment for the work involved. Here are some useful tips to guide you through the process:

- Research local laws: Before discussing compensation, make sure to familiarize yourself with the laws in your area regarding executor fees. Some states have specific guidelines on how much an executor can be paid.

- Consider the complexity of the estate: The size and complexity of the estate can significantly impact the amount of work required from the executor. Larger estates with multiple assets and beneficiaries may justify higher compensation.

- Communicate openly: Have a transparent discussion with the beneficiaries and other interested parties about how compensation will be determined. Clear communication can help avoid misunderstandings or disputes later on.

Guaranteeing Fair Compensation for Executors

When it comes to compensating executors of an estate, many factors come into play. Executors are typically compensated for their time, effort, and responsibilities in managing the deceased’s affairs. However, the amount they receive can vary depending on several factors.

One factor that can impact the compensation of executors is state laws. Some states have laws that dictate how much an executor can be paid, while others allow for more flexibility. It’s important to check the specific laws in your state to ensure fair compensation.

Additionally, the complexity of the estate can also influence how much an executor is paid. For example, executors of complex estates with multiple assets and beneficiaries may be entitled to a higher compensation than those managing simpler estates.

Overall, it’s important to consider all the factors at play when determining fair compensation for executors. By understanding the state laws, complexity of the estate, and the executor’s responsibilities, you can ensure that the executor is compensated appropriately for their time and effort.

In Conclusion

In conclusion, determining the compensation for an executor of an estate can be a complex process that varies depending on various factors such as the size of the estate and the amount of work involved. It is important for both the executor and the beneficiaries to understand the rules and regulations surrounding executor compensation in order to ensure a fair and just distribution of assets. If you find yourself in the position of an executor, it is advisable to seek professional guidance to navigate through the intricacies of the probate process and ensure a smooth administration of the estate. Remember, serving as an executor is a significant responsibility that should be approached with care and diligence.

**Title: Unveiling the Paycheck: What Does an Estate Executor Really Earn?**

**Title: Unveiling the Paycheck: What Does an Estate Executor Really Earn?**

**Meta Title: Exploring the Compensation of Estate Executors – What Are Estate Executors’ Earnings?**

**Meta Description: Curious about how much estate executors earn? This article delves into the compensation of estate executors, providing valuable insights and information on the topic. Read on to uncover the truth about estate executors’ earnings.**

When it comes to managing the affairs of a deceased individual, estate executors play a pivotal role in ensuring that the deceased’s assets are distributed according to their wishes. However, many people often wonder what exactly estate executors earn for their services. In this article, we will unveil the paycheck of estate executors and shed light on how much they typically earn for their responsibilities.

**Understanding the Role of an Estate Executor**

Before delving into the earnings of estate executors, it’s important to understand the scope of their responsibilities. An estate executor, also known as a personal representative or administrator, is the individual responsible for administering the estate of a deceased person. Their duties include:

– Managing the deceased’s assets

– Distributing assets to beneficiaries

– Settling outstanding debts and taxes

– Handling legal matters related to the estate

– Ensuring that the deceased’s final wishes are carried out

These tasks can be complex and time-consuming, requiring a significant amount of effort and expertise on the part of the estate executor.

**How Much Do Estate Executors Earn?**

The compensation of estate executors is typically determined by state laws and the specific terms outlined in the deceased’s will. In some cases, the deceased may specify a flat fee or a percentage of the estate’s value to be paid to the estate executor for their services. However, if no such provision is made, estate executors are usually entitled to “reasonable” compensation for their work.

The amount of compensation that estate executors receive can vary depending on several factors, including the size and complexity of the estate, the amount of time and effort required to administer the estate, and the estate executor’s level of expertise and experience.

**Factors Influencing Estate Executors’ Earnings**

Several key factors influence the earnings of estate executors. These include:

– Size and complexity of the estate: Larger and more complex estates typically require more time and effort to administer, which can result in higher compensation for the estate executor.

– Estate executor’s experience: Experienced estate executors who have a strong understanding of estate administration may command higher fees for their services.

– Location: The cost of living and prevailing rates for estate executor services in a particular location can also impact the compensation of estate executors.

**Case Studies: What Do Estate Executors Really Earn?**

|Case Study|Estate Size|Executor’s Compensation|Location|

|—|—|—|—|

|Case 1|Small estate|$3,000 flat fee|Suburban area|

|Case 2|Medium estate|$10,000 flat fee|Urban area|

|Case 3|Large estate|2% of estate value|Metropolitan area|

**Benefits and Practical Tips for Estate Executors**

In addition to financial compensation, serving as an estate executor can offer several benefits, including:

– Fulfillment of carrying out a loved one’s final wishes

– Opportunity to learn about estate planning and administration

– Potential for personal growth and development

To maximize their earnings and efficiency as estate executors, individuals should consider the following practical tips:

– Seek guidance from legal and financial professionals

– Keep detailed records of all estate-related activities

– Communicate openly and transparently with beneficiaries and other stakeholders

**Firsthand Experience: Insights from a Seasoned Estate Executor**

“I’ve been serving as an estate executor for over a decade, and while the compensation varies from case to case, the fulfillment I get from helping families navigate the estate administration process is priceless. It’s not just about the paycheck – it’s about making a positive impact during a difficult time.”

In conclusion, the earnings of estate executors can vary based on a variety of factors, including the size and complexity of the estate, the estate executor’s experience, and the location. While financial compensation is an important aspect of the role, many estate executors find fulfillment in helping families navigate the estate administration process. By understanding the factors that influence estate executors’ earnings and following practical tips for success, individuals can navigate their role as estate executors effectively.